“Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.”

– Sir John Templeton

What This Means for Investors

Templeton’s philosophy centered on the idea of contrarian investing. Here is how he broke down those four stages:

• Pessimism (The Beginning): When things look the worst and everyone is selling, prices are at their lowest. This is actually the safest and most profitable time to buy.

• Skepticism (The Growth): As prices start to recover, most people don’t believe the rally is “real.” This climbing of the “wall of worry” allows the market to grow sustainably.

• Optimism (The Maturity): People begin to feel comfortable and start moving their money back into the market because they see others making a profit.

• Euphoria (The End): This is the danger zone. When everyone is convinced that prices will only go up and “this time is different,” the market has run out of new buyers and is primed for a crash.

Join Us for The Latest Financial Headlines and Valuable Research from The McGowanGroup. Built for Investors by Experienced Portfolio Managers!

Click here to get the monthly newsletter

Headline Round Up!

*TEXAS!

-

Million-Dollar Home Sales Hit Record High in Texas During 2025 Led by DFW Metroplex!

-

Huge 1.6 Billion Barrels of Undiscovered Oil in Permian Woodford and Barnett Shales According to Geological Survey and APA Corp. announced Massive Oil & Gas Reserves in West Texas by The Davis Mountains Yet to Produce!

-

All Hat No Cattle? Saks Global’s Bankruptcy is Neiman Marcus’ Second Chapter 11 Filing. What happens now to the iconic downtown Dallas store?

-

Venture Capitalist Chamath Palihapitiya Estimates $1 Trillion of Billionaire Wealth Fled California Ahead of “Wealth Tax” 5% Assessment. Florida and Texas the Beneficiaries?

-

Wall Street Journal: Speed Obsessed Texas Wildcatter Rod Lewis in Pole Position for Venezuela’s Energy Riches.

*How wrong was the Federal Reserve and “Blue Chip Economists” in Their December Projections?

*Residential Real Estate: Despite The Encouraging December Bounce of +5.1% for Existing Home Sales, 2025 Was a 30 Year Low?

*Potential $20 Billion, All Stock, Oil and Gas Merger for Coterra Energy, Inc. and Devon Energy Corp.?

*U.S. 2025 Q4 Inflation Total at .5% in December. Lower than expected & annualizing at Federal Reserve’s target rate of 2%.

*Bloomberg: U.S. Budget Deficit for Calendar Year 2025 Shrank to $1.67 Trillion.

*Heavy Metal Intensity! Gold, Silver, Copper Start The Year With Record Highs.

*PIMCO Says Emerging Market Rally to Last For Years!

*Iranian Bank Collapse on Loans to Leaders & Regime Cronies Accelerated a Long Running Financial Crisis.

*Digital Memory & Storage Companies Continue to Rally!

*CNN: Nvidia’s Huge Next Breakthrough!

*Uh-Oh? OKLO, Inc. CEO, Jacob DeWitte, Says Labor Shortages May Hinder Power Plant Build Out.

*Scott Becker and Kiplinger: Economy and Stock Market Stories for 2026? Does The Equity Market Bull Continue?

Profit Report

What does Your Long Term Chart Tell Us About Dangerous Euphoria Especially in the Financial Markets?

