McGowanGroup Wealth Management

Q1 2026 Client Updates

Cautious Optimism

The State of the U.S. Economy

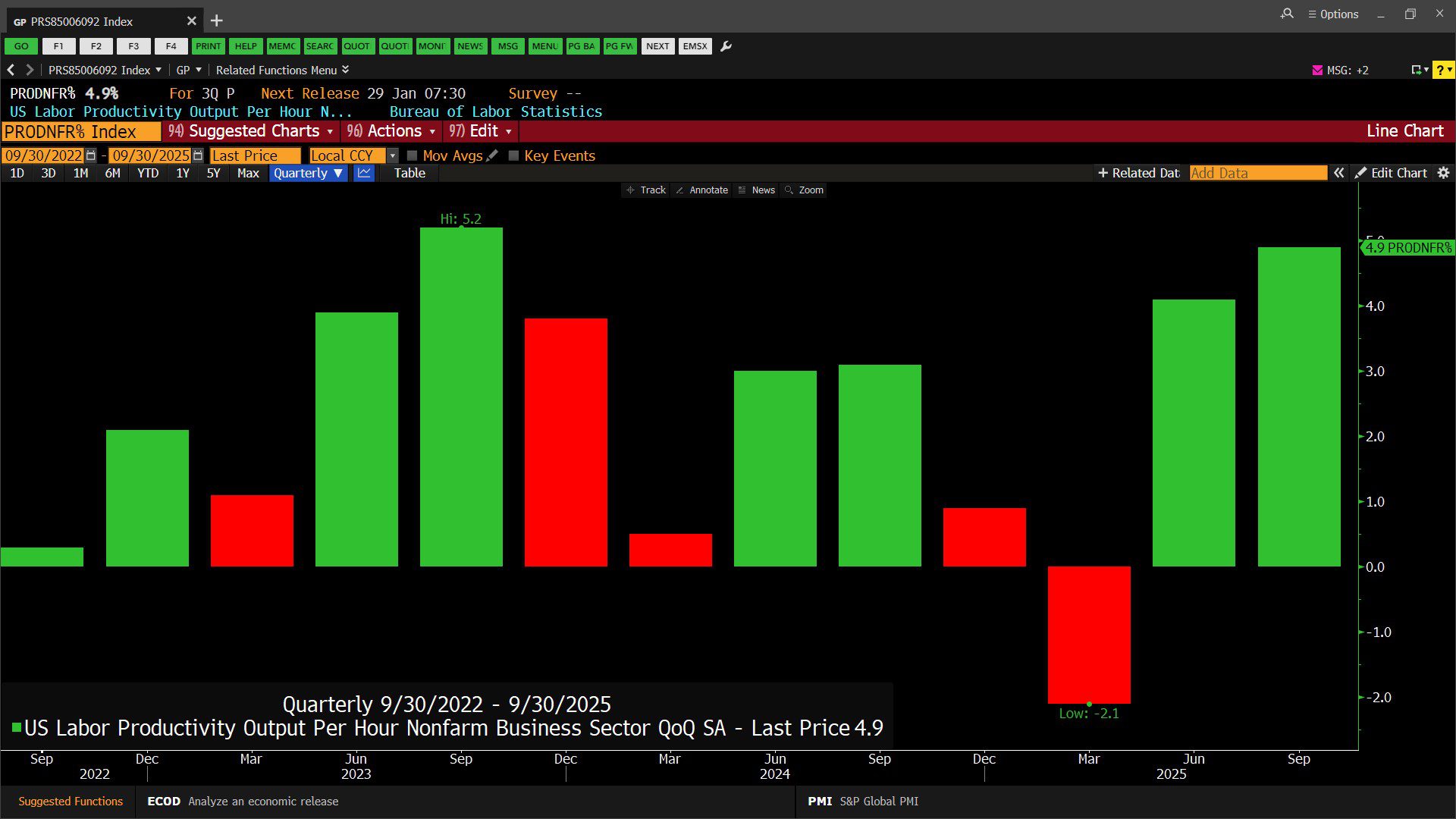

The ending numbers for economic growth were above average and exceeded consensus expectations. U.S. 2025 economic growth annualized at 4.3% in Q3 2025. U.S. economic growth for Q4 2025, per The Atlanta Federal Reserve’s Real GDPNow projection, was estimated at 5.4% as of January 8th, 2025 despite the 6-week government shutdown.

