Q: With recent financial headlines focused on the Federal Reserve, what is an economic issue that many investors might miss?

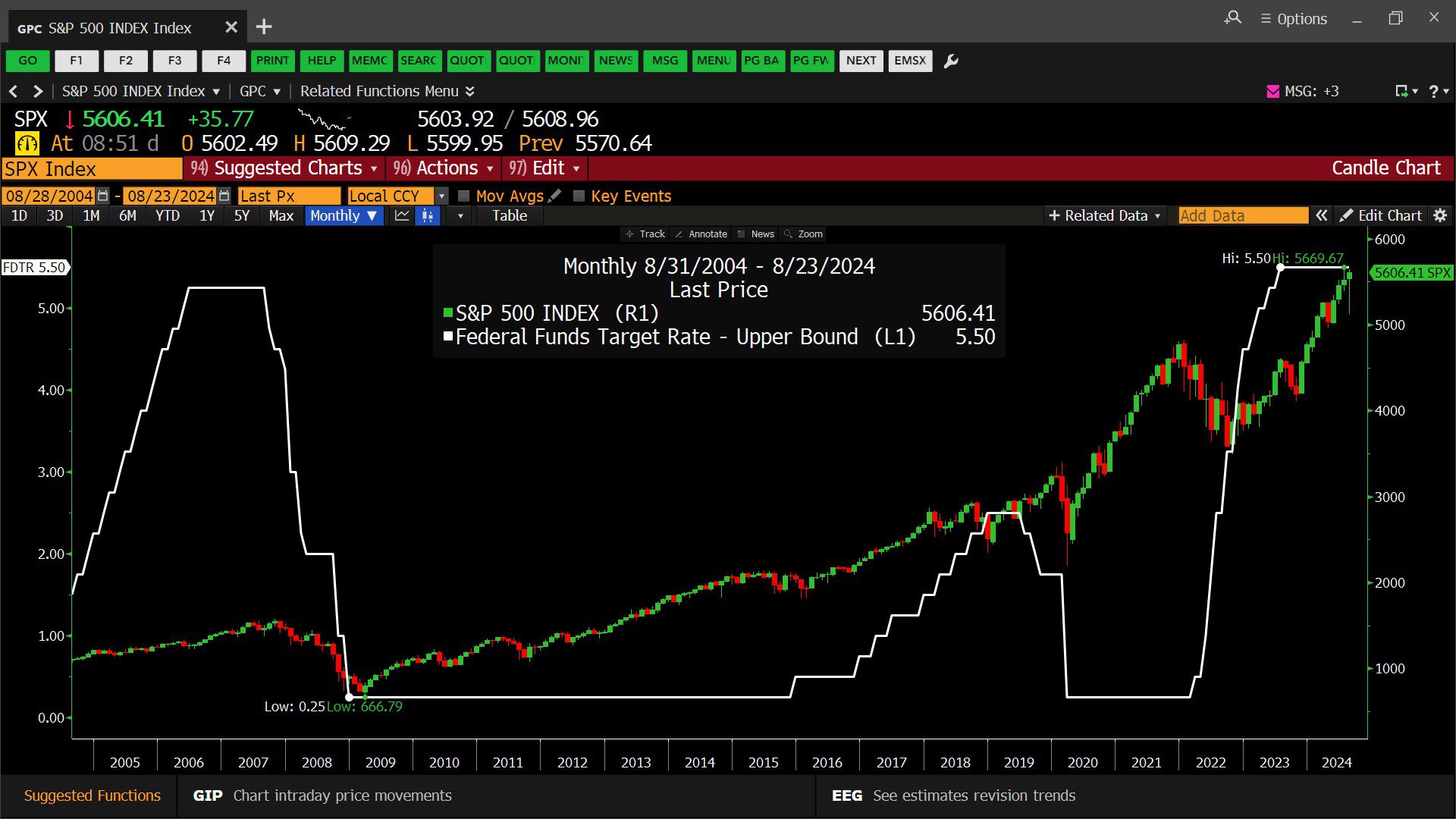

A: The Federal Reserve’s current projections forecast a decrease in the overnight bank lending rate from 5.25% to 2.8% by 2027. The decrease in cash rates and money market rates likely increases the relative value of high cash flow assets.

Q: With different possible election outcomes soon, what are some important issues for long term investors to consider?

A: Investors should prepare for resulting tax policy changes, regulatory changes, and government spending changes from any new administration.

Headline Round Up

*Oops! Department of Labor Overstated Job Growth by 818,000 in the 12 Months That Ended in March. Employers added 174,000 jobs instead of 242,000 jobs leading to a downward revision of 28%.

*Federal Trade Commission’s Ban on Non Compete Agreements Rejected by Federal Judge in Texas!

*Target Spikes to a Three Month High This Week as It Beats Q2 2024 Profit, Revenue and Comparable Sales Expectations!

*Peloton Spikes 40% as Turnaround Plan Sees Success and Losses Shrink?

*Tesla Lags in Offering Driver Assistance Features in China While Chinese Electric Vehicle (EV) Makers Already Sell Models with Tech in Chinese Domestic Market.

*Tesla Issues Another Recall This Week? 9,100 model X SUVs literally coming “unglued”?

*Clean Fuel Start Ups Collapsing Due to Rising Costs, Extended Project Timelines & Delays in Receiving Tax Credits.

*Carl Icahn Charged by SEC For Failing to Disclose Billions in Personal Loans Backed by Icahn Enterprises, L.P. Stock.

*The “#1 Most Profitable Hedge Fund Manager of All Time,” and It Says So on The Elevator Doors at Its Miami Headquarters!

*Canadian Convenience Store Giant, Circle K Offers $38 Billion for 7-11 in a “Friendly, Non-Binding” Proposal!

*AON, PLC Says Employer Health Care Costs Set to Increase Another 9% Next Year?

*U.S. Manufacturing Activity Contracts at Fastest Pace This Year Early This Month. “…Inflation is continuing to slowly return to normal levels and the economy is at risk of slowing amid imbalances”, Says Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

*Enbridge, Inc.’s CEO, Greg Ebel Says U.S. Liquefied Natural Gas (LNG) Doubling on “Colossal” Artificial Intelligence (AI) Power Use.

*Zoom Zooms on New Products and Sales Growth in Q2.

*Ford Delays EV Production at New Tennessee Plant and Scraps 3 Row SUV as Business Strategy Shifts to Hybrids.

*The CEO Who Made 250 Million While His Hospital Chain Collapsed.

SPDR Dow Jones Industrial Average Exchange Traded Fund (ETF) Trust (08/01/2024 – 08/23/2024)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index & Federal Funds Target Rates (08/28/2004 – 08/23/2024)

– Courtesy of Bloomberg LP

SPDR Dow Jones Industrial Average Exchange Traded Fund (ETF) Trust, Invesco QQQ Trust Series 1 and SPDR Standard & Poor’s 500 Exchange Traded Fund (ETF) Trust (08/24/2023 – 08/23/2024)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index – Quarterly Earnings Analysis by Sector (05/16/2024 – 08/15/2024)

– Courtesy of Bloomberg LP

Target Corp. (08/25/2019 – 08/23/2024)

– Courtesy of Bloomberg LP

Peloton Interactive, Inc. (08/25/2019 – 08/23/2024)

– Courtesy of Bloomberg LP

Profit Report

The equity market’s Armageddon head-fake of early August?

The continued evolution of McGowanGroup Wealth Management investment plans.