2025 Q1 McGowanGroup Wealth Management Client Updates

01/15/2025

At the founding of our firm decades ago, McGowanGroup refers to the team and the clients working together collaboratively as a “Mastermind” group for the purpose of delivering excellence in service and relentless pursuit of superior client profits!

2025 The Year Ahead

Current economic growth: The Atlanta Federal Reserve’s Real GDPNow number estimates Q4 2024 growth at 2.7% which is relatively strong compared to the 2.1% average since 2001. Expected profit growth: Bloomberg’s recent consensus estimates for 2025 S&P 500 Index profit growth are 12% for 2025 and 12% for 2026.

The First quarter brings the new administration with intended policy changes that include Deregulation, Lower Taxes, Reduced Government Waste with Spending Discipline. Noisy Tariff negotiations appear designed to gain national advantages for the United States and U.S. companies with outcomes yet to be seen.

The Second quarter will provide an upgraded review platform and client portal! Your Wealth Manager will incorporate tours of the upgraded systems and formats. Our investment in upgraded systems captures the advantages of advanced applied technology in allocation strategy as well as performance reporting.

I believe the Third quarter can bring clear advances for investors with increased corporate productivity, potential corresponding increased profits, along with potential reduced inflation from policy changes.

Energy and Artificial Intelligence

Data center expansion is likely the first phase of capabilities to improve efficiency. The initial wave of upgrades delivered attractive growth for the Artificial Intelligence (AI) technology supply chain. The resulting increases in electricity demand have led to rallies in the Utilities Sector, Nuclear, and of course, Natural Gas.

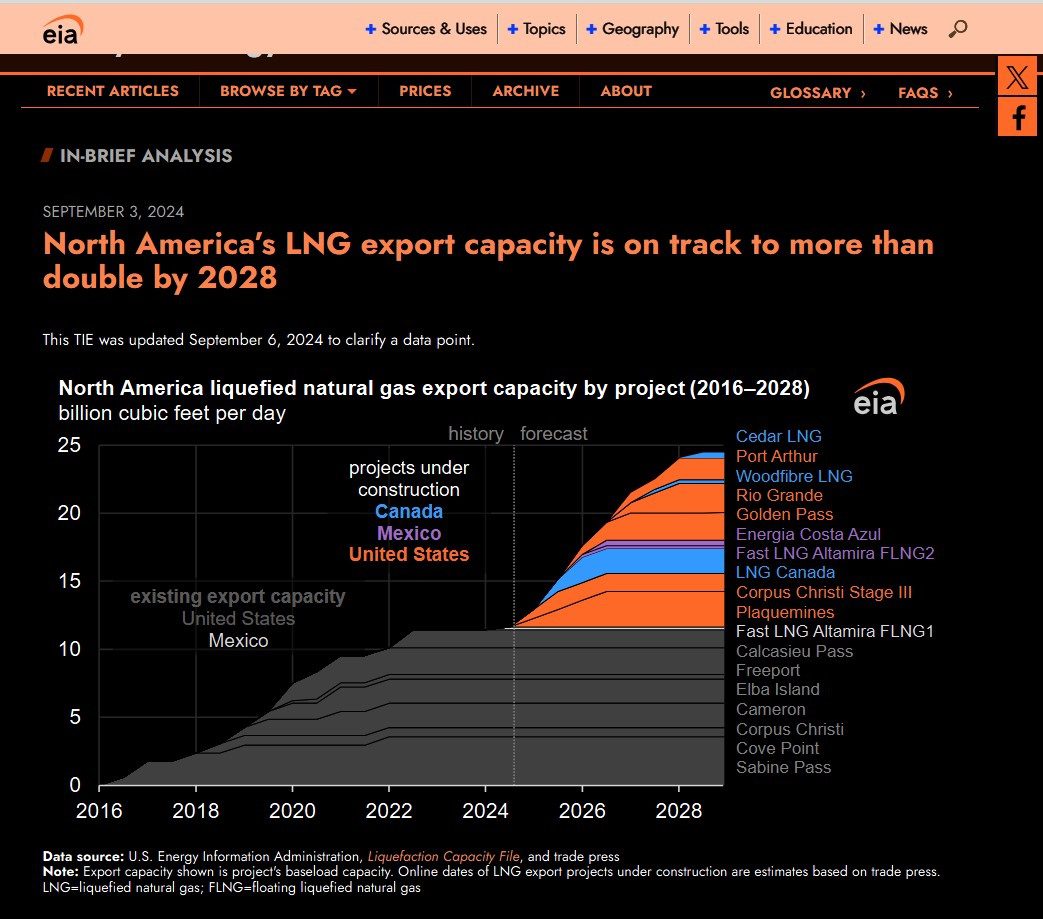

Energy Infrastructure

Rising dividends and stock buybacks underscore attractive opportunities for investors. Deregulation potentially leads to increased business productivity and profit growth. Liquid natural gas export capacity is on track to double by the end of 2028 according to the U.S. Energy Information Administration. The pipelines and export facilities still appear underpriced relative to other sectors. Data center electricity demand is an obvious choice for natural gas power generation.

