Q: What good economic news shocked investors this week?

Q: Which factors contributed to the increase?

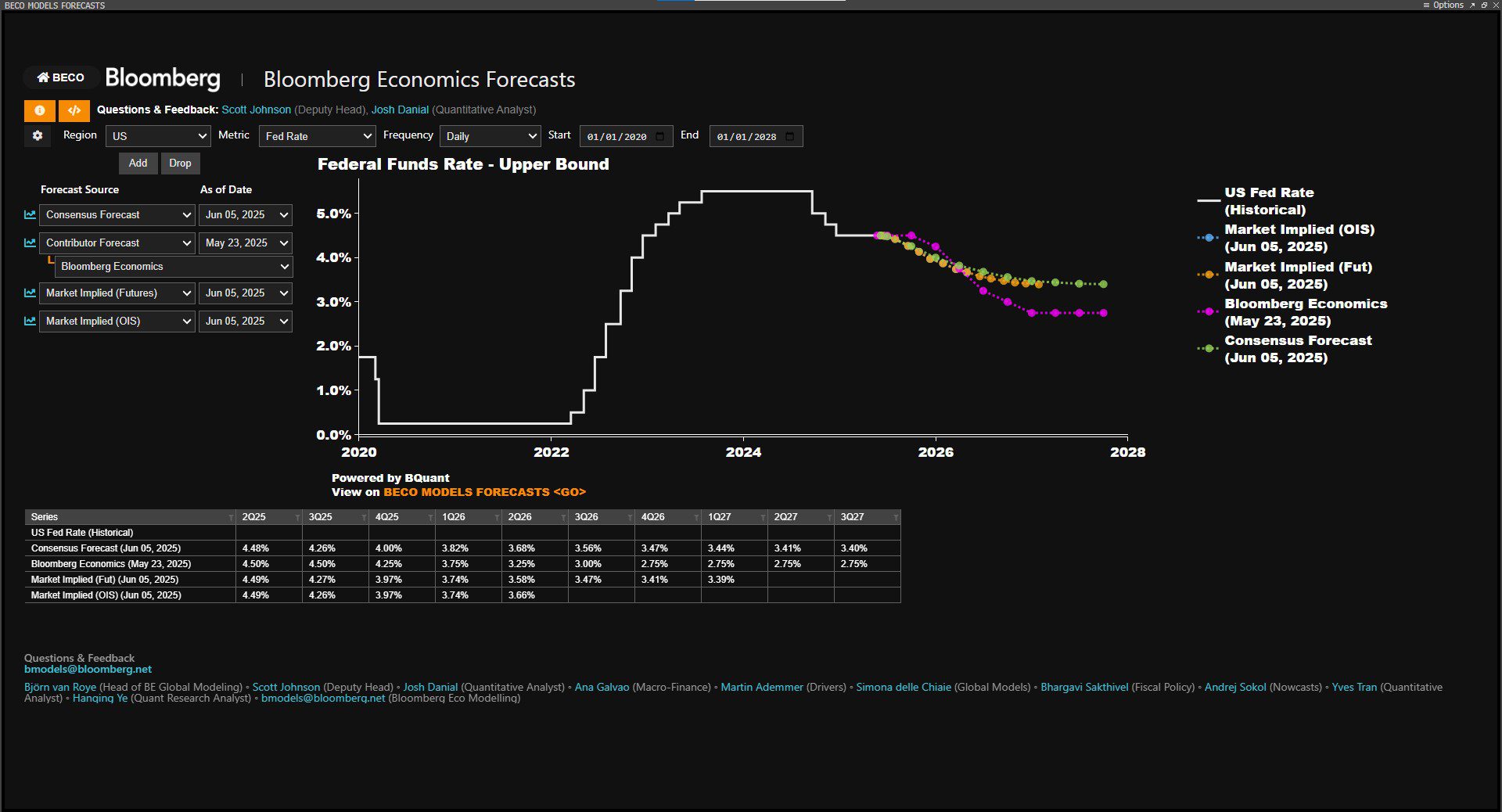

Q: What steps is the Federal Reserve likely to take between now and 2026?

Q: What could potential changes mean for the markets?

Join Us for The Latest Financial Headlines and Valuable Research from The McGowanGroup. Built for Investors by Experienced Portfolio Managers!