Remarkable economic resilience considering that the federal government reduced the federal workforce during the shutdown by 162,000, and, by over 270,000 during 2025. The nearly 9% workforce reduction corresponds to a falling budget deficit estimate by usdebtclock.org, $1.7 trillion down from over $2 trillion. Not a surplus, however a move in the right direction for tackling the deficit. 2026 U.S. economic growth forecasts include the Federal Reserve projection of 2.3%, recently raised from 1.8%, and a consensus global growth rate of 3.2% in late 2025.

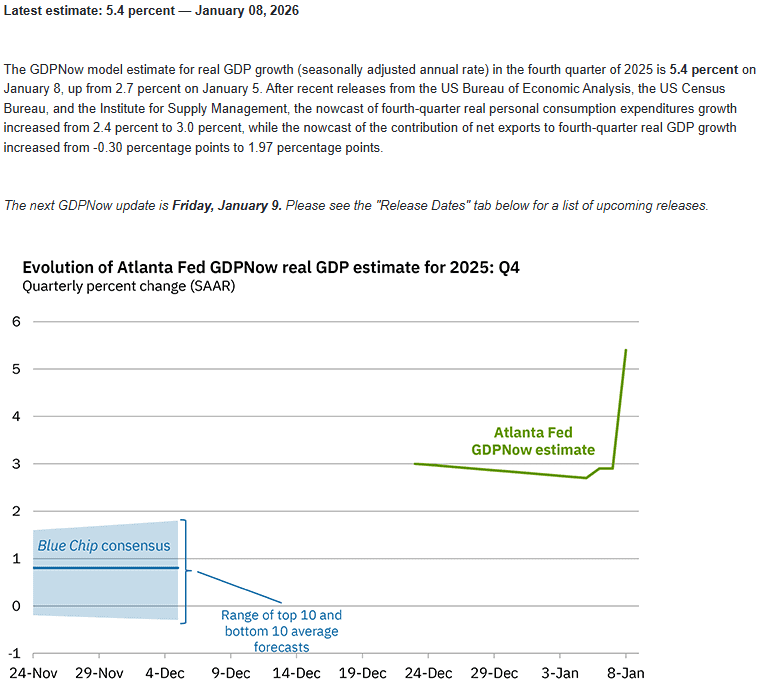

The Federal Reserve recent 2026 core inflation projection for the end of 2.5% could imply 1-3 interest rate cuts of .25% for the overnight bank lending rate. Tailwinds that may help reduce interest rates include lower taxes, deregulation, and productivity gains.

Overvaluations and Potential Solutions For Investors?

While the S&P 500 Index is near record high valuations based upon earnings, the multiple is highest for the largest technology companies and relatively low for the category which we refer to as Deep Value. These are assets with favorable estimated forward returns when compared to similar assets at inflated valuations.

Energy and Artificial Intelligence

The recent rally in U.S. equity indexes was driven, in part, by rapid recovery in Artificial Intelligence (AI) related companies after the correction early in 2025. The AI revolution is already increasing productivity and profitability for many companies, similar the roaring 1990’s PC/Internet driven boom. Data center expansion is one of the results of AI demand for processing power. The initial wave of technology upgrades delivered attractive growth for the AI technology supply chain.

Who is spending money on AI Technology? Current capital expenditures appear unsustainable for many data center providers and even some electric utilities. Reduction in capital expenditures by AI providers sets the state for potential correction opportunities in 2026.

Who is generating revenue on AI Technology? The resulting increases in electricity demands have led to increased use of natural gas while nuclear power is undergoing a renaissance.

Energy Infrastructure

Pipelines: Rising dividends and stock buybacks underscore attractive opportunities for investors. Deregulation possibly leads to increased business productivity and profit growth. North American Liquid Natural Gas (LNG) export capacity is on track to double by the end of 2029 according to the U.S. Energy Information Administration. Currently, the pipelines and export facilities still appear underpriced relative to other sectors. In our estimations, Data Center electricity demand is an obvious choice for natural gas power generation. McGowanGroup portfolios currently contain nuclear holdings including companies benefiting from the current build out of increased capacity.

