“Not so my Lord; I am too much in the sun.”

– Hamlet Act 1, Scene 2

Q: Things did not go well for Hamlet after that, but what lessons can investors learn from Hamlet?

A: Investors should take heed regarding overpriced buying frenzies. The Dutch Tulip Bulb market bubble in the 1600s, The Dot-Com Boom in the late 90s, Overvalued Technology Stocks in 2000, & Bank Stocks in 2008 are just a few examples of what overpriced frenzied buying in financial markets can lead to.

Q: Interesting quote of the week on inflation from who?

A: “If the state does not spend more than it collects and does not issue (money), there is no inflation. This is not magic,” the self-described “anarcho-capitalist” said. That was this week’s quote from controversial Argentinian President Javier Milei. This week, Argentina announced a quarterly budget surplus of $309 Million, the first government surplus since 2008 while currently in Argentina “annual inflation stands at 290 percent year-on-year, poverty levels have reached 60 percent and wage-earners have lost a fifth of their purchasing power”.

Headline Round Up

*U.S. Gross Domestic Product (GDP) Growth Slows to 1.6%?

*Tech Smack! Meta, MSFT, IBM, Get Gobsmacked After Earnings Reports.

*Tesla Rises on Worst Earnings Report in 7 Years?

*BlackRock Says Global Energy Transition Will Require $4 Trillion Annually by Mid-2030s? Michael Dennis, Head of BlackRock’s Alternatives Strategy & Capital Markets, Asia Pacific, stated that $4 trillion dollar figure will require increases in private and federal capital. Maybe there are better solutions?

*Cathie Wood’s ARK Funds Unraveling. Too much exposure to technology sector to blame?

*Zimbabwe’s New Currency, Zimbabwe Gold (ZiG), Wipes Out More Than 330% Crushing Their Stock Market.

*Real Estate Exodus Subsiding? Blackstone’s Gated Funds Cover All Redemption Requests from February and March This Year for Investors Stuck Since Late 2022.

*Federal Trade Commission (FTC), Headed by Chairperson Lina M. Kahn, Announces Ban on Non-Compete Agreements for Anyone Other Than Senior Executives. FTC estimates that one in five Americans is subject to a noncompete agreement.

*Federal Communications Commission (FCC) to Vote on Classifying Broadband Carriers as Common Carriers Under Title II of the 1934 Communications Act. This would allow the FCC to regulate them like AT&T.

*FTC Blocks Merger Uniting Coach and Michael Kors? Says merger would give combined company “too much power in the market for accessible luxury satchels”.

*Texas Grid Pushed to Brink by Population Growth, Industrial & Tech Sector Growth and Bitcoin Mining?

*Energy Transfer, LP Raises Dividend Again!

*Texas Instruments Spikes on Revenue Turnaround Forecast After Dismal Earnings Report.

*Visa, Inc. Profit Surges 17% as Customer Spending Increases!

*Oracle Leaves Austin for Nashville in Bid to Get Closer to Healthcare Industry?

*JPMorgan Chase & Co.’s Trading Desk Model Flashes Buy Signal?

*Hertz Hurting? Company Reports $392 Million Loss While it Unwinds Tesla Fleet.

*G42, a United Arab Emirates Based Technology Company, Gets Microsoft Backing on Artificial Intelligence (AI) Supercomputer Being Built in Dallas!

*Raytheon Hits 52 Week High on Ukraine Israel Aid.

*Novo Nordisk’s Wegovy Access Expanded to Millions on Medicare.

*AI Datacenter Demand Exceeds Supply as Bottlenecks Slow Growth.

*The Hedge Fund that Made a Fortune on China’s Real Estate Bust.