Bond Market Irony

While the Federal Reserve has lowered the overnight bank lending rate and, correspondingly 90-day U.S. T-Bills from 5.3% to 4.3%, as the longer interest rates spiked. The 10 Year U.S. Treasuring hit a low yield of 3.5% in mid-2024 and the rate is currently around 4.66% effectively ending the inverted yield curve that many said forecasted recession. Investors are keenly aware that longer commitments should pay more than shorter ones.

Surprisingly, Global High Yield Bond fund prices remained resilient during the long rate spike with a current overall yield near 9%. Premium prices could result in gain harvesting to increase safety. The higher longer yields likely create more excellent choices in other parts of the bond market like Tax Free Municipals. Meaningful deficit reduction could result eventually in lower long-term rates and potential gains in longer duration bonds.

Tax Planning Season

At McGowanGroup, we automatically upload the documents that you will need for tax season. We also provide the information to your CPA if we have their information on file to save you time. Please call us if you have changed CPAs or if you would like to confirm that we have their information, 214-720-4400. We will upload tax documents as soon as we have them.

Our Next Steps

The Investment Committee (IC) meets each Wednesday morning to review and upgrade the model portfolios using an impressive, evolving, research process. In the Bear Market of 2022, the IC mapped out impressive targets for the portfolios that have been largely successful, so far, in the model portfolios. These effective choices, as we are all aware, can change on a whim but we’re confident in our vetting process.

Equity market rallies provide the opportunity to raise Tactical Safety for future resilience especially as valuation targets and underperformers are harvested systemically. Pullbacks in market values for equity provides the opportunity to add high cash flow assets.

Our efforts to raise Tactical Safety during rallies allows the IC to allocate to great cash flowing assets in the next correction, gaining potential advantages for the long term.

We remain committed to the mission of Superior Client Profits Through Excellence in Service. Thank you for allowing us to serve you and your family!

Spencer McGowan and The Team That Cares – McGowanGroup Wealth Management

Q: What are some important points for investors in the year ahead?

Q: What are some reasons why the energy sector is currently leading the U.S. equity markets?

Q: What financial news could have corresponded to the big spike in U.S. equity markets this week?

Join Us for The Latest Financial Headlines and Valuable Research from The McGowanGroup. Built for Investors by Experienced Portfolio Managers!

Click here to get the monthly newsletter

Headline Round Up

*Big Bank Earnings Bonanza in Q4 2024!

*Core Consumer Price Index (CPI) Inflation Declines in December.

*Goldman Sach’s Head of Oil Research, Daan Struyven, Says Geopolitical Risk Could Potentially Send Oil Prices Even Higher.

*Fresh U.S. Sanctions Most Severe Against Russian Oil So Far.

*U.S. Sanctions on Chinese Oil Firms Just the Beginning Under Trump?

*Europe and Asia Compete in Liquified Natural Gas (LNG) Markets as Europe Successfully Reduces Independence on Russian Gas.

*U.S. Deficit Focus: Q4 Budget Deficit 40% Higher Than Previous Year as Refinancing Costs Along with Continued Spending Growth & Declining Tax Receipts Combine to Push the National Debt Past $36 Trillion?

*Global Surge in Bond Yields as Selloff in Government Debt Making It Costlier to Borrow.

*Price Pressure in December Shows Motor Vehicle Insurance Inflation Increased 11.3% From a Year Ago While Airline Fares Also Increased 7.9%.

*Moderna Plunges on Slashed Sales Forecast for 2025 Due to Slow Demand for Its Covid and RSV Vaccines.

*Mercedes Set to Roll Out Car You Can Talk to with Help from Google’s Artificial Intelligence (AI)!

*MicroStrategy to Raise Capital by Selling $42 Billion in Stock Through 2027 to Buy More Bitcoin?

*Disappointment as Nvidia’s Biggest Customers Facing New Delays from Glitchy Blackwell AI Chip Racks.

*Magnificent 7 vs. BATMMAAN?

*Trump’s Economic Advisor, Stephen Miran, Makes Case for 20% Tariffs.

2025 Mergers, Acquisitions, and IPO’s

*LNG Exporter Venture Global Announces $2.3 Billion Initial Public Offering (IPO).

*Bill Ackman’s Investment Firm, Pershing Square Capital Management, LP, Offers Shareholders $85 a Share for Howard Hughs Holdings in Merger Play.

