Financial markets this week traded remarkably in sync with Washington’s statements regarding stimulus and Federal Reserve activity. Important implications for investors!

*Are Market Indexes and an Economic Recovery dependent upon artificial stimulation and Why?

*What does PIMCO say about 3 to 5 year expectations?

*What has the Federal Reserve done so far?

*What have Congress and the President done so Far?

*What does it mean for 2021, 2022, and 2023?

*Is anyone concerned about inflation? Should we be?

*What strategies are likely to achieve success over the next 5 years?

*Why is using politics to make short term investment decisions like playing a round of golf by swinging your laptop?

Join us for a fast-paced tour of the Global Financial markets focused on you, the informed investor!

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index Quarterly Earning Estimates (10/09/2017 – 10/09/2020)

– Courtesy of Bloomberg LP

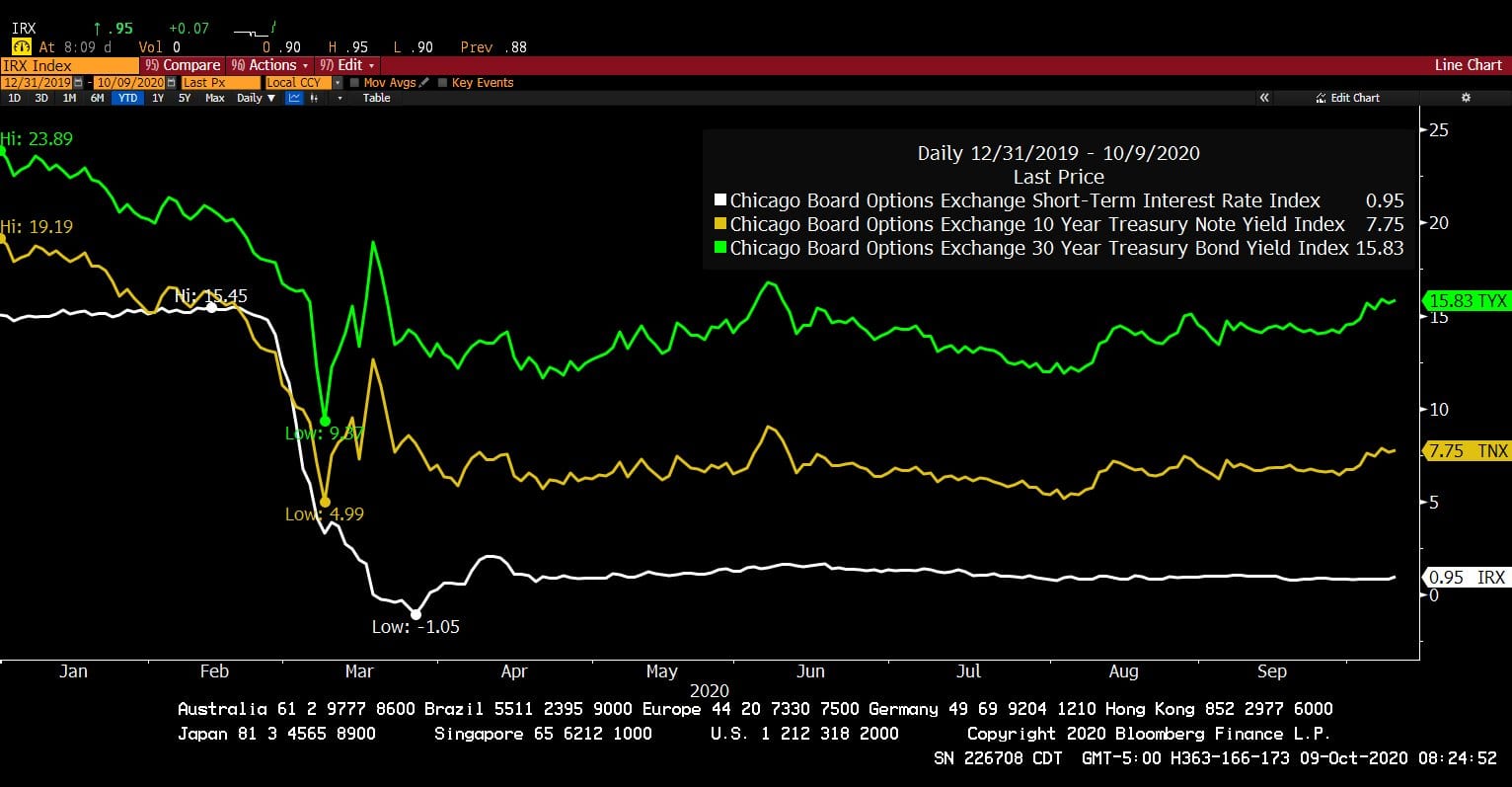

C.B.O.E – Short Term Interest Rate Index, 10 Year Treasury Note Yield Index & 30 Year Treasury Bond Yield Index (Year to Date)

– Courtesy of Bloomberg LP

Exchange Trade Fund Flows (10/09/2020)