Click here to get the monthly newsletter

Financial Market Headline Round Up

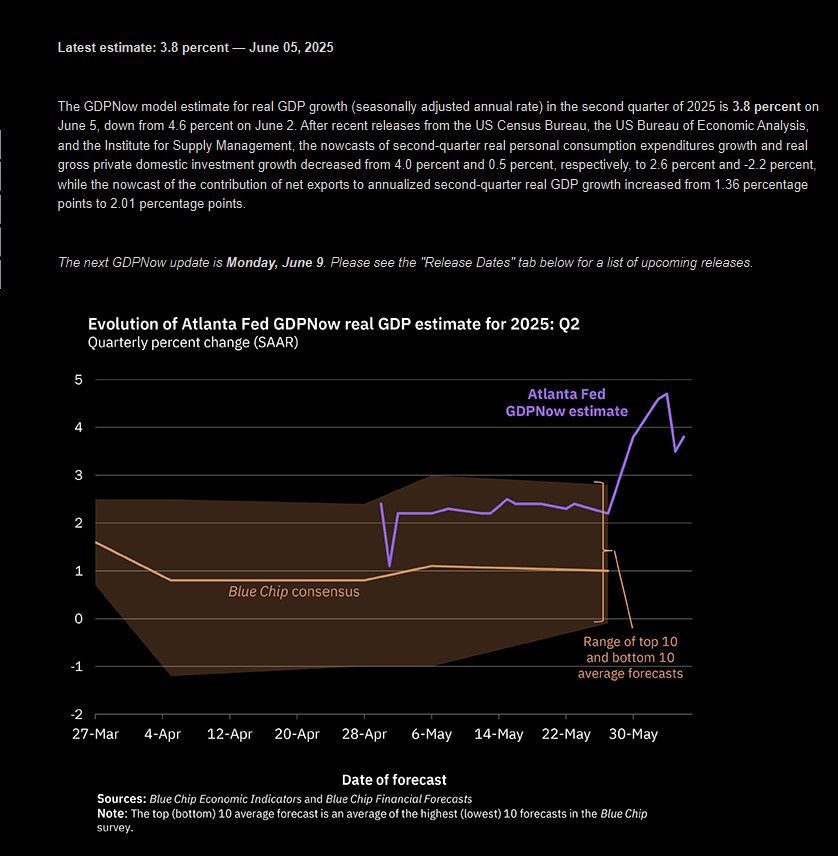

*Atlanta Fed Raises Q2 Real GDP Estimate to 3.8%.

*ECB Cuts Rates to 2% due to slowing inflation and potential tariff impacts. Why Is Jerome Powell Still 4.3%?

*Job Openings Increase 190,000 in April.

*Trade Deficit Chopped in Half due to Record Drop in Imports.

*Xi and Trump Talk Trade and Rare Earths on The Phone!!

*Congress Kills Global Corporate Tax From Organization for Economic Cooperation.

*Crypto Firm Circle, issuer of USDC Stablecoin, Soars in IPO!

*Elon Musk and President Trump Have Huge Bromance Spat Over Big Beautiful Bill’s Lack of Spending Cuts.

*Tax Bill Hikes Taxes on Endowments, MIT Increases From $27M to $411M.

*Success Story: Oklahoma City Thunder Dominating NBA. Clay Bennett and GM Sam Presti Lead the Way.

*401k Savings Rates Hit Record High 14.3% for First Three Months this Year.

*Steel and Aluminum Prices Soar on Doubling of Tariffs.

*Dumb: Muni Bonds Issued for Manure to NatGas Project Default.

*Nuclear Renaissance: Meta Signs 20 Year Deal with Constellation Energy for Clinton, IL Plant Renovation.

Texas!

*Highland Park Ascension: One of the Priciest Homes for Sale in Texas Lists for $34.5 Million

*Galveston Rising! With 2 Million Cruise Guests Per Year, Fastest Growing Cruise Port in The Nation.

