The NetWorth Radio dashboard of great research expands this week again building on last week’s fascinating focus on the popular and pricey FAANG group. This obvious group deemed Covid-19 immune beneficiaries of the pandemic.

But, wait! What comes next? Is this a head fake?

Bill Miller’s Bloomberg Radio podcast link will also be included in our next free subscription list email update for clients and listeners. The discussion from a 40 year value veteran unfolds a key scenario that builds on our program from last week.

The vital intelligence here projects one of the most important potential shifts likely for the second half of 2020: Money Flow moving from Growth to Value.

Valuable Investment Intelligence for effective decisions often begins with a clear picture of what has happened leading to future scenarios and possible outcomes. The benefits of clearly defined objectives then provide a logical list of choices to accomplish those goals over longer time horizons.

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

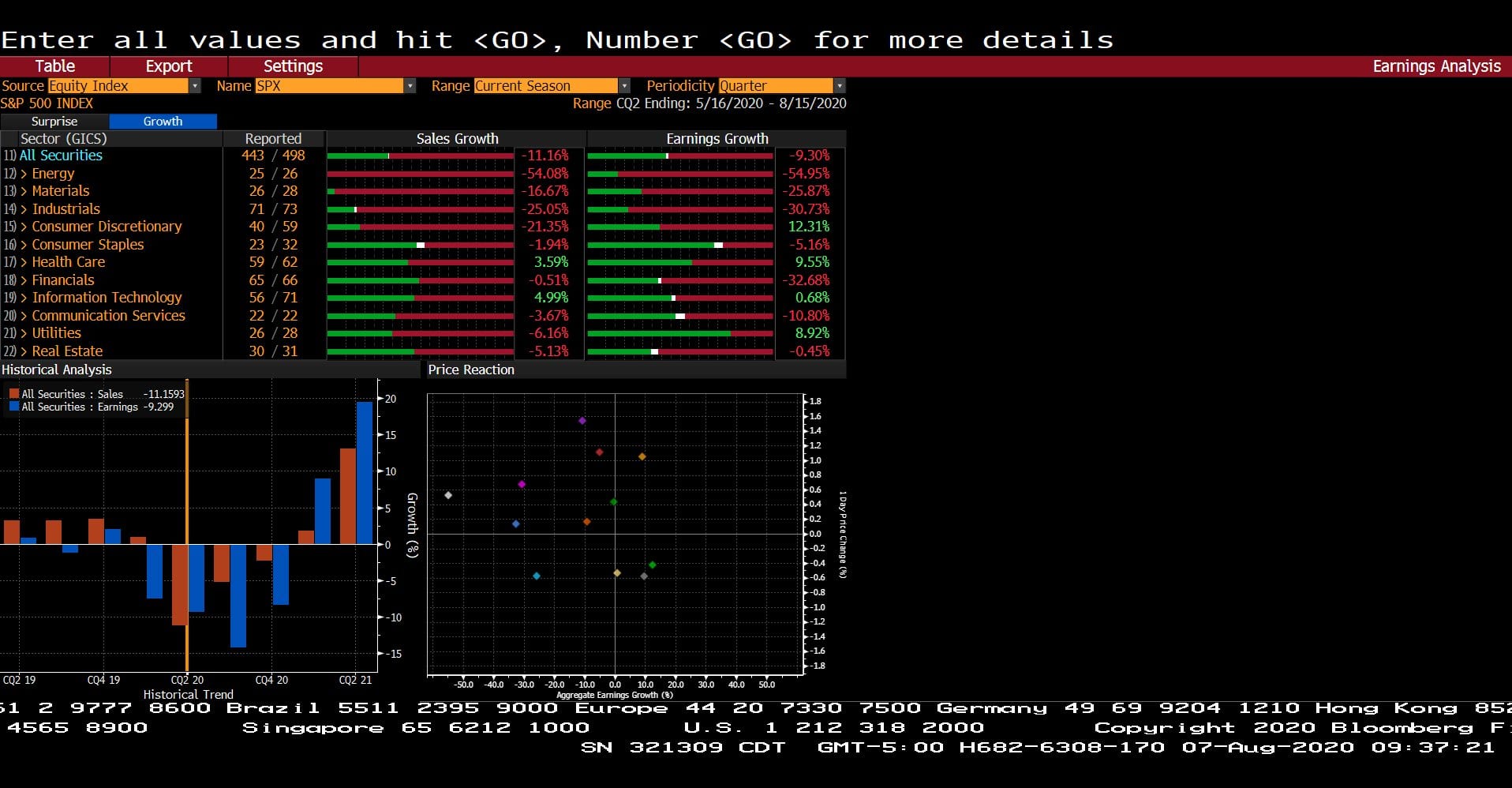

Standard & Poor’s 500 Index – Earnings Analysis (05/16/2020 – 08/15/2020)