– Courtesy of Bloomberg LP

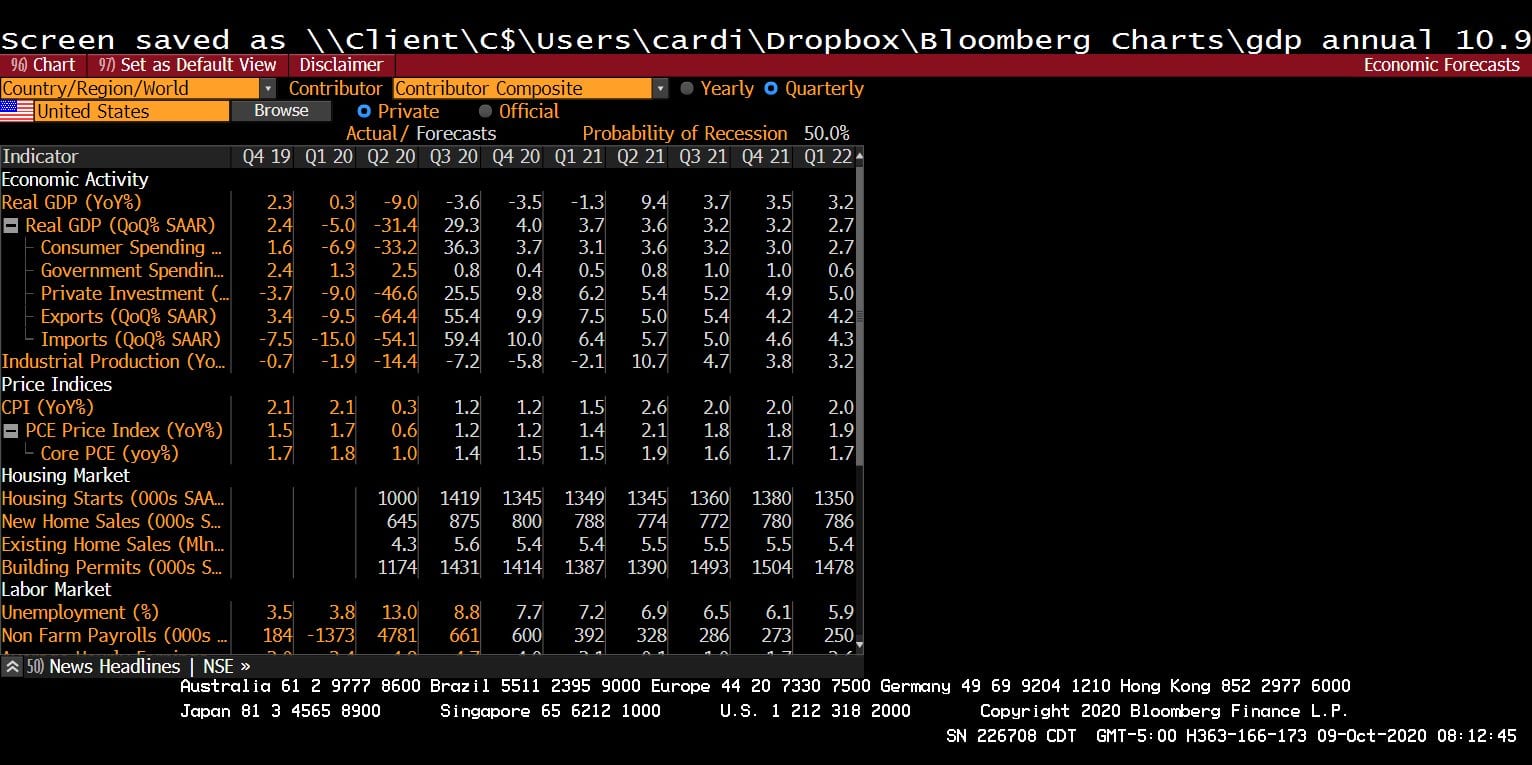

Quarterly U.S. Economic Actual & Estimated Forecasts w/ Probability of Recession (4th Qtr. 2019 – 1st Qtr. 2022)

