Election Impacts: Deregulation, Lower Taxes, Reduced Government Waste and Spending?

The Equity markets quickly reacted with the Dow setting new records above 44,000 this past week. The best explanation appears to be that investors’ expectations are building in deregulation, lower taxes, and reduced government waste as well as reduced government spending.

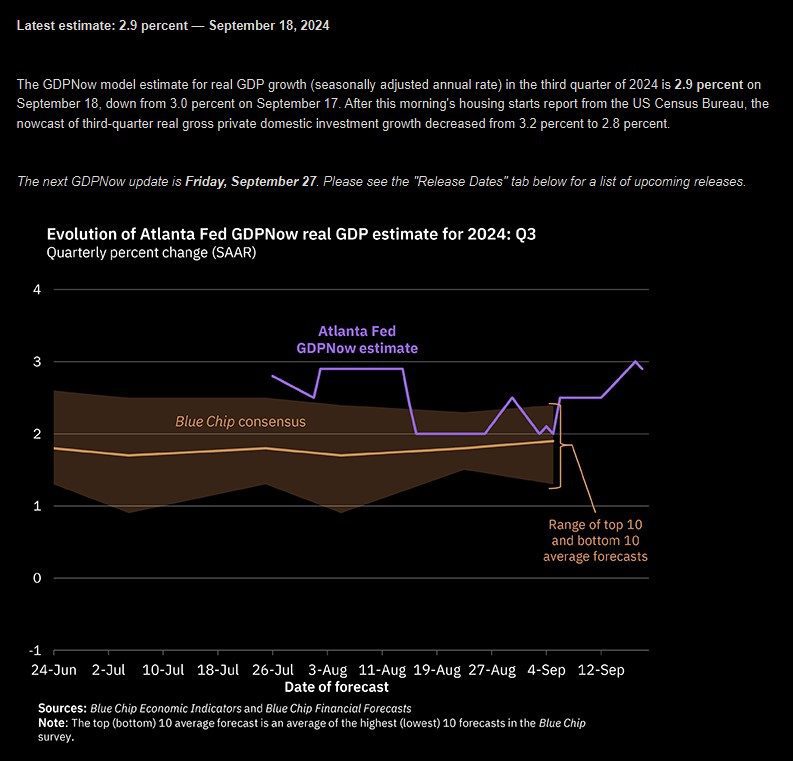

Economic Growth

As of this writing, The Atlanta Federal Reserve Real GDPNow estimates Q3 growth at 2.9%, relatively strong compared to the 2.1% average since 2001.

Corporate Profits

The Q2 2024 earnings growth for the S&P 500 was over 11% over 2023.

2024: A Year of New Highs So Far

At the beginning of 2024, our client update included this paragraph:

“A 2024 Magic Carpet Ride?”

One of the primary factors over the past 2 years, of course, was the Federal Reserve interest rate tightening cycle, which corresponded to the bear market of 2022. Future cash flows are worth less when cash rates are relatively high. The Federal Reserve’s most recent projections show a return to a more normal 2.5% over the next 3 years for the Federal Funds Rate and corresponding rates on Treasury Bills. For high cash flow assets, a lower discount rate increases the net present value of future cash flows.

Artificial Intelligence: Mania, Hype, and Reality? Yes, Yes, and Yes?

At this writing, Artificial Intelligence (AI) driven technology companies are leading the rally while the Dow Jones Industrial Average Index is up single digit returns year to date. These tech stocks are continuing a rally well into double digit returns for the year so far.

Data center expansion is likely the first phase of capabilities to improve projected efficiency. Money flows into these stocks are clearly anticipating productivity and profit gains that could take longer than anticipated to materialize for investors.

Profit Impact?

Assuming a 1990’s technology increase in productivity that accompanied internet and PC adoption, The S&P 500 currently forecasts a potential 33.3% gain in profits before the end of 2025 from the end of Q1 2024. Is this overly optimistic? One danger is over-anticipation of profit increases explaining companies exhibiting multiple expansion.

Reasonable valuations, owning great businesses, and real cash flow from earnings could be solutions to that danger.

Energy Infrastructure

As of December 2023, Recurrent Advisors estimated that energy infrastructure companies are trading at about six times cash flow. The prospective resulting increase in assets under control per share would equate to about 40% over a 5-year period in addition to the cash dividends.

