-

What were the 10 biggest financial surprises of 2020?

-

What are the financial forecasts for 2021?

-

What are the biggest potential surprises of 2021?

-

If Cash Rates are zero, what happens to the Financial Markets?

-

Could U.S. Treasury and Money Market Rates go negative in the U.S.?

-

What traditional allocations are in the most danger of disappointment longer term?

-

What are the consequences of doubling the Fed’s balance sheet?

-

What happens after a government borrows huge amounts?

-

Is the U.S. turning Japanese?

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

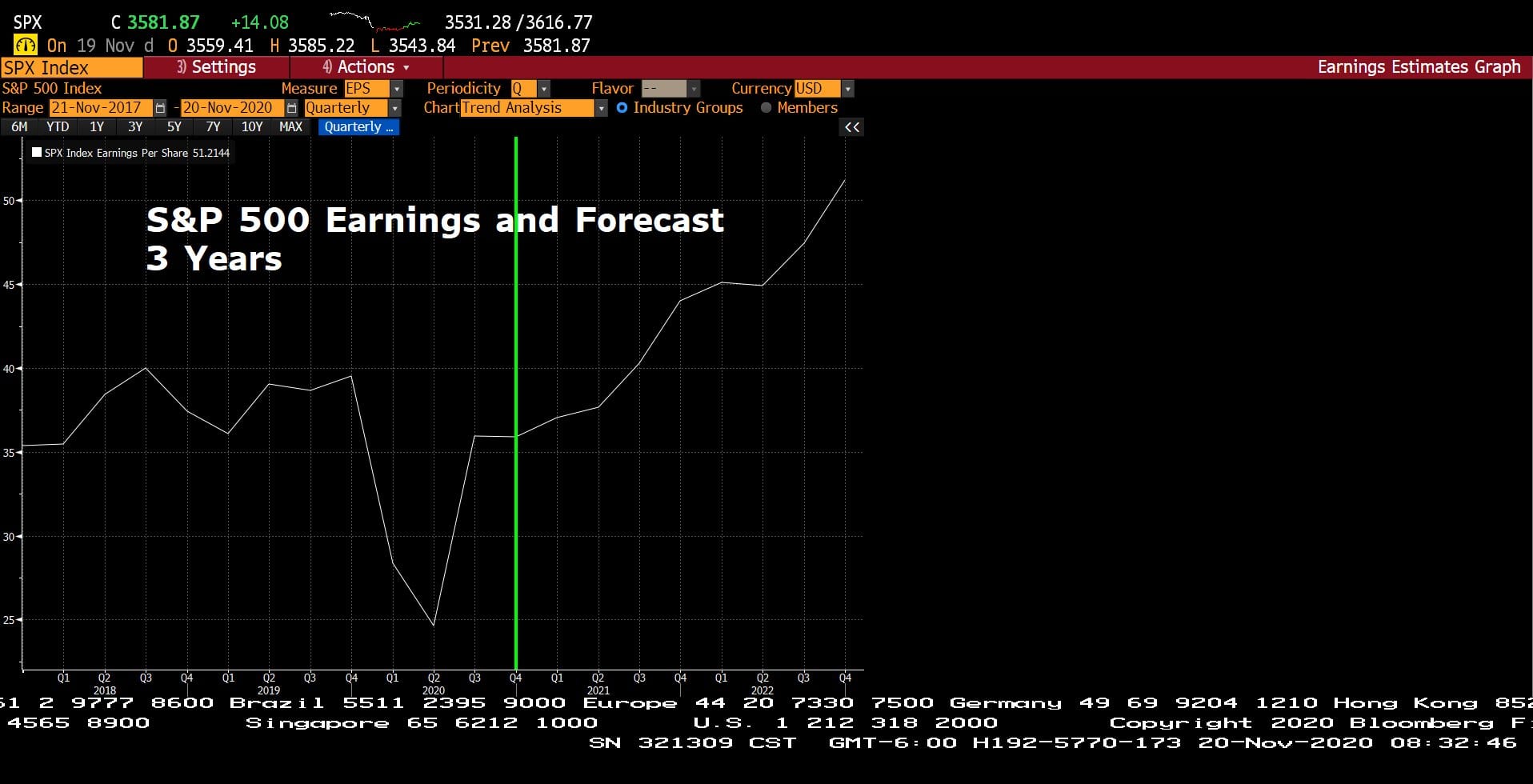

Quarterly Standard & Poor’s 500 Index Estimated Earnings – Actual and Forcasted (Approx. 3 Years)