– Courtesy of Bloomberg LP

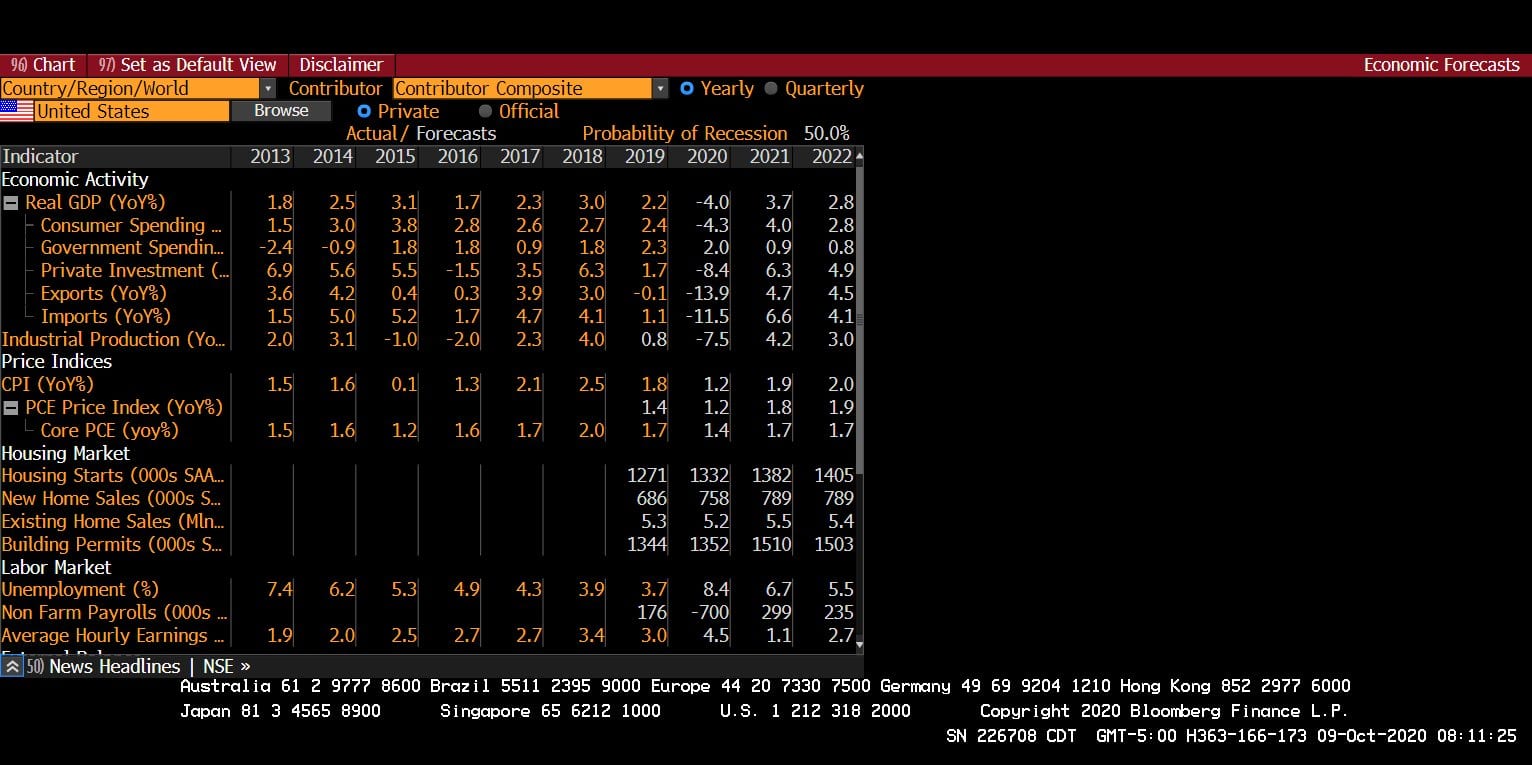

Yearly U.S. Economic Actual & Estimated Forecasts w/ Probability of Recession (2013 – 2022)

– Courtesy of Bloomberg LP

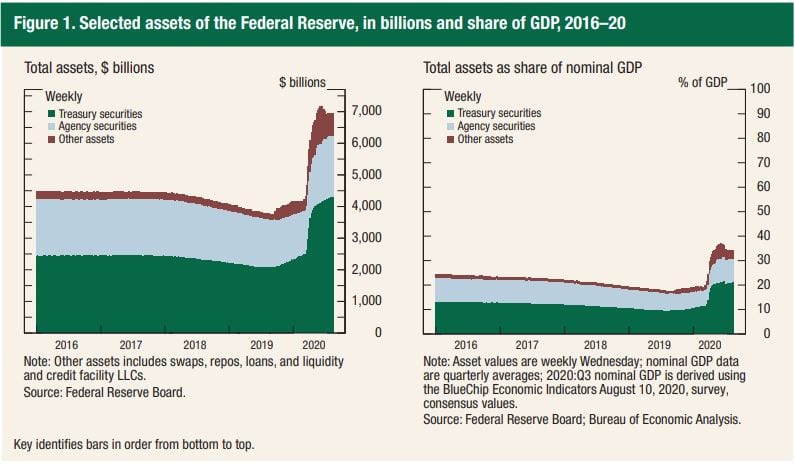

Selected Assets of the Federal Reserve in Billions & Share of GDP (2016 – 2020)

– Federal Reserve Board, Bureau of Economic Analysis

MAC Global Solar Energy Index (01/01/2004 – 10/09/2020)

– Courtesy of Bloomberg LP

Natural Gas Spot Price (Year to Date)

– Courtesy of Bloomberg LP

Headline Round Up!

*Congress and the President Use Fiscal Stimulus as a Campaign Tool with Headlines Driving Money Flows.

*Fed Prints Record Trillions! How Much?

*Bond Markets Reacted to Fed Minutes Not Actually Guaranteeing Zero Rates Through 2023.

*PIMCO Makes an Important Statement on What to Expect from Indexes for 3-5 Years!

*Morgan Stanley Swallows Eaton Vance for $7 Billion!

*Goldman Raises $14 Billion for What?

*Fear, Loathing, and Default in Las Vegas and New Orleans. What does the end of eviction moratorium mean for REITS in 2021?

*NASDAQ in Talks with Gov. Abbott to Move to Dallas! Trading “Gone to Texas.”

*Rare Earth’s? Trump Orders All In! Remember the rare earth stock trading? What about Cobalt, Congo, and Bill Gates?

*Morgan Stanley’s Balance Sheet Goes All in for V-Shaped Recovery!

*Value Stocks September Wake Up Call!

*Pipelines Spike!

*Joe Biden Cannot Ban Fracking? Why?

*Remember the headline from last week that seemed important to the markets, but now may not matter in the long term?

*President and First Lady Tested Positive for COVID-19. UK’s Boris Johnson and Brazil’s President Bolsonaro Recovered After Testing Positive During 2020.

*Institutional Research Source Makes Predictions on 2021 Based Upon Election Outcome.

*Goldman Says “Blue Wave” Would Boost Economy! (and likely their earnings?)

Profit Report!

*Tax Plan Updates!

*Biden Tax Plan?

*Trump Tax Plan?

*This Week’s Money Flow and Sector Performance Updates.