*Texas Stock Exchange On Track for 2026 Debut

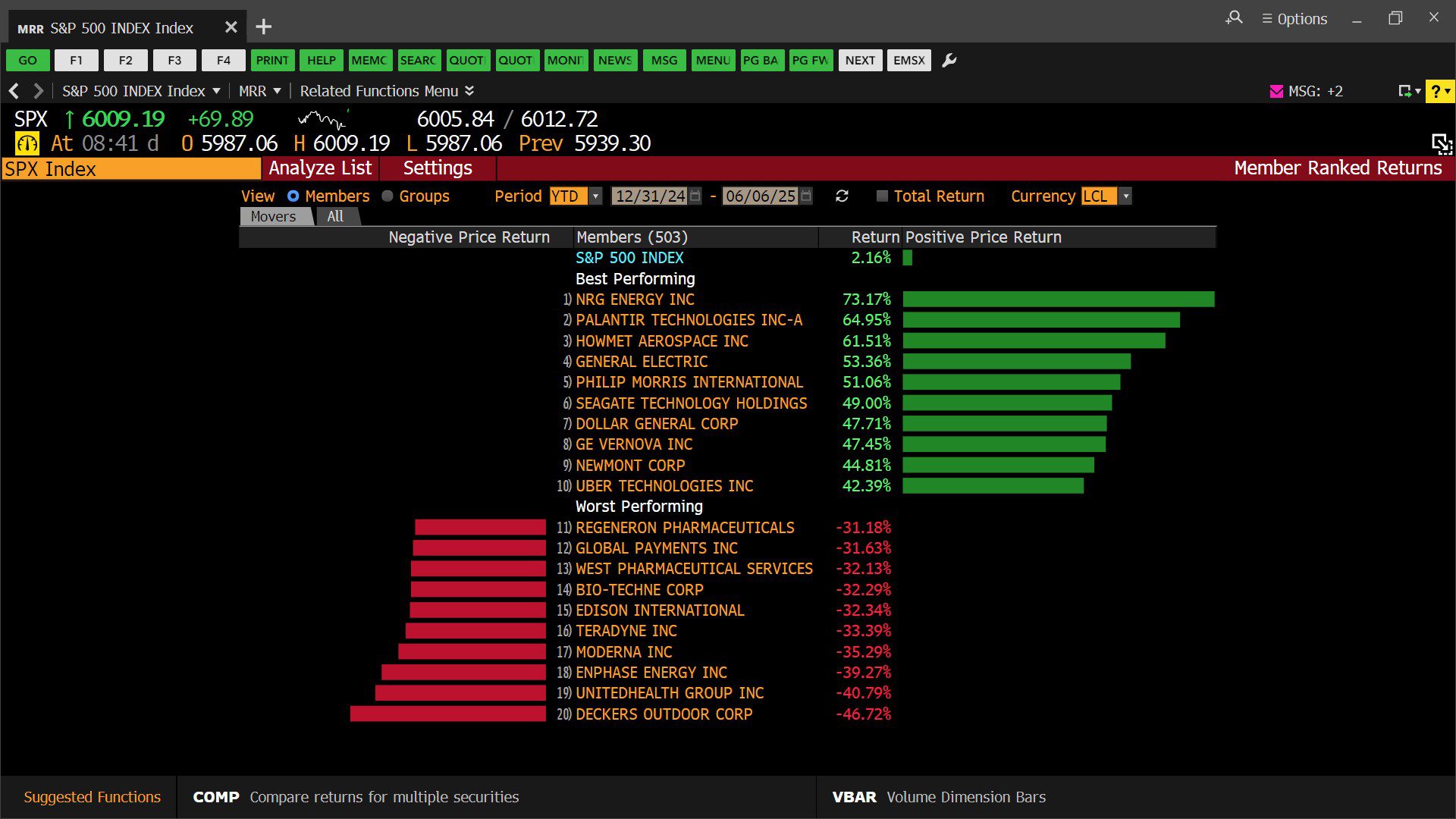

SPDR Standard & Poor’s 500 Index ETF (Exchange Traded Fund) – Daily (12/31/2024 – 06/06/2025)

