Q: What are some of the factors that contributed to the Dow Jones Industrial Average topping 35,000 this week for the first time since April of 2022?

A: Microsoft hit an all-time high at the release of their Alternative Intelligence (AI) subscription plan, Johnson and Johnson rallied after reporting their latest earnings & money flows appeared stronger for Value stocks over Growth stocks.

Q: What does the Federal Reserve think will happen between now and 2026?

A: Projections for 2026 include a Federal Funds Rate at 2.5% instead of the current rate over 5% & recent Inflation projections decline to 2%.

Q: What is significant for investors about Carvana’s 31% stock price spike this week?

A: Retained losses since 2016 are over $30 per share and projected to continue.

Headline Round Up

*Dallas Offices Downsizing?

*”Big Short” Investor, Steve Eisman, Predicts Stock Market Will Continue to Rally Assuming Economy Stays Fine.

*Investors Bailing on Cathie Wood’s ARK Innovation Exchange Traded Fund (ETF). Average Investor Down 21% Annualized from Inception Based Upon Dollar Weighted Returns.

*After Tax Retirement Catch Up Contributions for High Earners Sunset in January. What does this mean for savers?

*Goldman Sachs Earnings Fall 58% Due to Real Estate and Consumer Losses in Q2. Profitability also fell to 4%.

*Crowdfunding Real Estate Funds Vanished According to Bankruptcy Court Papers!

*Current Pay Raises Top Inflation Finally After 2 Years & Yet Producer Prices Rise Only 1/10%.

*Chinese Junk Bonds Plummet While Defaults Mount in Worst 3 Day Slide Since November.

*AT&T Hits 31 Year Low Over Lead Encased Telecom Cable Clean Up Costs.

*Ford Slashes F-150 Electric Prices! Ford is on track to lose over $3 Billion in Electric Vehicle (EV) Effort.

*Mexico’s PEMEX a “Hotbed of Bribery.”

*FINALLY! Tesla’s Cyber Truck, Made in Austin, is Here!

*Innovator Equity Defined Protection ETF Provides “100% Downside Protection.” What could possibly go wrong?

*OPEC Predicts Tighter Oil Market for 2024.

*Citigroup’s Ed Morse Sees $90 Ceiling Per Barrel Oil with $70 Floor.

*Criminal Gender Pay Gap? Embezzler Samuel Bankman-Fried Got $2.2 Billion While Girlfriend Caroline Ellison Just $6 Million?

*No Incentive For Efficiency: Government Offices Only 50% Attended?

*Magnolia Arkansas Could Become the Epicenter of the Lithium Boom?

*Canada Goes Nuclear!

Dow Jones Industrial Average (07/21/2021 – 07/21/2023)