Dow Jones Industrial Average Index – Daily (12/31/2024 – 01/17/2025)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index – Quarterly Earnings Analysis by Sector (11/16/2024 – 02/15/2025)

– Courtesy of Bloomberg LP

Energy Select Sector SPDR Fund – Daily (12/31/2024 – 01/17/2025)

– Courtesy of Bloomberg LP

North America’s LNG Export Capacity is on Track to More Than Double by 2028 (09/03/2024)

– Courtesy of The U.S. Energy Information Administration

C.B.O.E. – Short Term Interest Rate Index (01/18/2024 – 01/17/2025)

– Courtesy of Bloomberg LP

C.B.O.E. – 10 Year Treasury Note Yield Index (01/18/2024 – 01/17/2025)

– Courtesy of Bloomberg LP

iShares 20+ Year Treasury Bond Exchange Traded Fund (01/18/2024 – 01/17/2025)

– Courtesy of Bloomberg LP

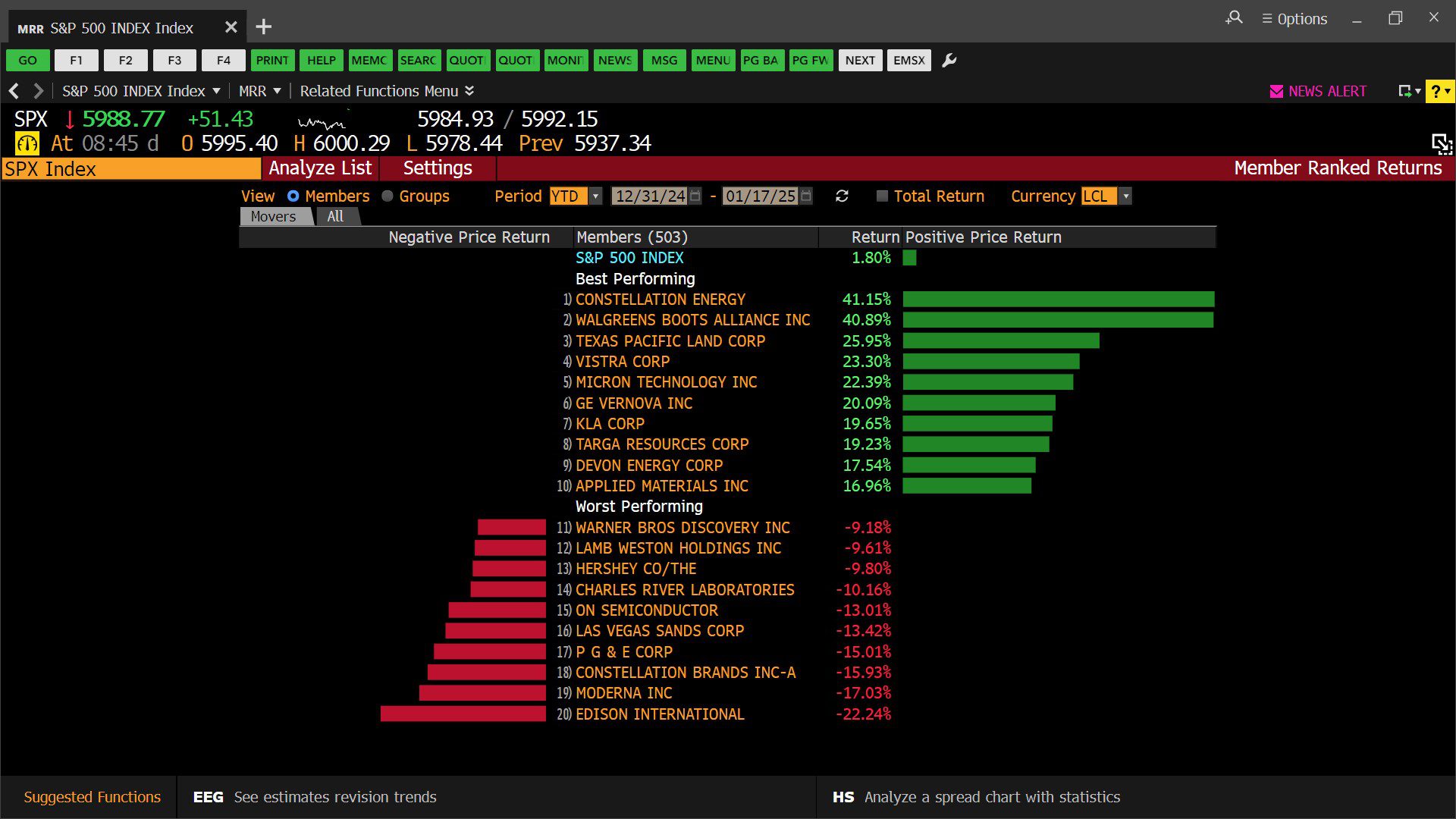

Standard & Poor’s 500 Index – Top 10 & Bottom 10 Member Ranked Returns (12/31/2024 – 01/17/2025)

– Courtesy of Bloomberg LP

Generic Natural Gas Futures Contract Spot Price – Daily (01/18/2024 – 01/17/2025)

– Courtesy of Bloomberg LP

Profit Report

What are some 2030 targets for key asset allocations?