McGowanGroup Wealth Management

Q1 2024 Client Update

January 4th, 2024

2 Years in the Desert

The large equity gains in the financial markets of 2023 essentially returned the major indexes to the same levels as the close of 2021, no progress for 2 years. Overall, our managed accounts performed above the indexes with great resiliency during the declines.

A 2024 Magic Carpet Ride?

One of the primary factors over the past 2 years, of course, was the Federal Reserve interest rate tightening cycle, which corresponded to the bear market of 2022. Future cash flows are worth less when cash rates are relatively high. The Federal Reserve’s most recent projections show a return to a more normal 2.5% over the next 3 years for the Federal Funds Rate and corresponding rates on Treasury Bills. For high cash flow assets, a lower discount rate increases the net present value of future cash flows.

Recession?

The Federal Reserve economic growth projections are 1.4% for 2024. Goldman Sachs forecasted growth over 2% in their 2023 year-end update.

Energy Infrastructure

As of December, Recurrent Advisors estimated that energy infrastructure companies are trading at about 6 times cash flow. Of that estimated 16%, 8% roughly represents current dividends and direct share buybacks about 8%. The resulting increase in assets under control per share would equate to about 40% over a five year period in addition to the cash dividends.

Global High Yield

Our four primary high yield managers delivered an impressive 2023. The current yield, equally weighted is above 9%*. While that is an impressive cash dividend, the estimated discount to par value under control per share, is over 20%. The resulting appreciation potential during declining interest rates could be quite impressive assuming bonds drift back towards par values.

Blue Chip Additions

The McGowanGroup Wealth Management investment committee successfully added positions in nuclear, utility assets, pharmaceuticals, and AI related technology during 2023 dips.

Our Next Steps?

Equity market rallies provide the opportunity to raise tactical safety for future resilience especially as valuation targets are harvested.

A Cautionary Note

Election years provide equal opportunities for rejoicing and lamentations. The temptation to let politics drive portfolio decisions often leads to distraction and mistakes. Let not your heart be troubled as we are on the case and grateful to serve.

We wish you and your family a happy and prosperous new year!

The Team That Cares,

McGowanGroup Wealth Management.

* Your specific accounts could be higher or lower than the stated percentage rates & your specific return could be different depending on your contribution/distribution rates of your accounts.

Headline Round Up

*U.S. Overtakes Australia and Qatar as Top Liquefied Natural Gas (LNG) Exporter with 2023 Shipments.

*The Future is Bright if You Know Where to Look. Artificial Intelligence (AI) & Medicine promise a better life down the road.

*Hedge Funds “For the Masses” Overall Post Disappointing Returns.

*Tell This to Your Boss: 5.4% Average Pay Raise for Workers Who Stayed in Their Jobs and 8% Raise for Job Changers.

*Obesity Market Global Sales Could Hit $80 Billion by 2030?

*529’s Can Become a Roth After 15 Years?. New changes in 2024.

*China’s BYD Co. Passes Tesla, Inc.

*Europe Eats $2.2 Billion Loss on Pfizer’s Paxlovid Covid Dose Expiration.

*Bitcoin Tops $45,000, 1st Time in 21 Months, on Long Anticipated Exchange Traded Fund (ETF) Approval That Still Hasn’t Happened!

*Tech Stocks Sell Off Starts the Year. AI Hangover, NASDAQ Falls & Energy Bounces?

*Mexico Nationalizes French Hydrogen Processing Plant Air Liquide?

*SpaceX Launches Satellite Cell Service with T-Mobile.

*U.S. Auto Sales Rebounded 13% in 2023. Oversupply and Declining Prices in 2024?

*Novo Nordisk A/S Developing New Technologies for Weight Loss.

*Microsoft Adds New AI Key to PC Keyboards.

*Real Estate Private Equity Investors Bailing Out.

*Chevron Writes Off Up To $4 Billion in California/Gulf of Mexico Assets. Gone to Texas?

Mergers and Acquisitions

*APA Corp. to Buy Callon Petroleum Co. for $2.6 Billion in All Stock Deal.

Invesco QQQ Trust Series 1 (12/30/2021 – 01/5/2024)

– Courtesy of Bloomberg LP

SPDR S&P 500 Exchange Traded Fund Trust (12/31/2021 – 01/05/2024)

– Courtesy of Bloomberg LP

Chicago Board Options Exchange – Short Term Interest Rate Index (12/31/2021 – 01/05/2024)