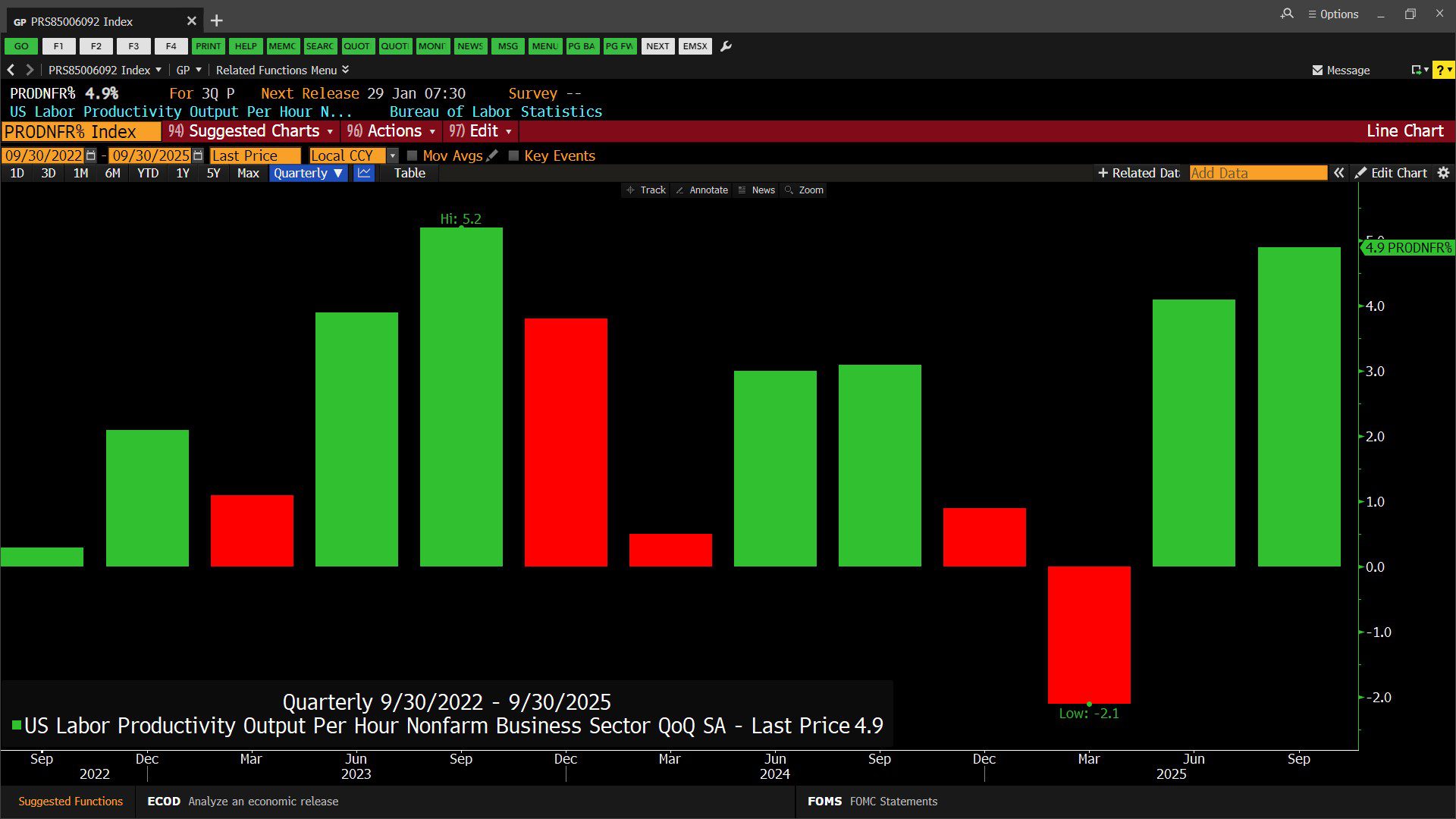

U.S. Labor Productivity Output Per Hour Non-Farm Business Sector Quarter over Quarter, Seasonally Adjusted (09/30/2022 – 09/30/2025)