– Courtesy of Bloomberg LP

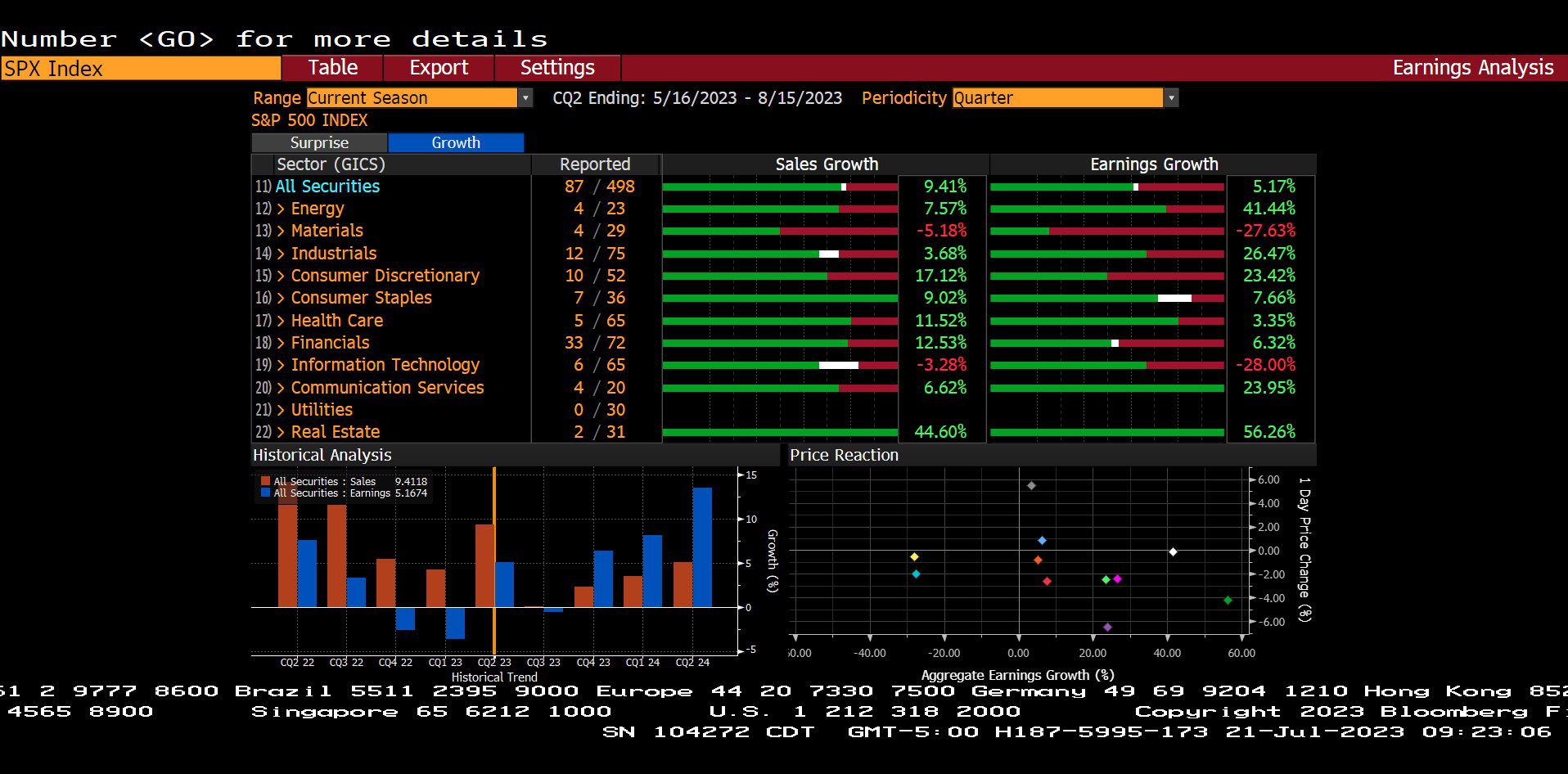

Standard & Poor’s 500 Index – Quarterly Earnings Analysis By Sector (05/16/2023 – 08/15/2023)

– Courtesy of Bloomberg LP

Invesco QQQ Trust Series 1 (07/21/2021 – 07/21/2023)