– Courtesy of Bloomberg LP

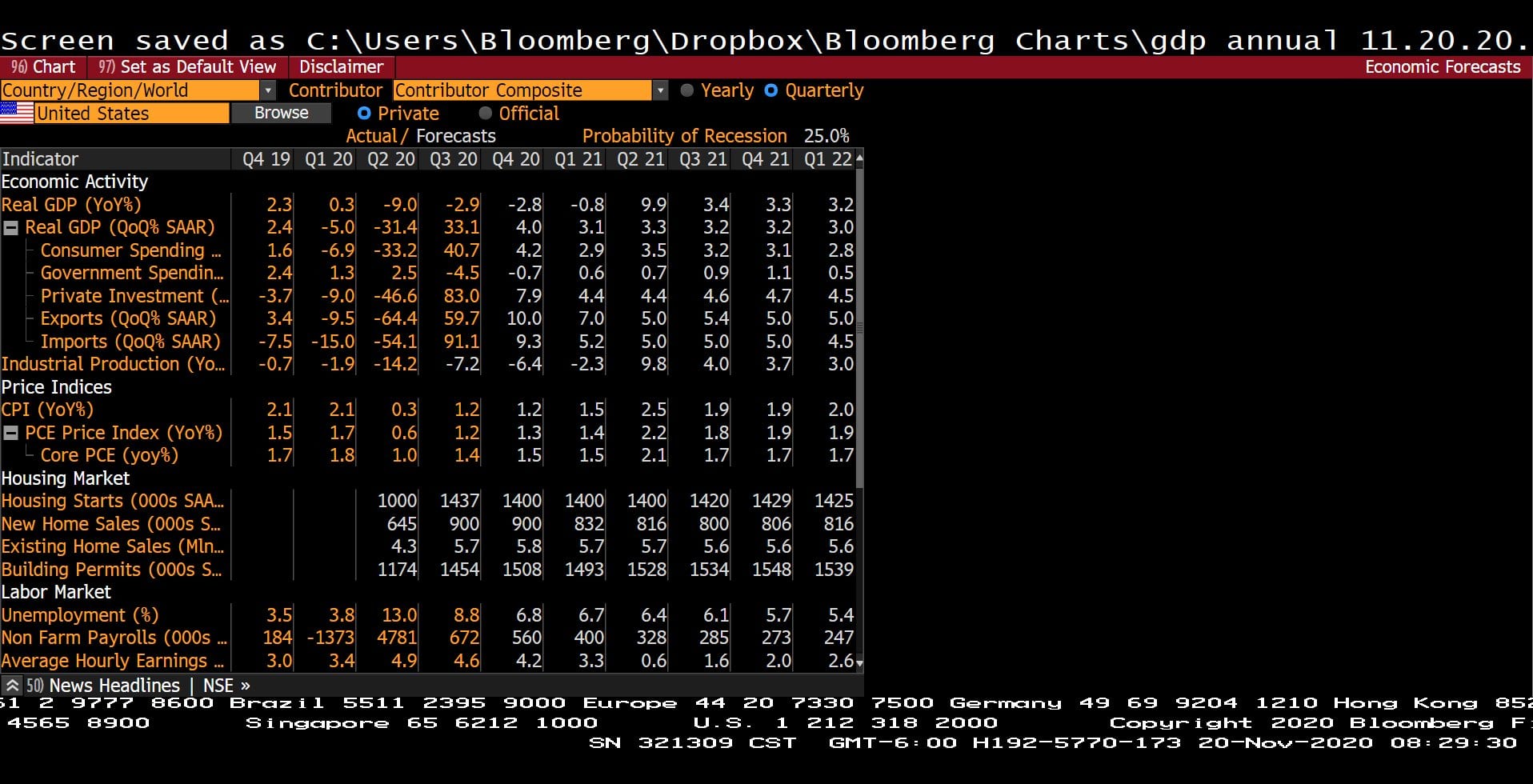

Quarterly U.S. Economic Forecasts with Probablity of Recession (Q4 2019 – Q1 2022 )

