Q: What are some of the reasons technology stocks were roasted in the equity markets this week?

A: It appears that profit taking started after the July 10th peak in the Nasdaq 100 index. Recently, Tesla reported a 43% drop in profits from last year and selling accelerated in the tech sector. High stock valuation multiples, slowing growth rates for companies, and Artificial Intelligence (AI) related capital expenditures appear to be key factors.

Q: What was some good news for the financial markets this week?

A: Second quarter U.S. Gross Domestic Product (GDP) growth was reported at a healthy 2.8%! The Atlanta Federal Reserve’s Real GDPNow estimate was 2.6% on July 24 underscoring the value of those estimates.

Headline Round Up

*A Stock Market Rotation of Historic Proportions!

*Tech’s Splurge on AI Infrastructure Arms Race Forcing Spending.

*Alphabet’s Google Smacked After Reporting More AI Spending.

*Viking Therapeutics Joins Weight Loss Mania! Spikes 20% on Early Entry Into Late-Stage Trial.

*Oversupply for Some Car Brands Shocks Auto Stocks Mid-Week.

*General Motors Delays Orion Assembly Electric Pick Up Plant Until Mid-2026.

*Oil Smacked Below $80, Reports of Asia Demand Slowing as Inventories Actually Fell for the Week.

*Will Net-Zero Initiatives Double Copper Demand By 2035?

*Overpriced? Home Prices Hit Another Record Yet Existing Home Sales Fall to Slowest Paces Since 2010.

*Homebuilder Stocks Stage Wild Rally Hopeful of Interest Rate Cut?

*Past Due Credit Cards Highest Share Since 2012?

*UPS Tumbles 11% on Worse Than Expected Earnings & Forecasting Lower Revenue.

*Spotify Surges on Crossover Point to Profitability with Record Profit & Subscriber Boost.

*Ether Exchange Traded Funds (ETFs) Launch Fizzles Down 9% for the Week.

*Blackstone Mortgage Trust, Inc., A Commercial Mortgage Real Estate Investment Trust (REIT), Pounded After Dividend Cut.

*Amazon’s Alexa Losing Billions?

*American Airlines, Southwest, and Delta Stocks Pounded on Future Earnings Declines This Year.

*Berkshire Harvests Part of Their Bank of America Position, But It is Still Their Second Largest Equity Position.

Dow Jones Industrial Average Index (12/29/2023 – 07/26/2024)

– Courtesy of Bloomberg LP

Invesco QQQ Trust Series 1 (12/29/2023 – 07/26/2024)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index – Quarterly Earnings Analysis by Sector (05/16/2024 – 08/15/2024)

– Courtesy of Bloomberg LP

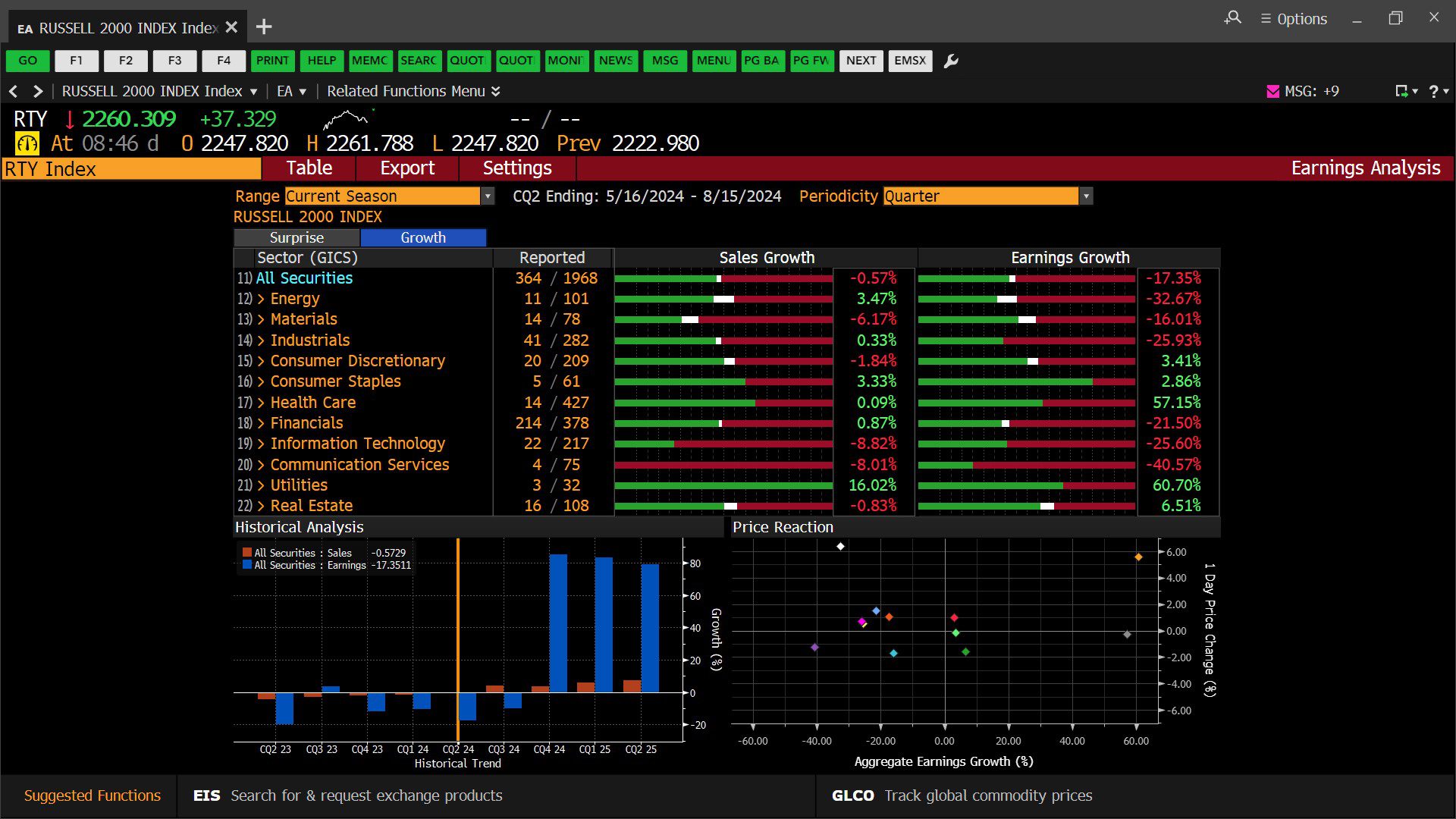

Russell 2000 Index – Quarterly Earnings Analysis by Sector (05/16/2024 – 08/15/2024)

– Courtesy of Bloomberg LP

Russell 2000 Value Index – Quarterly Earnings Analysis by Sector (05/16/2024 – 08/15/2024)

– Courtesy of Bloomberg LP

Alphabet, Inc. (12/29/2023 – 07/26/2024)

– Courtesy of Bloomberg LP

NVIDIA Corp. (12/29/2023 – 07/26/2024)

– Courtesy of Bloomberg LP

Tesla, Inc. (12/29/2023 – 07/26/2024)

– Courtesy of Bloomberg LP

Meta Platforms, Inc. (12/29/2023 – 07/26/2024)

– Courtesy of Bloomberg LP

Profit Report

Politics and Economic Forecasts: Warren Buffet’s Wisdom from 1994!