– Courtesy of Bloomberg LP

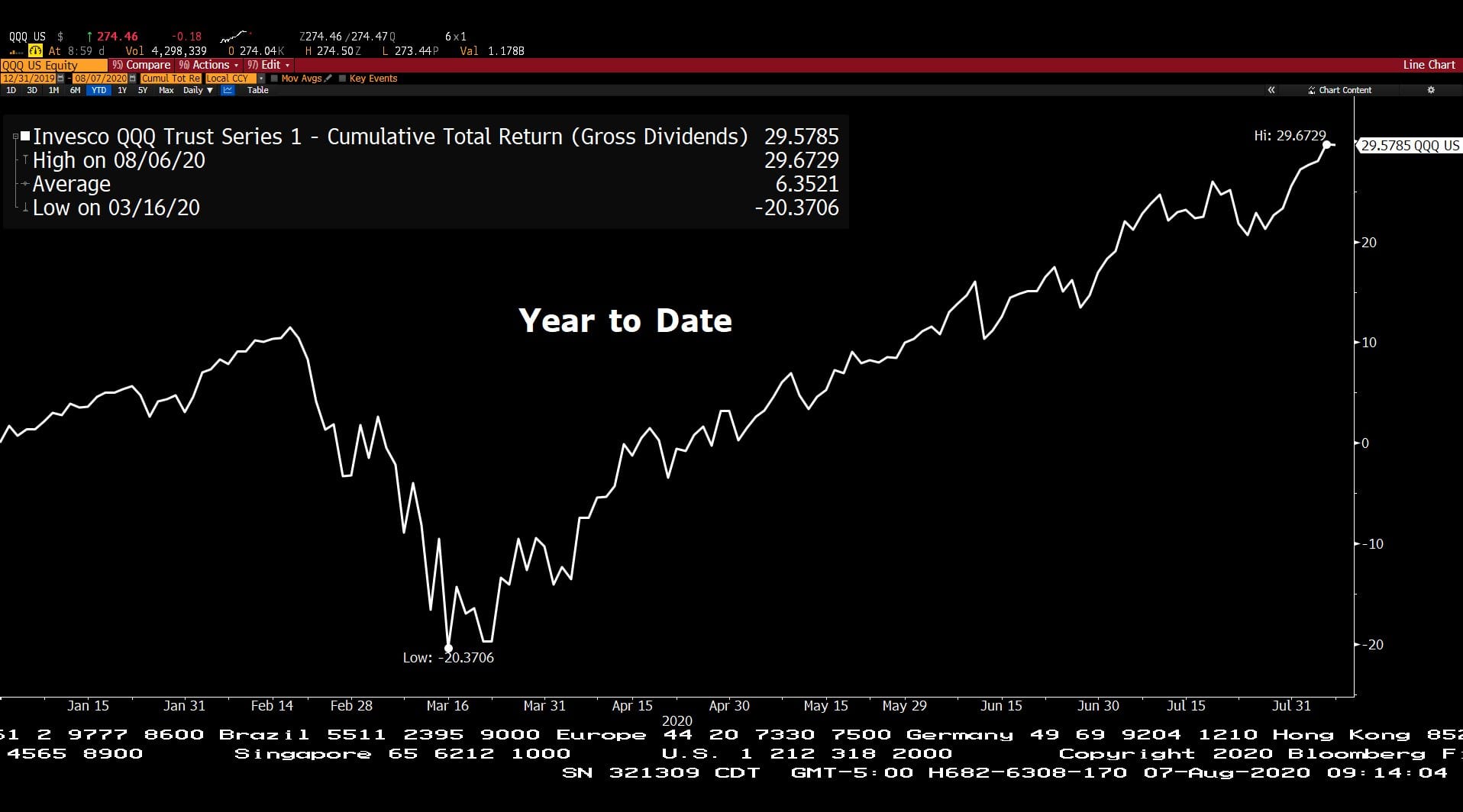

Invesco QQQ Trust Series 1 (Year to Date)

– Courtesy of Bloomberg LP

U.S. Employment Total in Labor Force (08/07/2000 – 07/31/2020)