– Courtesy of Bloomberg LP

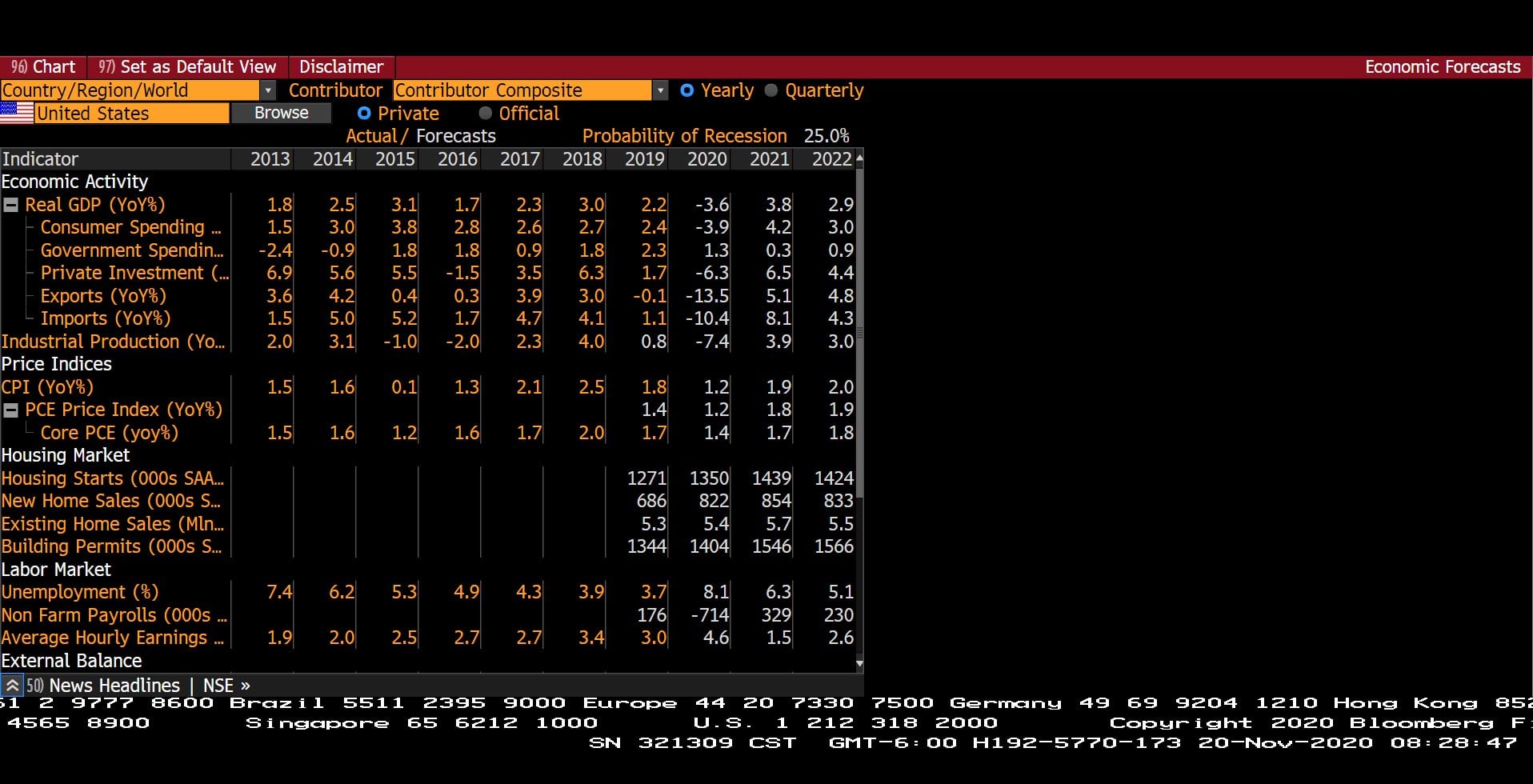

Yearly U.S. Economic Forecasts with Probability of Recession (2013 – 2022)

