Q: What were some of the financial markets’ reactions to Iran’s ballistic missile strike on Israel?

A: Oil spiked over $73 per barrel up nearly 10% for the week while the U.S. equity markets fell 1% during the week after initially holding steady after the Iranian strike.

Q: What is a possible market impact to an Israeli response?

A: The Wall Street Journal details potential Israeli strikes on Iranian leadership, nuclear facilities, and oil infrastructure. Iran exports near 2 million barrels of oil per day so a disruption would likely create an undersupply compared to global daily demand.

Q: What is a potential outcome of the International Longshoreman Association’s strike?

A: Harold Daggett, the ILA union leader telegraphs a supply chain disruption by saying, “We’re going to show these greedy bastards you can’t survive without us!” as he addressed hundreds of union workers.

Q: What is the McGowanGroup’s current Assets Under Management?

A: Just under $1 Billion as of September 30th, 2024!

Headline Round Up

*Micron’s Shock Earnings Send Stock Soaring.

*Nuclear Renaissance: Michigan’s Palisades Set to Restart Late Next Year With $1.5 Billion Loan Finalized.

*Australian Mining Giant Fortescue Founder, Andrew Forrest, Says It’s Time for the World to Walk Away from the “Proven Fantasy” of Net Zero Emissions by 2050 and Embrace “Real Zero” by 2040 Instead!

*August 20th 2024, Daily Solar Production Up 83% Over Prior Year!

*Elon Musk Via X: “Solar Power is Growing Super Fast. In the Very Long-Term (Kardashev Scale), Solar Will be >99% of All Power Generation.”

*U.S. Buying 6 Million Barrels of Oil for Strategic Petroleum Reserve at Under $70.00 a Barrel. Delivery to take place between February and May 2025.

*Euro-Zone Inflation Drops Below 2% for the First Time Since 2021.

*German Two Year Bond Drops Below 2% for the First Time Since 2022.

*Goldilocks U.S. Economy Adds 143,000 Private Sector New Jobs in September! Again.

*Global Race to Cut Interest Rates While Borrowing Costs Declining?

*Stellantis Warns of Deterioration Across Global Car Industry.

*Federal Trade Commission (FTC) Clears Chevron-Hess Merger But Bans John Hess from Board! Allegations of Hess Encouraging OPEC Representatives to Take Actions That Support Higher Oil Prices?

*OpenAI Valued at $150 Billion After Latest Funding Round Raises $6.5 Billion?

*Wall Street Races to Bring Private Credit to the Masses. What is private credit and what could go wrong?

Generic Crude Oil Futures Contract Spot Price (09/30/2024 – 10/04/2024)

– Courtesy of Bloomberg LP

Department of Energy’s Cushing Oklahoma Crude Oil Total Stocks (10/10/2014 – 09/27/2024)

– Courtesy of Bloomberg LP

SPDR Dow Jones Industrial Average Exchange Traded Fund (ETF) Trust (12/29/2023 – 10/04/2024)

– Courtesy of Bloomberg LP

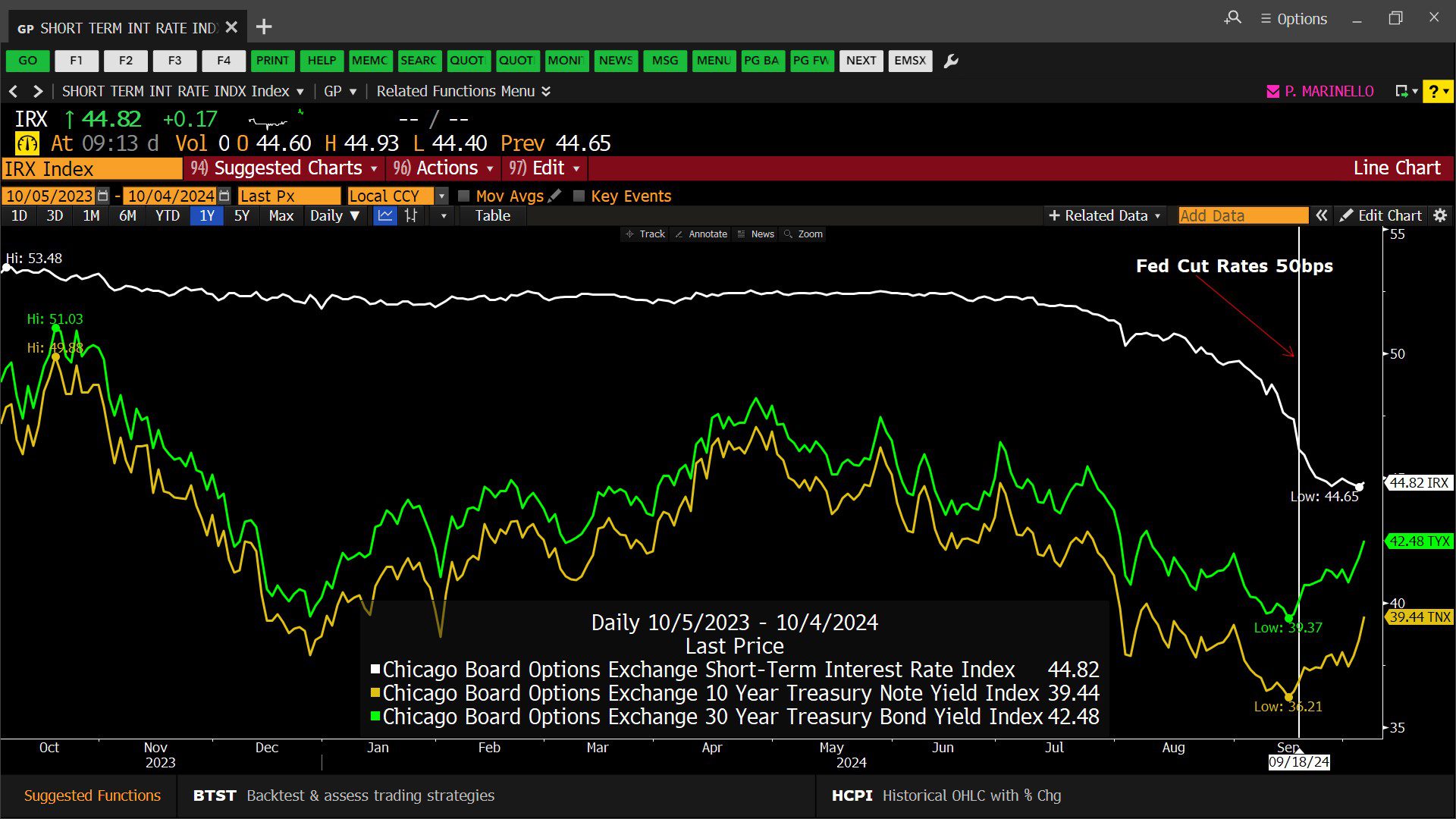

Chicago Board Options Exchange – Short Term Interest Rate Index, 10 Year Treasury Note Yield Index, & 30 Year Treasury Bond Yield Index (10/05/2023 – 10/05/2024)

– Courtesy of Bloomberg LP

Generic Natural Gas Futures Spot Price (10/07/2019 – 10/04/2024)

– Courtesy of Bloomberg LP

Generic Crude Oil Futures Contract Spot Price (10/07/2019 – 10/04/2024)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index – Quarterly Earnings Analysis by Sector (08/16/2024 – 11/15/2024)

– Courtesy of Bloomberg LP

Profit Report

Important Tax Planning Tool: Necessary Medical Deductible Over 7.5% of AGI.

The continued evolution of McGowanGroup Wealth Management investment plans.