– Courtesy of Bloomberg LP

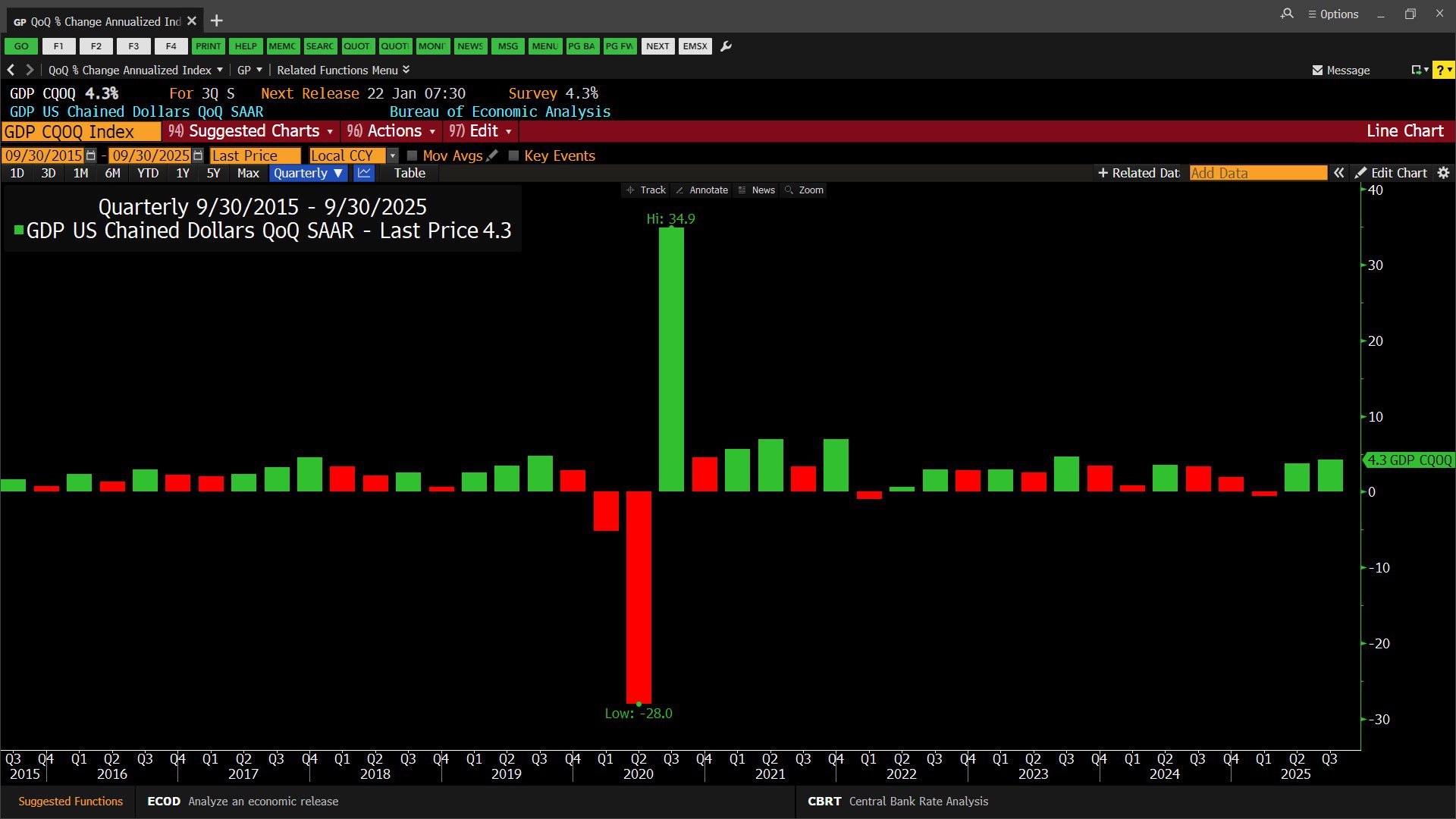

GDP (Gross Domestic Product) U.S. Chained Dollars, Quarter over Quarter, Seasonally Adjusted Annual Rate (09/30/2015 – 09/30/2025)

– Courtesy of Bloomberg LP

S&P 500 Index – Member Ranked Returns (12/31/2025 – 01/16/2026)

– Courtesy of Bloomberg LP

S&P 500 Index – Earnings Analysis by Sector (11/16/2025 – 02/15/2026)

– Courtesy of Bloomberg LP

S&P Cotality Case-Shiller Dallas Home Price Index, Seasonally Adjusted – Daily (01/17/2021 – 10/31/2025)

– Courtesy of Bloomberg LP

S&P Cotality Case-Shiller U.S. National Home Price Index, Seasonally Adjusted – Daily (01/17/2021 – 10/31/2025)

– Courtesy of Bloomberg LP

U.S. Existing Home Sales Month over Month, Seasonally Adjusted – Daily (01/16/2025 – 12/31/2025)

– Courtesy of Bloomberg LP

U.S. National Association of Realtors Total Existing Home Sales, Seasonally Adjusted Annual Rate – Monthly (12/31/2015 – 12/31/2025)

– Courtesy of Bloomberg LP

Dow Jones Industrial Average Index – Monthly (01/29/1926 – 01/16/2026)

– Courtesy of Bloomberg LP

McGowanGroup Wealth Management

Q1 2026 Client Updates

01/08/2026

Cautious Optimism

The State of the U.S. Economy

The ending numbers for economic growth were above average and exceeded consensus expectations. U.S. 2025 economic growth annualized at 4.3% in Q3 2025. U.S. economic growth for Q4 2025, per The Atlanta Federal Reserve’s Real GDPNow projection, was estimated at 5.4% as of January 8th, 2025 despite the 6-week government shutdown.