– Courtesy of Bloomberg LP

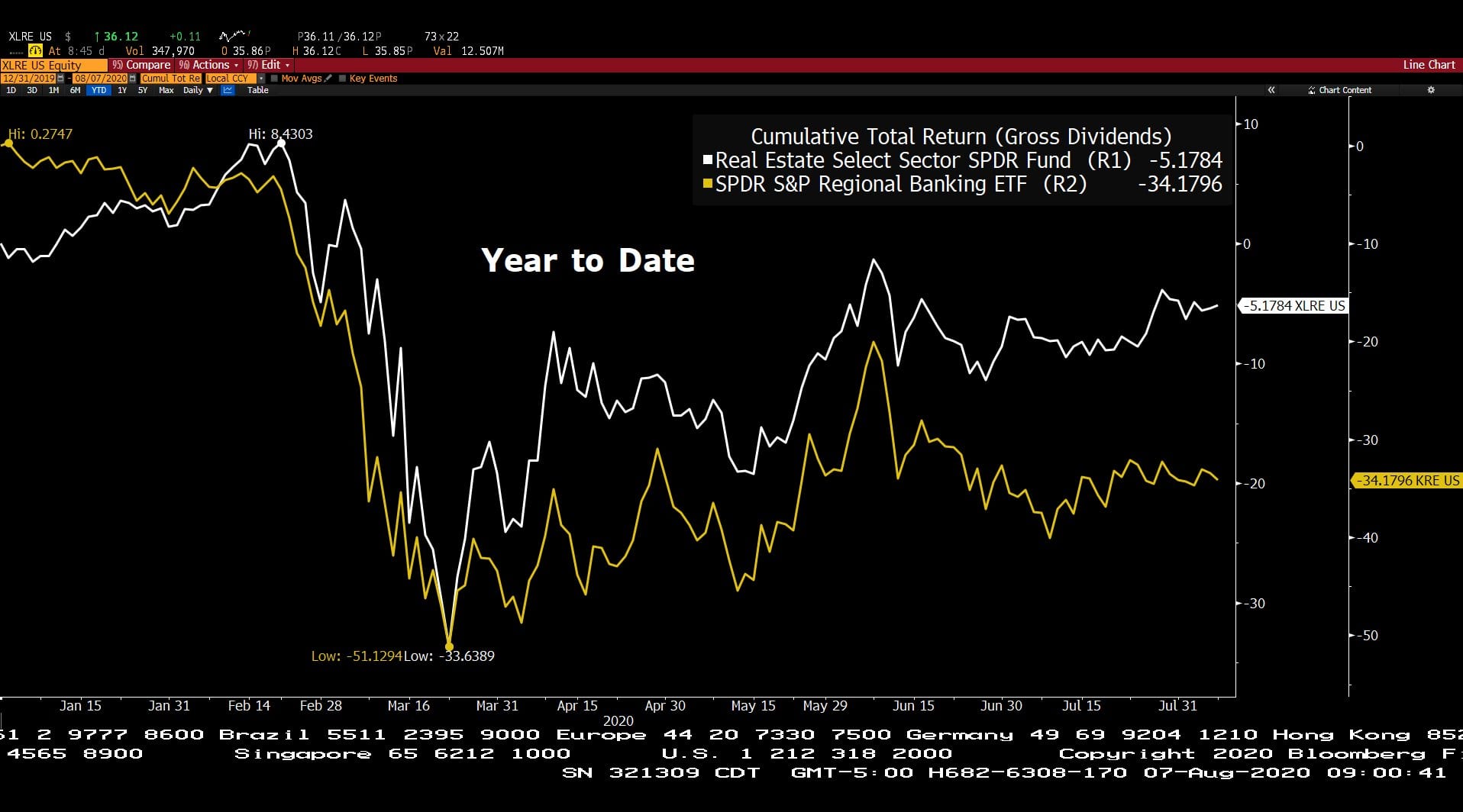

Real Estate Select Sector SPDR Fund & SPDR S&P Regional Banking ETF (Year to Date)