Standard & Poor’s/Bolsas y Mercados Argentinos (BYMA) – Argentina General Index (04/29/2019 – 04/26/2024)

– Courtesy of Bloomberg LP

Dow Jones Industrial Average Index (12/29/2023 – 04/26/2024)

– Courtesy of Bloomberg LP

Energy Select Sector SPDR Fund, Invesco QQQ Trust Series 1 & SPDR Standard & Poor’s 500 Exchange Traded Fund Trust (12/29/2023 – 04/26/2024)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index – Quarterly Earnings Analysis by Sector (02/16/2024 – 05/15/2024)

– Courtesy of Bloomberg LP

Tesla, Inc. (04/29/2014 – 04/26/2024)

– Courtesy of Bloomberg LP

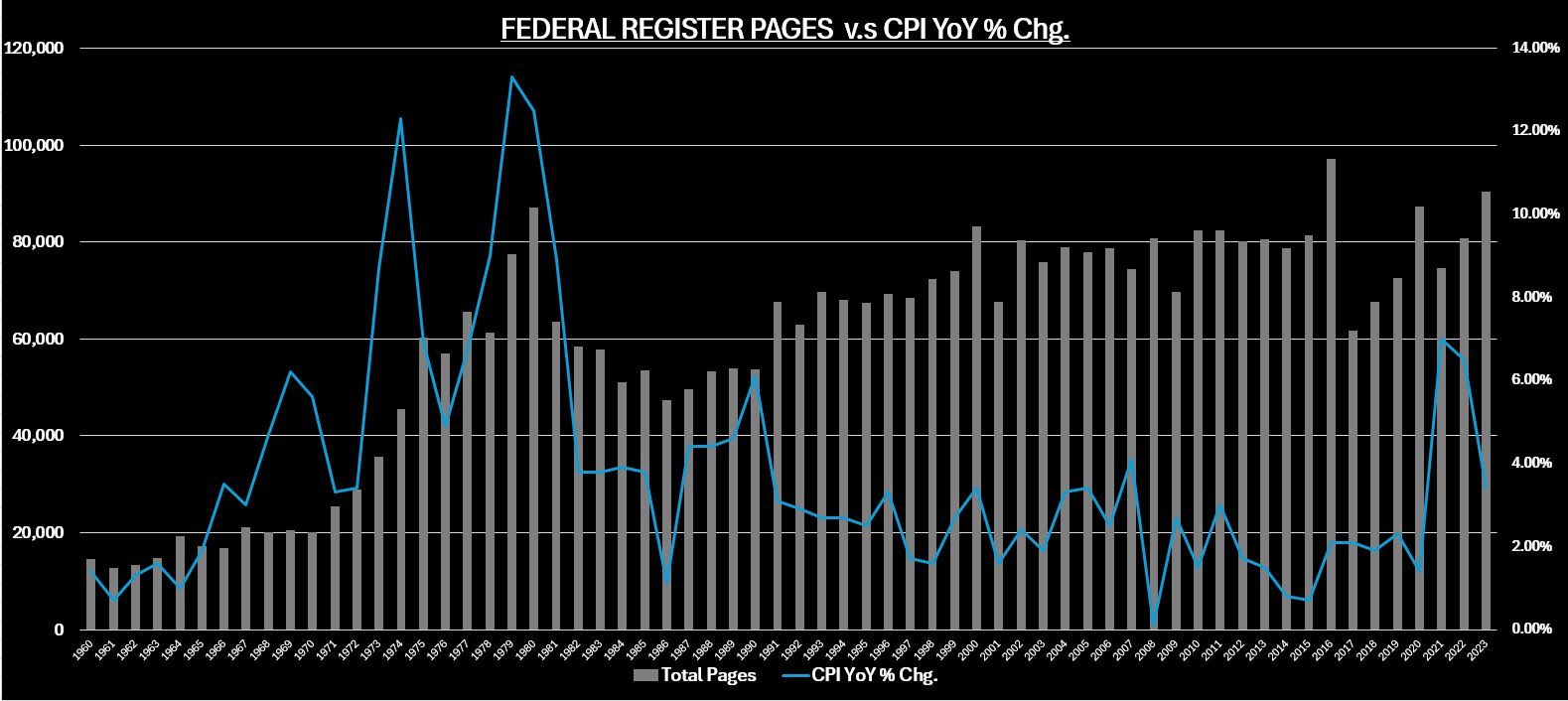

McGowanGroup’s Federal Register Page Numbers vs. Consumer Price Index Year over Year Changes (04/2024)

– Courtesy of McGowanGroup Asset Management : Information provided is pulled from generally reliable sources and compiled for illustrative purposes only. Additional information regarding methodology is available upon request.

Profit Report

The New Dividend Units Model Portfolio by McGowanGroup Wealth Management (MGWM)!

MGWM solutions toolbox!