– Courtesy of Bloomberg LP

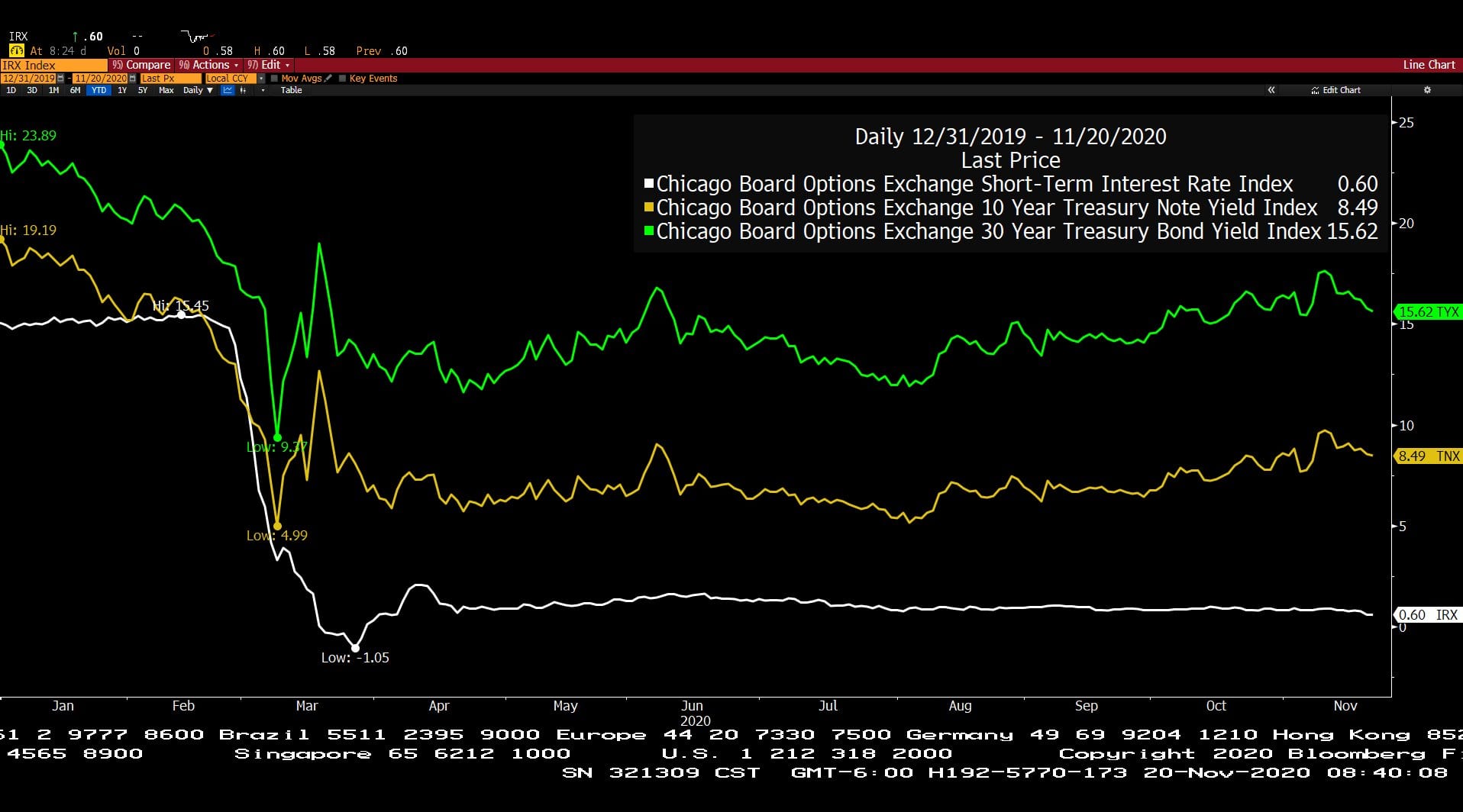

C.B.O.E. Short Term Interest Rate Index, 10 Year Treasury Note Yield Index and 30 Year Treasury Bond Yield Index (Year to Date)

– Courtesy of Bloomberg LP

iShares iBoxx High Yield Corporate Bond ETF (Year to Date)

– Courtesy of Bloomberg LP

Global X MLP ETF (Year to Date)

– Courtesy of Bloomberg LP

Natural Gas Future Spot Prices (Year to Date)

– Courtesy of Bloomberg LP

Health Care Select Sector SPDR Fund (Year to Date)

– Courtesy of Bloomberg LP

AllianceBernstein Global High Yield Income Fund, Inc. & BlackRock Corporate High Yield Fund, Inc.(12/29/2006 – 12/31/2012)

– Courtesy of Bloomberg LP

Headline Round Up!

*Operation Warp Speed at Warp Speed! The details? What does it mean for 2021.

*Buffet Buys Drug Stocks. Why Not Moderna?

*Bio-Medical Rally After Election

*Retail Sales 5.7% OVER 2019 in October. Financial media misses the story?

*Industrial Production Up 1.1% in October.

*U.S. Crop Prices Rising. Happy Farmers and China’s Hungry!

*Morgan Stanley Says Trust the Recovery.

*American Consumers Flush With Cash After Debt Paydown.

*Manhattan Office Glut Grows. Beware Multi-Family Residences.

*DFW BOOM! 196 Texas Corporate Relocations in Process Focused on DFW.

*Kodak Smack! Sold Stock Options Before They Owned ‘Em.

*Gotta LUV Southwest! “Predatory and Opportunistic”?

*When Moe’s is Closed Marge Makes Homer Fix Up the House! Home Depot and Lowes Boom.