– Courtesy of Bloomberg LP

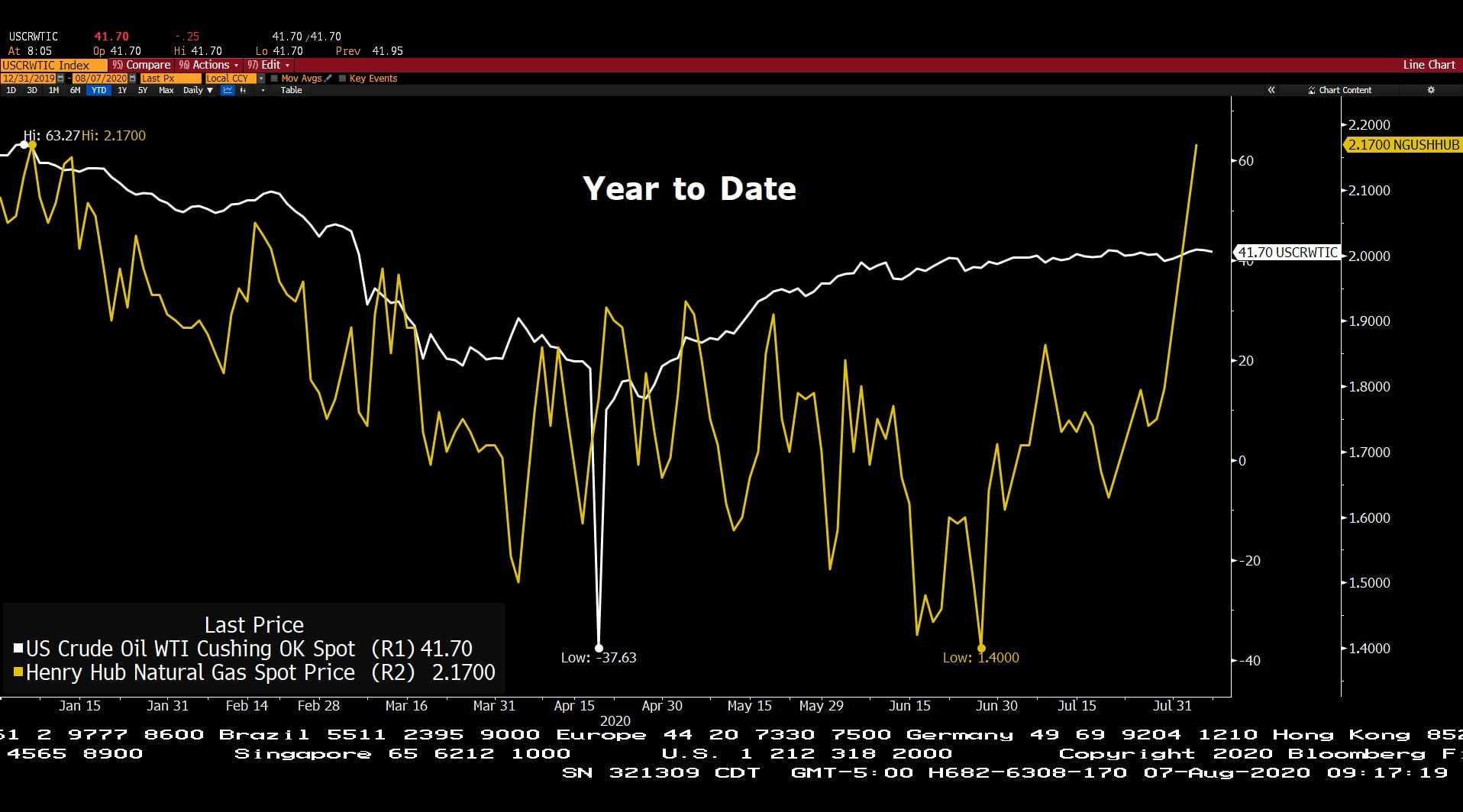

U.S. Crude Oil West Texas Intermediate Cushing OK Spot Price & Henry Hub Natural Gas Spot Price (Year to Date)

– Courtesy of Bloomberg LP

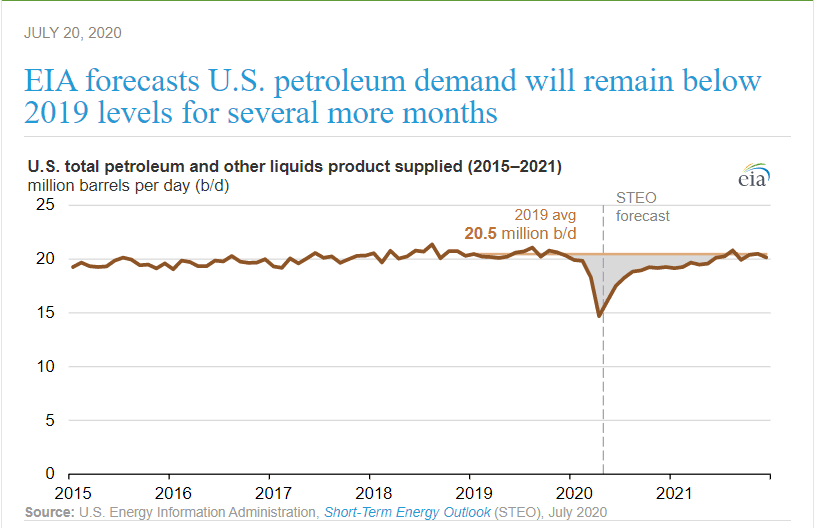

U.S. Total Petroleum and Other Products Supplied 2015 – 2021 (07/20/2020)

– Courtesy of The U.S. Energy Information Administration

Headline Round Up!

*Important Jobs Updates and Chart Analysis!

*U.S. Institute of Supply Management (ISM) States Manufacturing Level Expands ABOVE Pre-Pandemic Levels?

*ISM Services Index Also Moves ABOVE Pre-Pandemic Expansion Levels?

*Monthly Construction Rises Back to 2019 Levels?

*Real Estate Intelligence: Office Market SQUEEZED! REIT impacts? Wall Street’s Permanent Work From Home Office Downsizing. Want to go so see your advisor? We are here!

*U.S. Will Borrow $2 Trillion in Second Half! Is ½% 10 Year U.S. Treasury Too Low?

*China Steals From Apple and Saleen Racing Too? Plus, Previously Reported Houston Medical Hackers and Cisco’s Technology.

*7-11 Buys Speedway From Marathon Petroleum.

Texas Energy Gold Rush

*Bad News Q2 and Energy Transfer Report.

*U.S. Energy Information Administration (EIA): August 2021 US Oil Demand Restored!

*Hydrogen? How will it unfold?

*Renewable Updates: Solar Skyrockets, Renewable Funds Hot.

Profit Report!

*Who sold in March? Indexers, Moving Averaging Disciples, and others driven by fear of the unknown sold into the fastest and largest Bear decline in modern history. Strategy implications for long term investors?

*Trustee Boot Camp and MGAM Client Benefits: Get your kid a plan! Planning stories from our process to engage the next generation.

*Alex and Spencer’s devotion to effective Allocation Strategy: Performance Tracking, Money Flow research, possible outcome discussions, and MGAM Investment Committee processes.