Global High Yield Bond Fund prices and Floating Rate Loan Funds remained resilient during the long interest rate spike with a current overall yield near 7%. Premium prices could result in gain harvesting to increase “dry gun powder” for bargains in other areas of the markets. Meaningful deficit reduction could result in lower long-term rates and potential gains in longer duration bonds & tax free municipal bonds.

Our Next Steps

The McGowanGroup Investment Committee (IC) meets each Wednesday morning to review and upgrade the model portfolios using an impressive, evolving, research process. Equity market rallies provide investors the opportunity to raise Tactical Safety for future resilience as underperformers are harvested systemically. Pullbacks in market values for equity provide the opportunity to add high cash flow assets at attractive prices. Our wealth managers and the team remain committed to helping you evolve your financial plan!

New Client Portal & State of the Art Applied Technology

Our performance tracking for clients started in the 1990’s along with customer relations management software. Each designed for relentless pursuit of reliable, Superior Client Profits and Excellence in Service. We continue to have great feedback on the new Black Diamond Client Portal including the mobile app. Just call or email if you would like a refreshed link. The past year we devoted the extra resources to upgrade to the state-of-the-art financial software including the document vault. Special recognition: All Hail Scary Smart Joyce Cheng for her devotion!

Tax Planning 2025 – 2026

Good news! Pershing BNY automatically feeds your tax forms to your Black Diamond Portal and your CPA is notified as they are added to the document vault. If you have not provided your CPA information or have made a change, please call or email us so that we may update your records appropriately. We remain committed to the mission of Superior Client Profits Through Excellence in Service. Thank you for allowing us to serve you and your family!

Spencer McGowan and The Team That Cares,

McGowanGroup Wealth Management

Join Us for The Latest Financial Headlines and Valuable Research from The McGowanGroup. Built for Investors by Experienced Portfolio Managers!

Click here to get the monthly newsletter

Headline Round Up!

*Texas! Dallas Is Booming Except for Downtown?

*Texas! AT&T to Move HQ from Downtown Dallas to Plano!

*U.S. Productivity Surges.

*Trump’s Social Media Post Hits at Defense Stocks & Smacks Blackstone Along with Homebuilders.

*S&P 500 Index Biggest Winners & Losers in 2025?

*OPEC’s (Organization of Petroleum Exporting Countries) Latest Annual Statistical Review Says Venezuela Sits on 20% of World’s Oil!

*What Has to Happen for Oil Production in Venezuela to Increase?

*Refining Stocks Rejoice on Venezuela Windfall Hopes.

*Fill’Er Up? Chevron Lines Up 11 Ships to Head to Venezuela in January.

*The Latest Health Care AI (Artificial Intelligence) Uses.

*Saks Global, Owner of Saks Fifth Avenue & Neiman Marcus, Headed For Bankruptcy After Missing Interest Payment.

*Italy Economic Turnaround and Prime Minister Meloni.

*Wall Street Journal: Do Tariffs Cause Inflation? A Surprising Answer!

*Caterpillar’s Surging Stock & The Data Center Power Business.

*Nvidia Unveils Faster AI Chips Ahead of Expectations!

*Nuclear: Is The Future of Nuclear Small Modular Reactors?

*Nuclear Powered Commercial Ships Getting Closer to Reality?

Profit Report

Wall Street Journal: Five Investors Explain Their 2026 Strategy.

The Atlanta Federal Reserve’s GDPNow Real GDP Estimate for 2025, Q4 (January 8, 2026)

– Courtesy of The Atlanta Federal Reserve

U.S. Labor Productivity Output Per Hour Non-Farm Business Sector Quarter over Quarter, Seasonally Adjusted (09/30/2022 – 09/30/2025)

– Courtesy of Bloomberg LP

S&P 500 Index – Member Ranked Returns (12/31/2025 – 01/09/2026)

– Courtesy of Bloomberg LP

NASDAQ Composite Index – Member Ranked Returns (12/31/2025 – 01/09/2026)

– Courtesy of Bloomberg LP