Markets plunged instantly upon the tweet by President Trump of a positive COVID-19 diagnosis. Since both the UK’s Prime Minister Boris Johnson and Brazil’s President Bolsonaro recovered from a positive diagnosis, markets held well above the lows set last month.

With the nation obsessed with election headlines and the Washington cat fight, investors are best served with a focus on what is unfolding in the economy and financial markets.

-What is more important than the election for investors?

-What are the possible outcomes for COVID-19 in 2021?

-How is the economy doing right now and how is today different from predictions?

-What surprise reports are coming from Q3 results?

-How would a Biden or Trump administration impact 2021?

-Why was Residential Real Estate immune from the recession?

-What do European interest rates tell us about potential future gains in the Bond Market?

-What is Global Compression and what does it mean in 2021?

Any hope of a new, and much needed, comprehensive Infrastructure plan to be drafted for discussion with the newly elected, re-elected Congress and President vanished over the weekend turning Washington into a cat fight with hundreds of angry felines. Any attempt to restore order would likely result in scratches, bites, and a rabies shot.

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

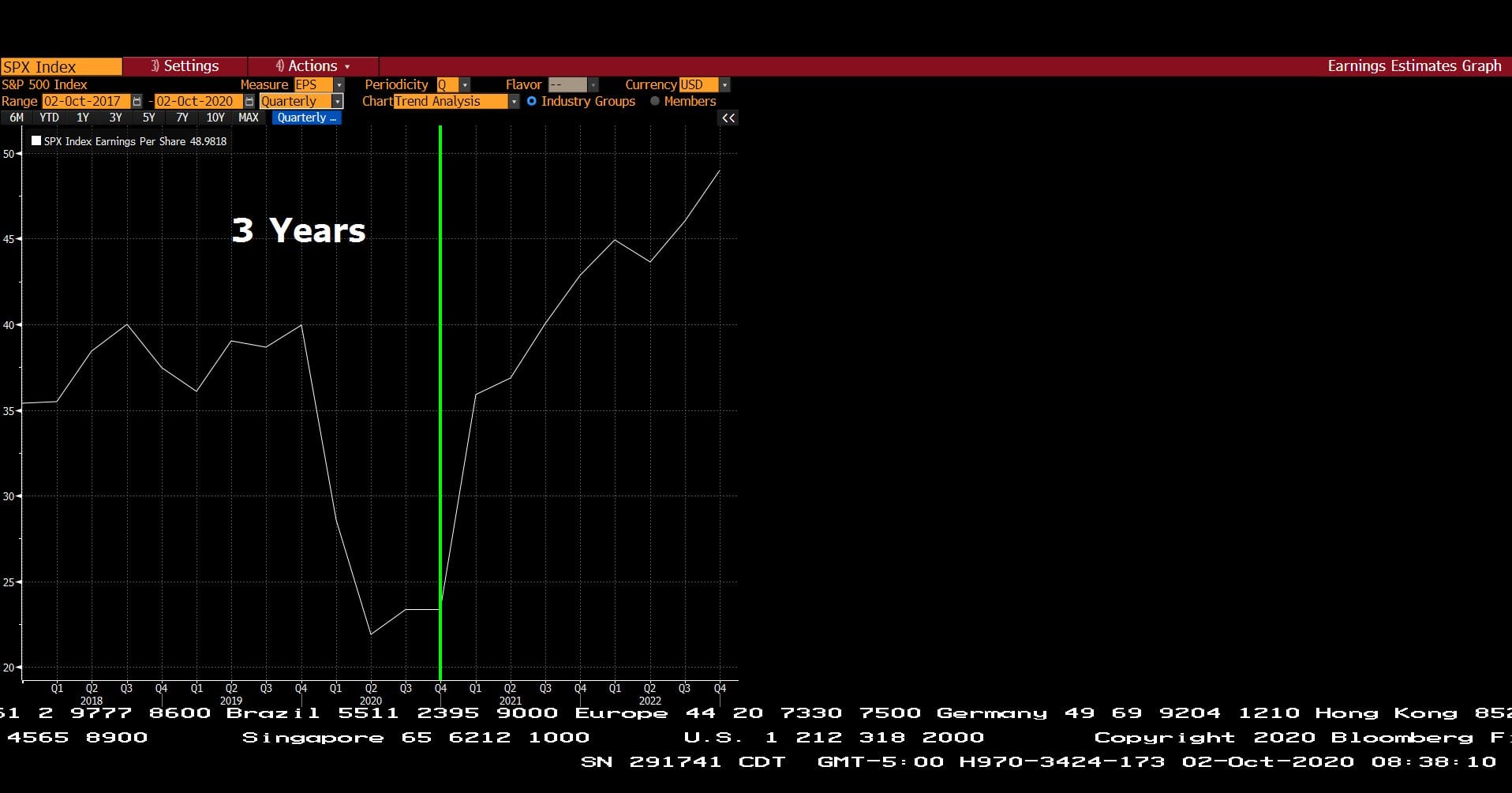

Standard & Poor’s 500 Index Quarterly Earning Estimates (10/02/2017 – 10/02/2020)

