• Are the Financial Markets indicating comfort with either election outcome?

• Where does all this stimulus money come from?

• With Interest Rates at ZERO, what will the big money buy in 2021?

• What is a “Cash Flow Panic?”

• Where is the money flowing now?

• What are the dangers now to “COVID immune” tech stocks?

• Earnings versus Indexes? What does this tell us about Q4 and 2021?

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

Health Care Select Sector SPDR Fund (Year to Date)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index Earnings Estimates (10/22/2017 – 10/22/2020)

– Courtesy of Bloomberg LP

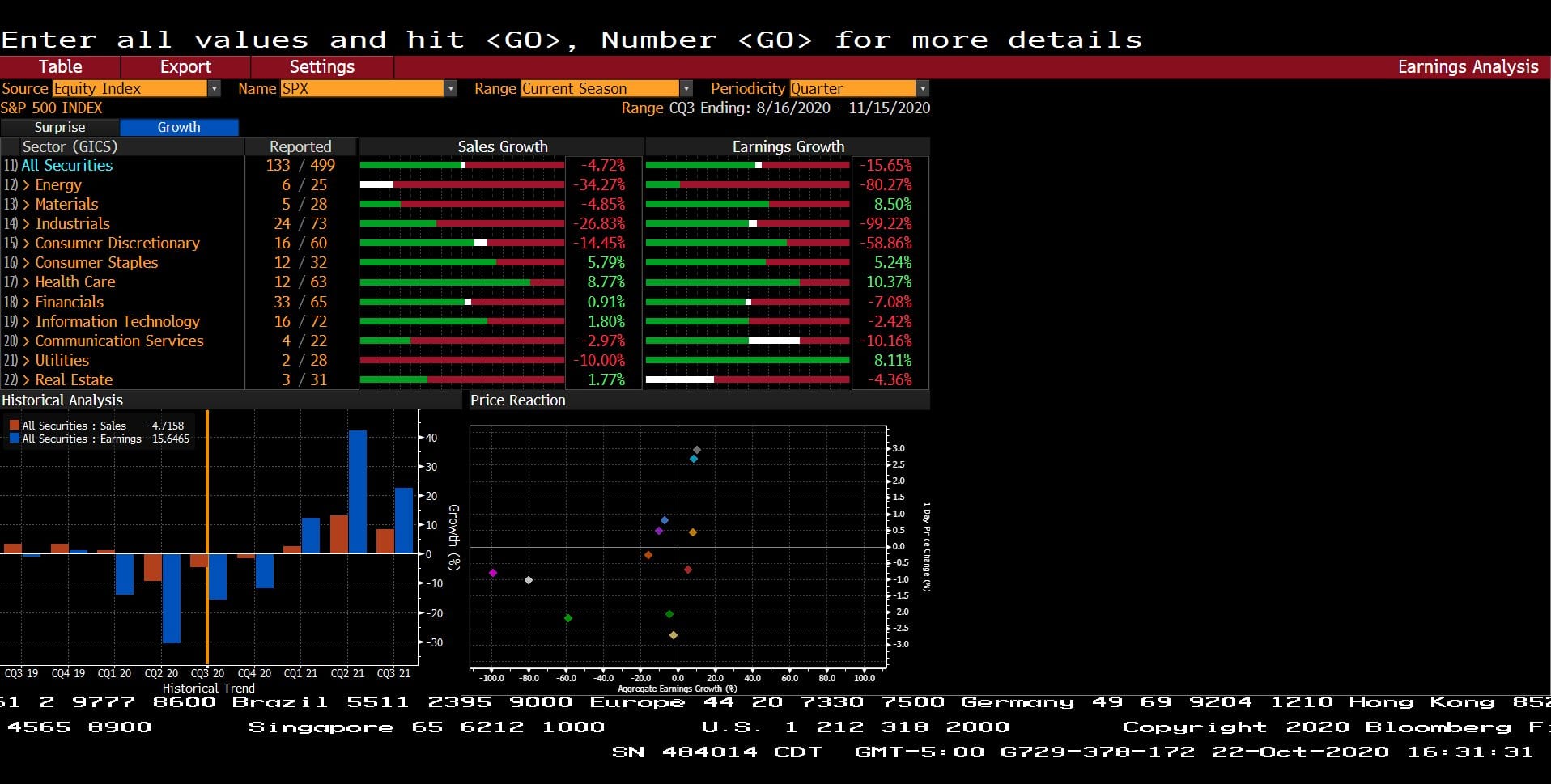

Standard & Poor’s 500 Index Earnings Analysis (08/16/2020 – 11/15/2020)

– Courtesy of Bloomberg LP

Exchange Traded Fund Flows (10/23/2020)

– Courtesy of Bloomberg LP

Global X MLP ETF (Year to Date)

– Courtesy of Bloomberg LP

Netflix, Inc. (Year to Date)

– Courtesy of Bloomberg LP

Headline Round Up!

*Federal Budget Deficit Grew to a Record $3.1 Trillion! Alex, what does this mean for investors?

*Single Family Home BOOM! Building Permits at a 13 Year High and Existing Home Sales at a 14 Year High.

*Urban Apartment Depression? Wave of Evictions are Hitting and Rents are Plunging. The Most Expensive Cities in Free Fall?

*Municipal Nightmare: Yields Near Zero and Duration Risk at All Time Highs along with Empty Dorms and Bankrupt Cities?

*Corona Who? China Grows at 4.9% in Q3. Why does their GDP number come out faster than the U.S.? Predetermined outcome?

*Air Travel Passengers Exceed 1 Million, First Time Since March. 40% of Same Day 2019. Stay tuned for airlines financials and sector advice.

*Conoco Buys Concho Shale! Is Texas Permian ground zero for future supply?

*Pioneer Natural Resources Ready to Buy Parsley Energy!

*Kinder Morgan Within 10% of 2019 Revenue, Within 5% of 2019 Profits.

*Natural Gas Spikes Over $3!

*Oil and Gas Demand Restoration? Pipeline Spike!

*Dakota Access Pipeline Clears Hurdle to Double Capacity!

*Solar Breakthrough?

*Hydrogen Trucks?

*Texas Wind?

Profit Report!

*Earnings season is in full swing. Here are the intelligence reports and 2021 strategy implications across industries.

*Q4 and 2021 Institutional research from John Hook!

*Bitcoin? Global Finance Implications? Paul Tudor Jones Says Bitcoin Rally just in “First Inning”.

*After Coronavirus Panic to Buy “COVID Immune” Stocks, Short Netflix?