– Courtesy of Bloomberg LP

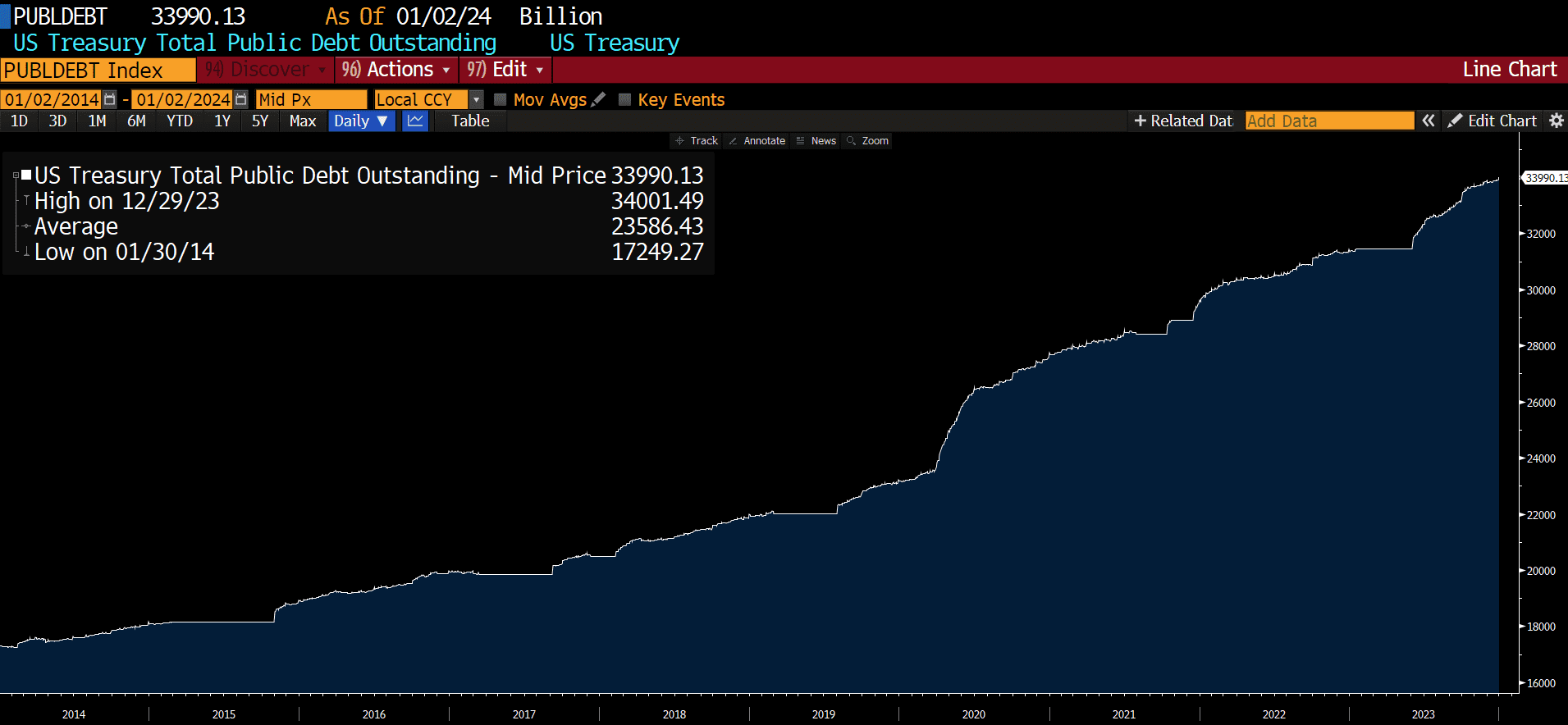

U.S. Treasury Total Public Debt Outstanding (01/02/2014 – 01/02/2024)

– Courtesy of Bloomberg LP

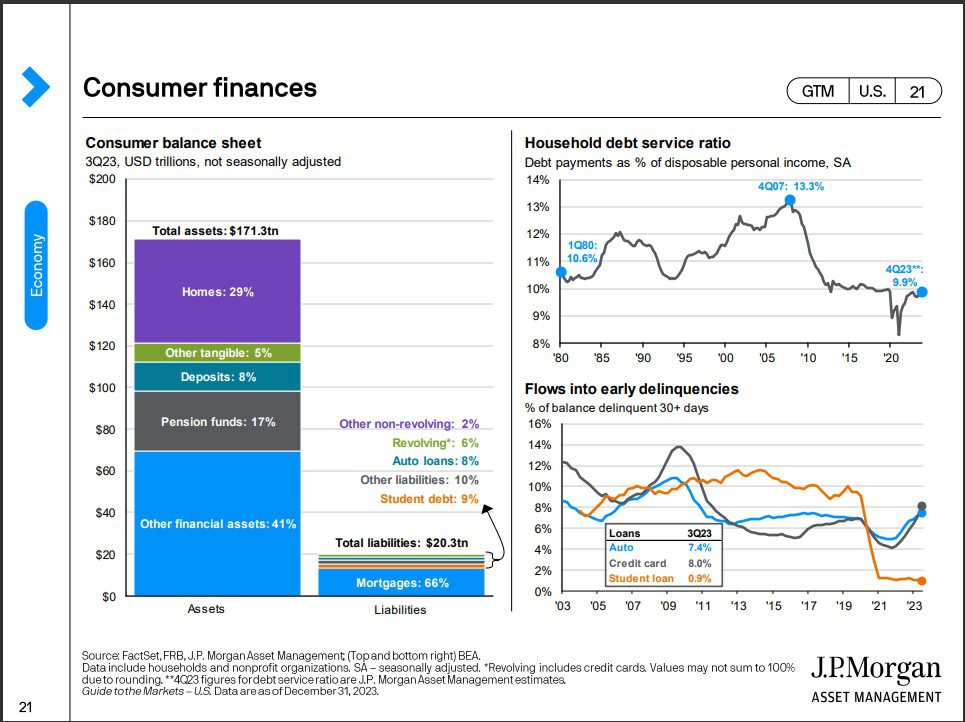

J.P.Morgan Guide to the Markets – U.S. Q1 2024, pg. 21 (12/31/2023)

– Courtesy of J.P.Morgan Asset Management

Profit Report

McGowanGroup Forecasts and Candidates for 2024 Bozo and Sir John Templeton Awards!