– Courtesy of Bloomberg LP

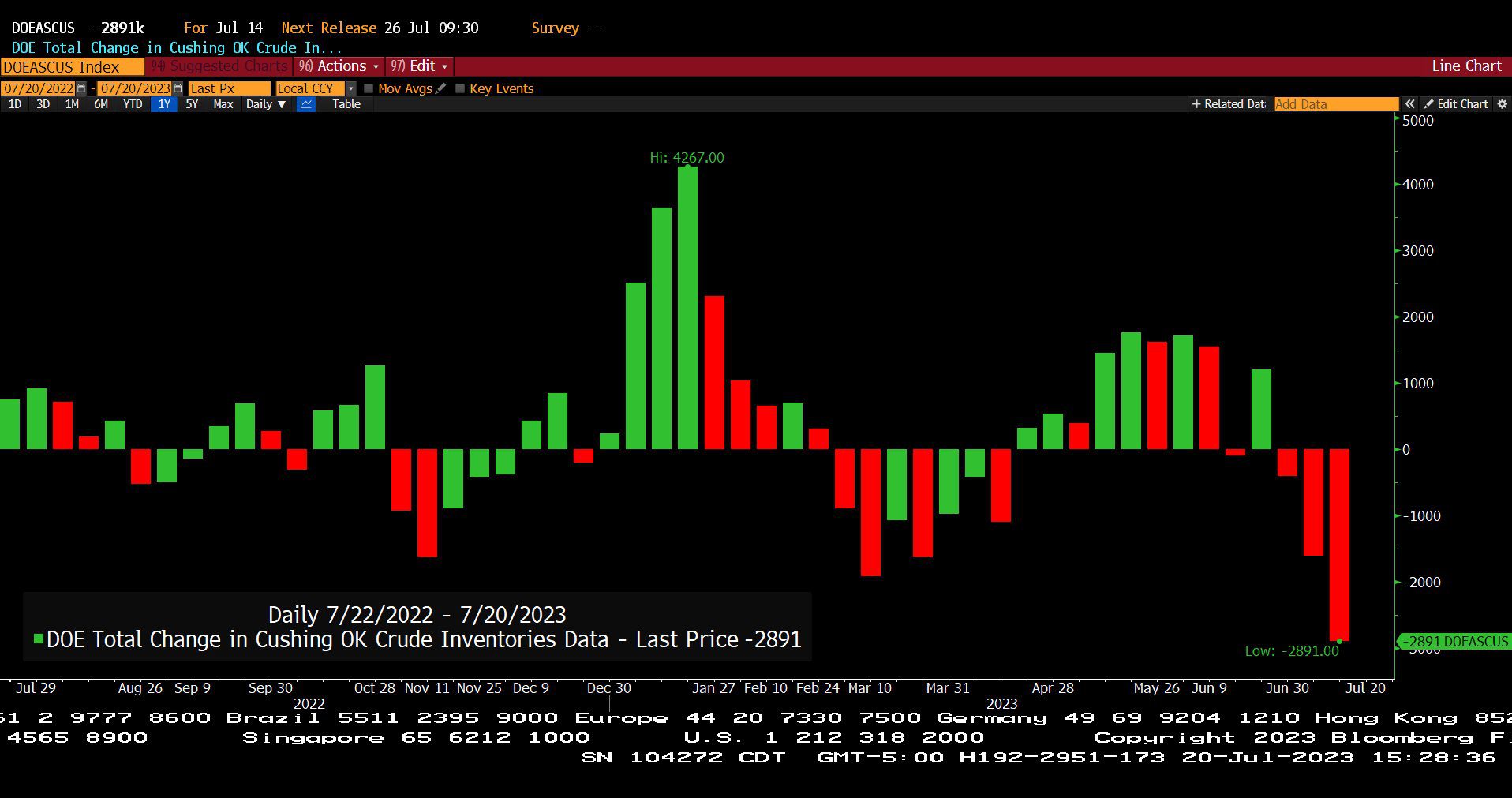

Department of Energy – Total Change in Cushing, OK Crude Oil Inventories Data (07/20/2022 – 07/20/2023)

– Courtesy of Bloomberg LP

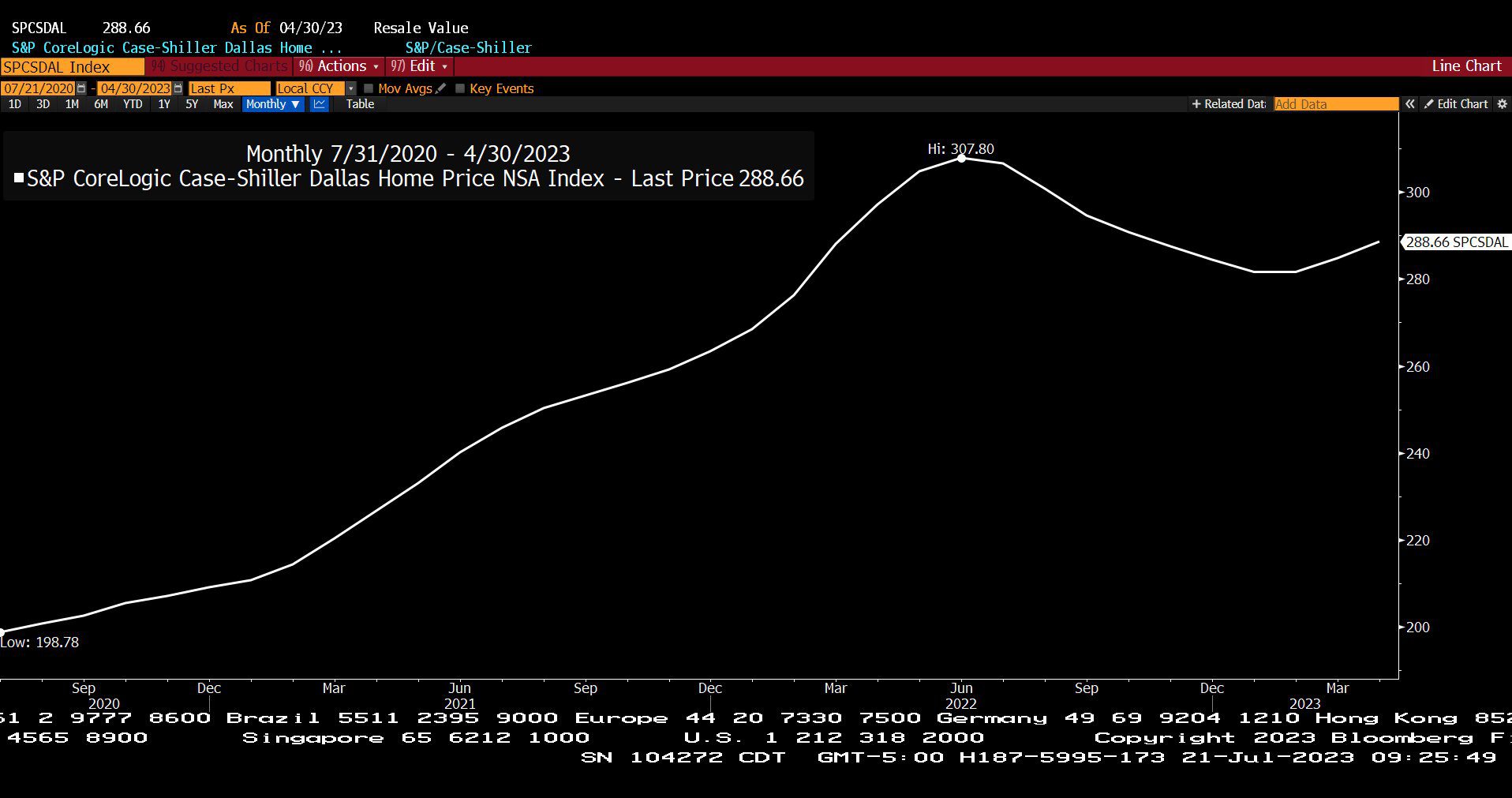

Standard & Poor’s Case-Shiller Dallas Home Price Index, Non Seasonally Adjusted (07/21/2020 – 04/30/2023)

– Courtesy of Bloomberg LP

Carvana, Co. (01/01/2016 – 07/21/2023)

– Courtesy of Bloomberg LP

Profit Report

Has your current advisor actually read your Trust and Will?