Global High Yield

Our four primary High Yield managers delivered impressive results in 2023 and a good return so far in 2024. The current yield, equally weighted, is currently above 8%. The resulting appreciation potential during declining interest rates could be impressive assuming bonds drift back towards par values or higher as interest rates fall. We have established harvest targets to move portfolios to tactical safety as warranted.

Blue Chip Additions

The McGowanGroup Wealth Management Investment Committee successfully added names from the following sectors: Nuclear, Utilities, Pharmaceuticals, and AI related technology during 2023 dips. Research is ongoing as the McGowanGroup looks to take advantage of future corrections.

Our Next Steps?

Equity market rallies provide the opportunity to raise tactical safety for future resilience especially as valuation targets are harvested. Pullbacks in the market values provide the opportunity to add high cash flow assets at discounts.

A Cautionary Note

Election years provide equal opportunities for rejoicing and lamentations. The temptation to let politics drive portfolio decisions often leads to distraction and mistakes. Let not your heart be troubled, we are on the case and grateful to serve.

We wish you and your family a prosperous holiday season!

Recession?

The 2017 tax cuts reduced the tax bill for middle class families at the $200,000 gross income level about $8,500, but these tax cuts expire at the end of 2025. The resulting tax increase of about 27%, according to some estimates, or $700 per month would likely force a contraction in spending and potentially economic growth. This is an important debate we will be watching in 2025.

Tax Planning Season

At McGowanGroup, we automatically upload the documents that you will need for tax season. We also provide the information to your CPA if we have their information on file to save you time. Please call us if you have changed CPA’s or if you would like to confirm that we have their information, 214-720-4400. We will upload the documents as soon as we have them.

November 1st, 2024

-

Preliminary Realized Gain Loss Estimates for taxable accounts

January 2025

-

List of active accounts in 2024 with retail and retirement distinctions

-

List of K1s with dates available for taxable accounts

February 2025

-

1099Rs for IRA distributions

-

Realized gain loss reports for taxable accounts

March 31st, 2025

-

1099s for taxable accounts

-

K1s for retail accounts

Headline Round Up

*The U.S. Treasury Bill Market Predicted a 50 Basis Point Rate Cut Before the Federal Reserve Interest Rate Cut. Federal Reserve Chairman Jerome Powell warns against assuming further big rate reductions going forward.

*Microsoft Announces $60 Billion Stock Buyback and Raises Dividend 10%.

*Intel to Make Custom AI Chip for Amazon.

*Meet Elon Musk’s Supercomputers: Dojo in New York and Cortex in Austin.

*Bernie Sanders Takes Novo Nordisk CEO Lars Jorgensen to Task in the Senate Regarding Drug Pricing in the U.S.

*Employee Stock Ownership Plans (ESOPs) Get Advocacy from Private Equity KKR’s Pete Stavros.

*The Work from Home Free-for-All is Coming to an End? Amazon leading the charge to bring employees back the office.

*Department of Justice Sues Visa for “Illegal Monopoly of Debit Payments”?

*Britain’s Ultra Wealthy Threatening to Exit in Masse Ahead of Proposed Tax Changes?

*Mortgage Hack for Interest “Rate Modification?”

*California Sues Exxon Alleging Plastics Deception.

*Uranium Exchange Traded Funds (ETFs) Glowing After Constellation Energy & Microsoft’s Three Mile Island Restart Project.

*Big Tech Rushing to Find Clean Power for AI.

*Interest Rate Cut Too Late for Some Commercial Property Owners.

*Clean Technology Updates from the Wall Street Journal.

*Go Javier! Argentinian President Javier Milei Nearly Doubles Housing Supply with Deregulation by Abolishing Rent Controls.

Evolution of Atlanta Fed GDPNow & Real GDP Estimate for 2024:Q3

– Courtesy of Atlanta Federal Reserve

McGowanGroup Wealth Management Q4 2024 Client Updates

– Courtesy of McGowanGroup Asset Management

Dow Jones Industrial Average (12/29/2023 – 9/27/2024)

– Courtesy of Bloomberg LP

Chicago Board Options Exchange – 30 Year Treasury Bond Yield Index, 10 Year Treasury Note Yield Index & Short Term Interest Rate Index (09/28/2023 – 09/27/2024)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index – Quarterly Earnings Analysis by Sector (08/16/2024 – 11/15/2024)

– Courtesy of Bloomberg LP

McGowanGroup Wealth Management Q4 2024 Client Updates

– Courtesy of McGowanGroup Asset Management

Profit Report

The Armageddon head fake of early August?

The continued evolution of McGowanGroup Wealth Management investment plans.