– Courtesy of Bloomberg LP

Exchange Trade Fund Flows (10/02/2020)

– Courtesy of Bloomberg LP

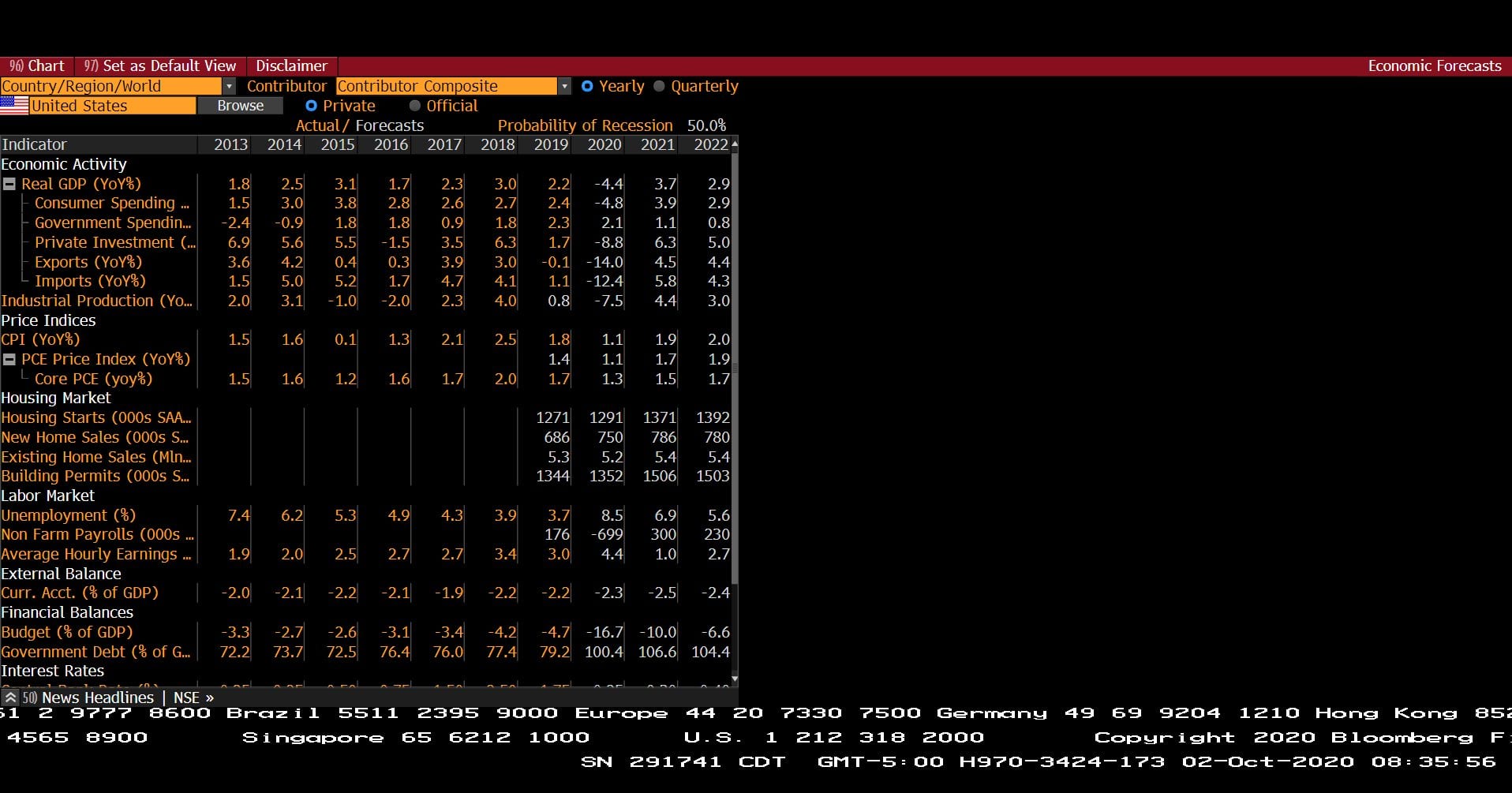

Yearly U.S. Economic Actual & Estimated Forecasts w/ Probability of Recession (2013 – 2022)