Remarkable economic resilience considering that the federal government reduced the federal workforce during the shutdown by 162,000, and, by over 270,000 during 2025. The nearly 9% workforce reduction corresponds to a falling budget deficit estimate by usdebtclock.org, $1.7 trillion down from over $2 trillion. Not a surplus, however a move in the right direction for tackling the deficit. 2026 U.S. economic growth forecasts include the Federal Reserve projection of 2.3%, recently raised from 1.8%, and a consensus global growth rate of 3.2% in late 2025.

The Federal Reserve recent 2026 core inflation projection for the end of 2.5% could imply 1-3 interest rate cuts of .25% for the overnight bank lending rate. Tailwinds that may help reduce interest rates include lower taxes, deregulation, and productivity gains.

Overvaluations and Potential Solutions For Investors?

While the S&P 500 Index is near record high valuations based upon earnings, the multiple is highest for the largest technology companies and relatively low for the category which we refer to as Deep Value. These are assets with favorable estimated forward returns when compared to similar assets at inflated valuations.

Energy and Artificial Intelligence

The recent rally in U.S. equity indexes was driven, in part, by rapid recovery in Artificial Intelligence (AI) related companies after the correction early in 2025. The AI revolution is already increasing productivity and profitability for many companies, similar the roaring 1990’s PC/Internet driven boom. Data center expansion is one of the results of AI demand for processing power. The initial wave of technology upgrades delivered attractive growth for the AI technology supply chain.

Who is spending money on AI Technology? Current capital expenditures appear unsustainable for many data center providers and even some electric utilities. Reduction in capital expenditures by AI providers sets the state for potential correction opportunities in 2026.

Who is generating revenue on AI Technology? The resulting increases in electricity demands have led to increased use of natural gas while nuclear power is undergoing a renaissance.

Energy Infrastructure

Pipelines: Rising dividends and stock buybacks underscore attractive opportunities for investors. Deregulation possibly leads to increased business productivity and profit growth. North American Liquid Natural Gas (LNG) export capacity is on track to double by the end of 2029 according to the U.S. Energy Information Administration. Currently, the pipelines and export facilities still appear underpriced relative to other sectors. In our estimations, Data Center electricity demand is an obvious choice for natural gas power generation. McGowanGroup portfolios currently contain nuclear holdings including companies benefiting from the current build out of increased capacity.

Global High Yield Bond Fund prices and Floating Rate Loan Funds remained resilient during the long interest rate spike with a current overall yield near 7%. Premium prices could result in gain harvesting to increase “dry gun powder” for bargains in other areas of the markets. Meaningful deficit reduction could result in lower long-term rates and potential gains in longer duration bonds & tax free municipal bonds.

Our Next Steps

The McGowanGroup Investment Committee (IC) meets each Wednesday morning to review and upgrade the model portfolios using an impressive, evolving, research process. Equity market rallies provide investors the opportunity to raise Tactical Safety for future resilience as underperformers are harvested systemically. Pullbacks in market values for equity provide the opportunity to add high cash flow assets at attractive prices. Our wealth managers and the team remain committed to helping you evolve your financial plan!

New Client Portal & State of the Art Applied Technology

Our performance tracking for clients started in the 1990’s along with customer relations management software. Each designed for relentless pursuit of reliable, Superior Client Profits and Excellence in Service. We continue to have great feedback on the new Black Diamond Client Portal including the mobile app. Just call or email if you would like a refreshed link. The past year we devoted the extra resources to upgrade to the state-of-the-art financial software including the document vault. Special recognition: All Hail Scary Smart Joyce Cheng for her devotion!

Tax Planning 2025 – 2026

Good news! Pershing BNY automatically feeds your tax forms to your Black Diamond Portal and your CPA is notified as they are added to the document vault. If you have not provided your CPA information or have made a change, please call or email us so that we may update your records appropriately. We remain committed to the mission of Superior Client Profits Through Excellence in Service. Thank you for allowing us to serve you and your family!

Spencer McGowan and The Team That Cares,

McGowanGroup Wealth Management