– Courtesy of Bloomberg LP

Atlanta Federal Reserve Real GDPNow Q2 2025 Estimate

– Courtesy of Atlanta Federal Reserve

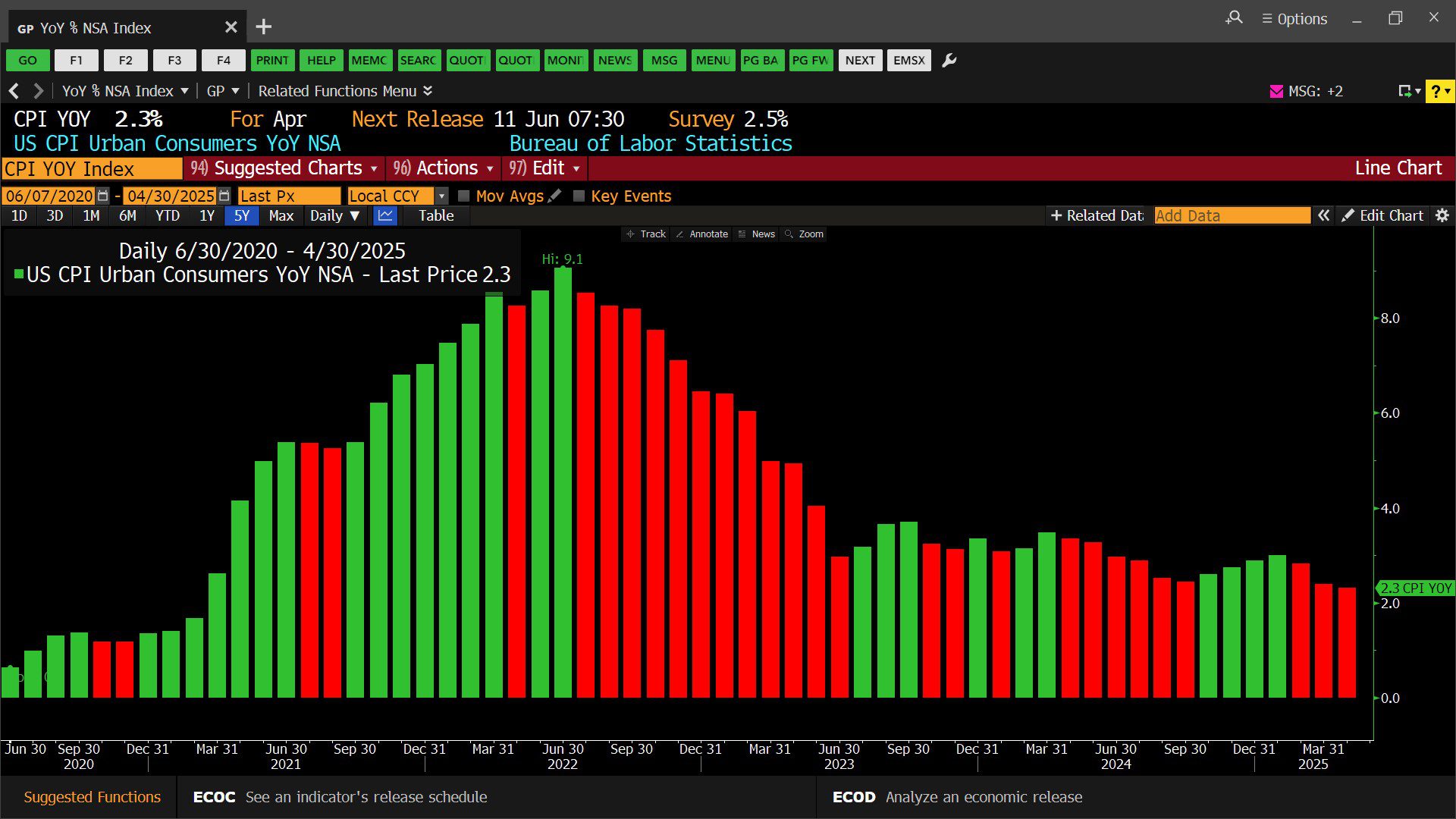

US Consumer Price Index Year-over-Year Daily (06/30/2020 – 04/30/2025)

– Courtesy of Bloomberg LP

European Central Bank Deposit Facility Announcement Rate Daily (06/08/2020 – 06/05/2025)

– Courtesy of Bloomberg LP

Bloomberg Federal Funds Rate Forecast (01/01/2020 – 01/01/2028)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index – Quarterly Earnings Analysis by Sector (12/31/2024 – 06/06/2025)

– Courtesy of Bloomberg LP

Profit Report

*Trading Pattern: Tariff Decline, Negotiation Rally. Likely Fed Rate Cuts Impact?