– Courtesy of Bloomberg LP

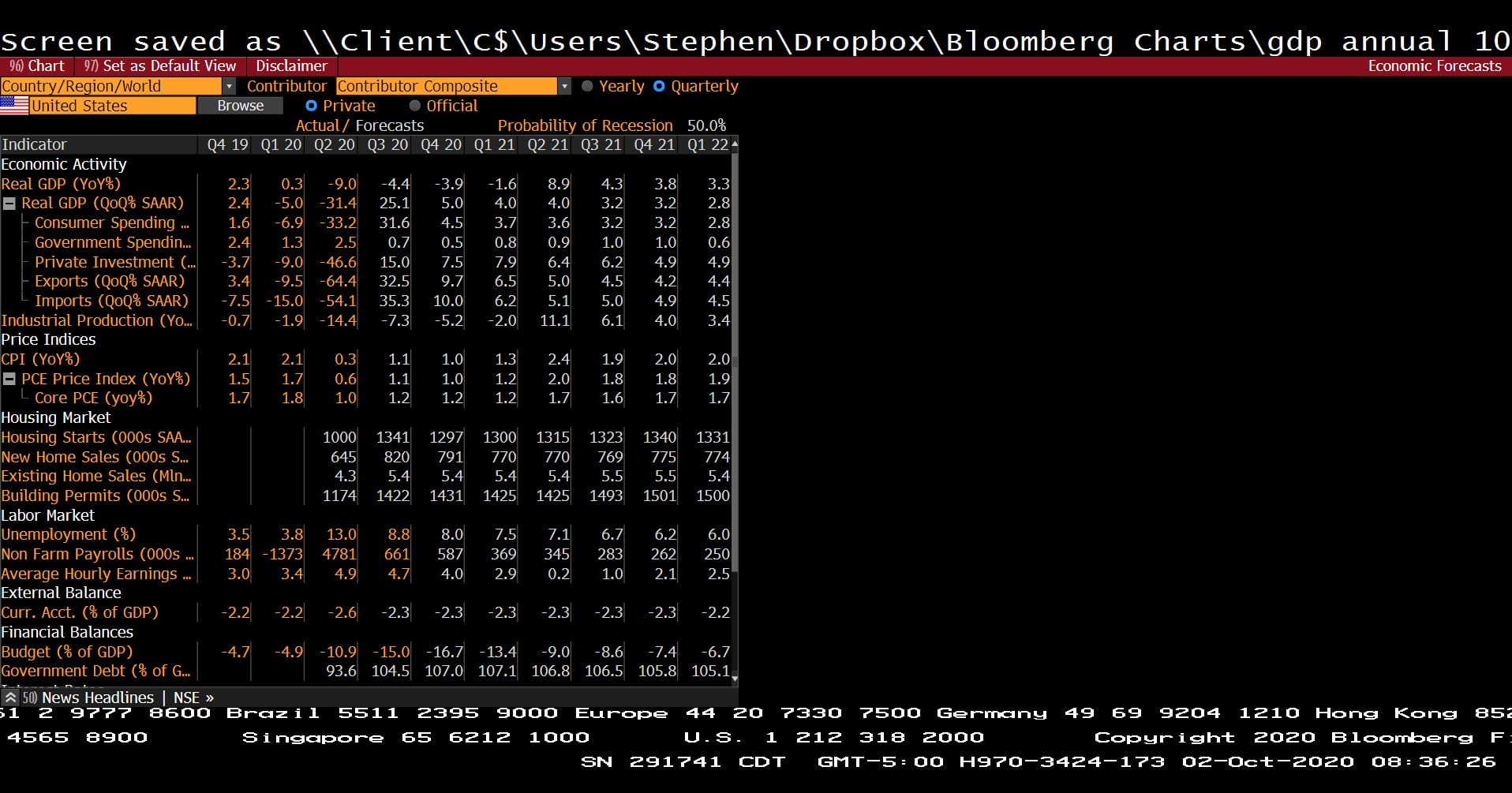

Quarterly U.S. Economic Actual & Estimated Forecasts w/ Probability of Recession (4th Qtr. 2019 – 1st Qtr. 2022)