Profit Report!

Alex’s Big Surprises

2020 Biggest Surprises:

1) Negative Prices for Oil

2) Shutdowns

3) Resurgence of Bitcoin (it didn’t die?!)

4) Housing Rates Plummet! Alex gets a 2.8% mortgage

5) Housing Goes Boom Boom!

6) 17% growth in M2– First Time in 75 Years (hint, the Fed prints but doesn’t print)

7) Election Dereliction

8) What do Halloween and Thanksgiving have in common? (Everyone is wearing a mask!)

9) Tech Rally!

10) Massive jump in Gross Domestic Product (GDP) Q3 and Q4

2021 Biggest Potential Surprises?

1) Inflation

2) Higher Taxes

3) College Debt Programs

4) Modern Monetary Theory (MMT), baby and Universal Basic Income (UBI)?

5) Zero Rates/Negative Rates

6) Cashflow Panic

7) No Growth?

8) Flat S&P 500?

9) Bitcoin to $300,000?

10) Alex builds a pool!

Spencer’s Big Surprises

2020 Biggest Surprises:

1.Coronavirus

2.ShutDowns

3.Riots

4.Zero Rate Fed Funds

5.Record Stimulus

6.MMT Prevails

7.Valuations Diverge

8.Tech Stocks Surge

9.Elon Musk Defies Gravity

10.Gone to Texas! NASDAQ, Joe Rogan, Elon Musk, etc.…

2021 Biggest Potential Surprises?

1.Coronavirus Containment

2.Inflation Returns

3.Energy Shortages

4.Negative U.S. Rates

5.Traditional Fixed Income Begins to Underperform

6.The Shift to Value and Cash Flow

7.Valuations Matter Again

8.Elon Musk and Richard Branson Go to Space

9.FAANG Tech Correction

10.Housing Market Boom Fizzles