– Courtesy of Bloomberg LP

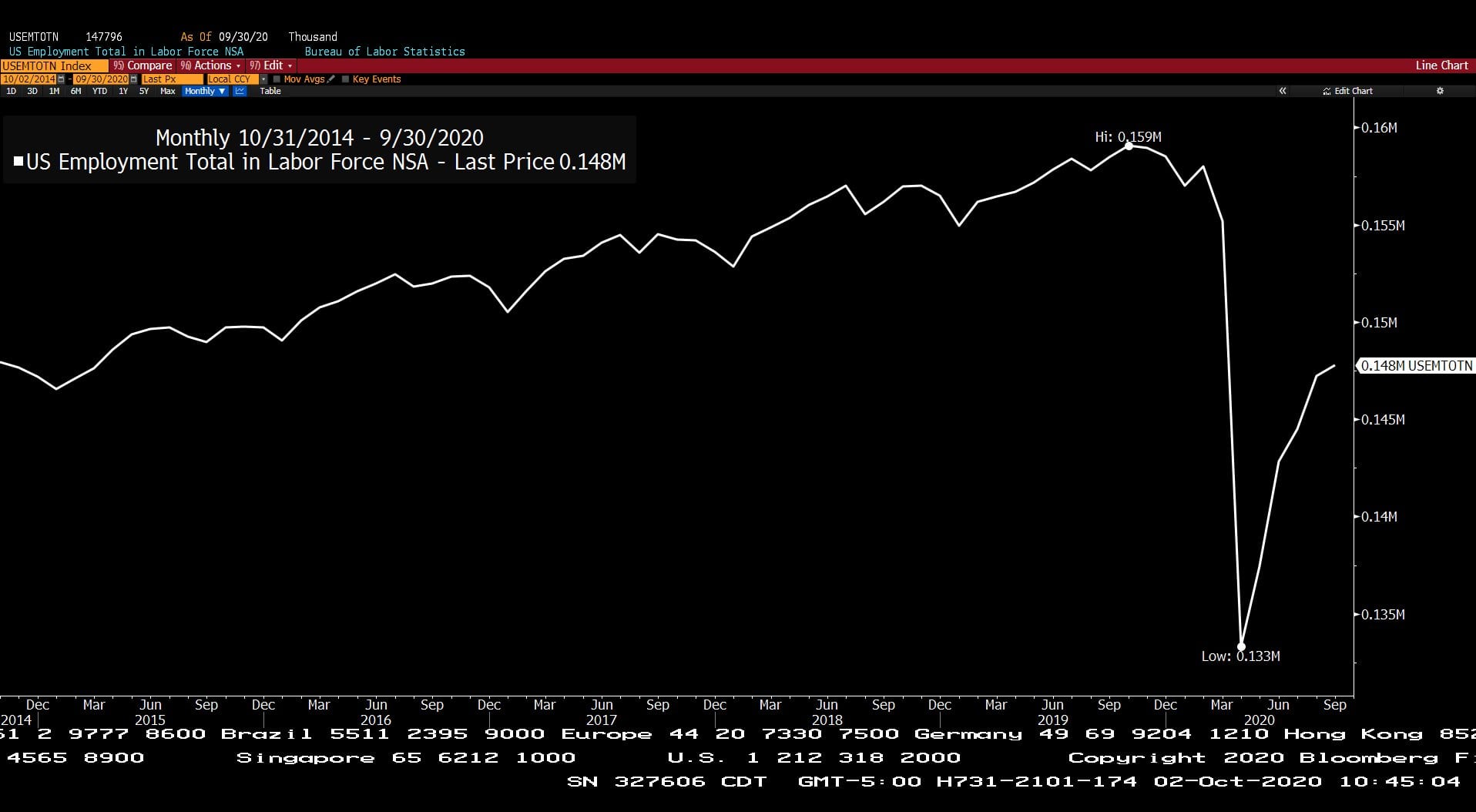

U.S. Employment Total in Labor Force NSA (10/14/2014 – 09/30/2020)

– Courtesy of Bloomberg LP

Natural Gas Spot Price (3 Years)

– Courtesy of Bloomberg LP

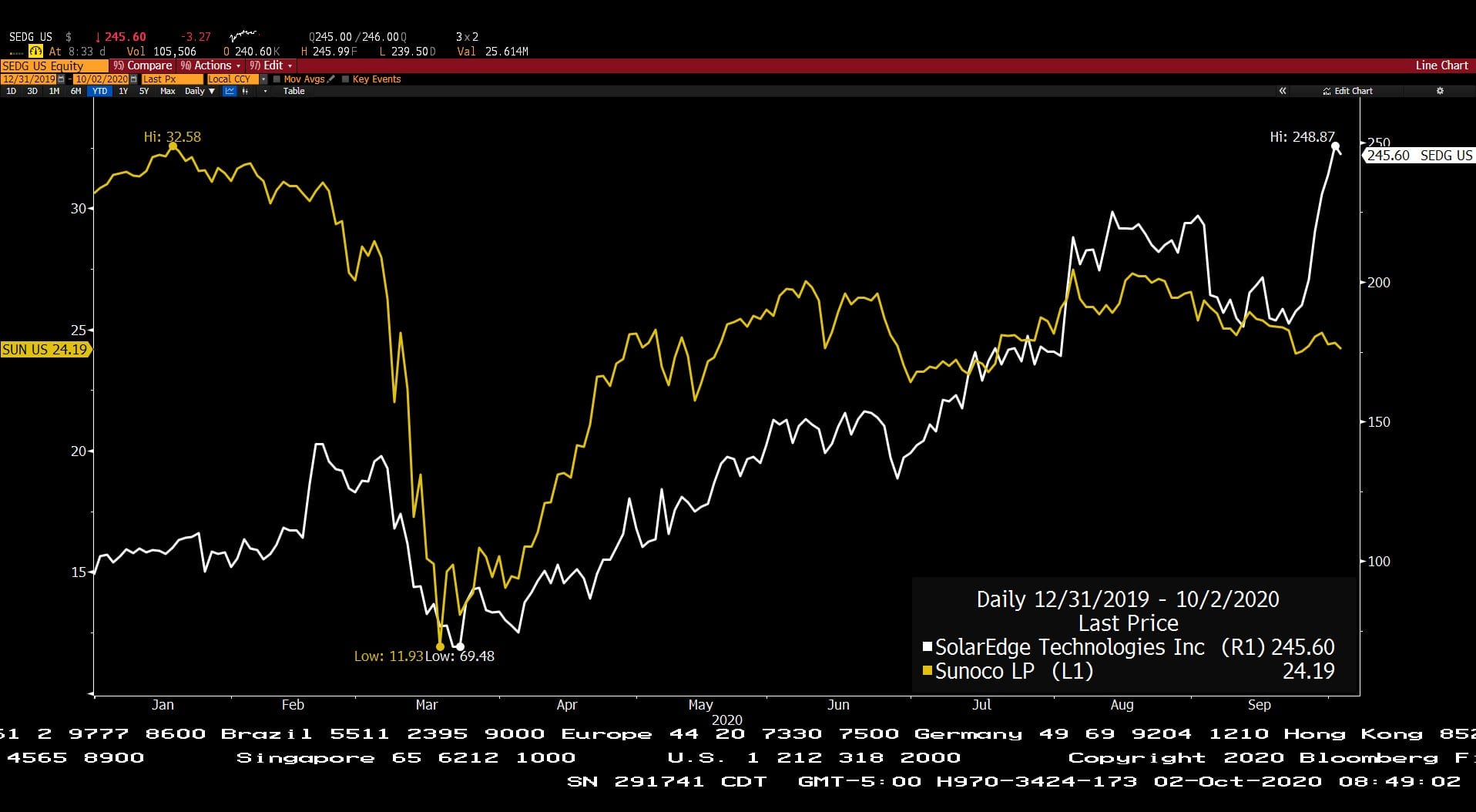

SolarEdge Technologies, Inc. & Sunoco LP (Year to Date)

– Courtesy of Bloomberg LP

MAC Global Solar Energy Index (Year to Date)

– Courtesy of Bloomberg LP

Headline Round Up!

*The Fastest Recovery in History? Q3 and Q4 Forecasts for Profits and The Economy.

*Net New Jobs Bring Total Employed to about 148 Million vs 159 Million Peak.

*Big Gains for North Texas Home Prices with 3 Month Acceleration. National Buying Rush!

*New York’s Deep Real Estate Recession. Offices Empty and International Demand Extinguished. 40% Jump in Bankruptcies with Riots and Continued Shut- Downs.

*Inflation Already Here?

*COVID-19 Cocktails? Regeneron’s Rapid Reduction.

*Value Stocks Outperforming Growth

*JPMorgan Trading Desk – “Crime Ring?”

*Stock Up on Cabernet: Wildfires Devastate Wine Industry. Alex, is there a trading market for this?

*California Power Shortages?

*Natural Gas Rally!

*Conoco Philips: Oil Demand Will Return and Grow. Share Buybacks Resumed!

*Solar Comes of Age!

Profit Report!

*Research Round Up!

*Emerging Market Bond Update!

*Biden Tax Plan? Michael Kitces details.

*Trump Tax Plan?

*This Week’s Money Flow and Sector Performance Updates.