Q: What massive money flows impacted the U.S. Treasury market and U.S. Equity markets this week?

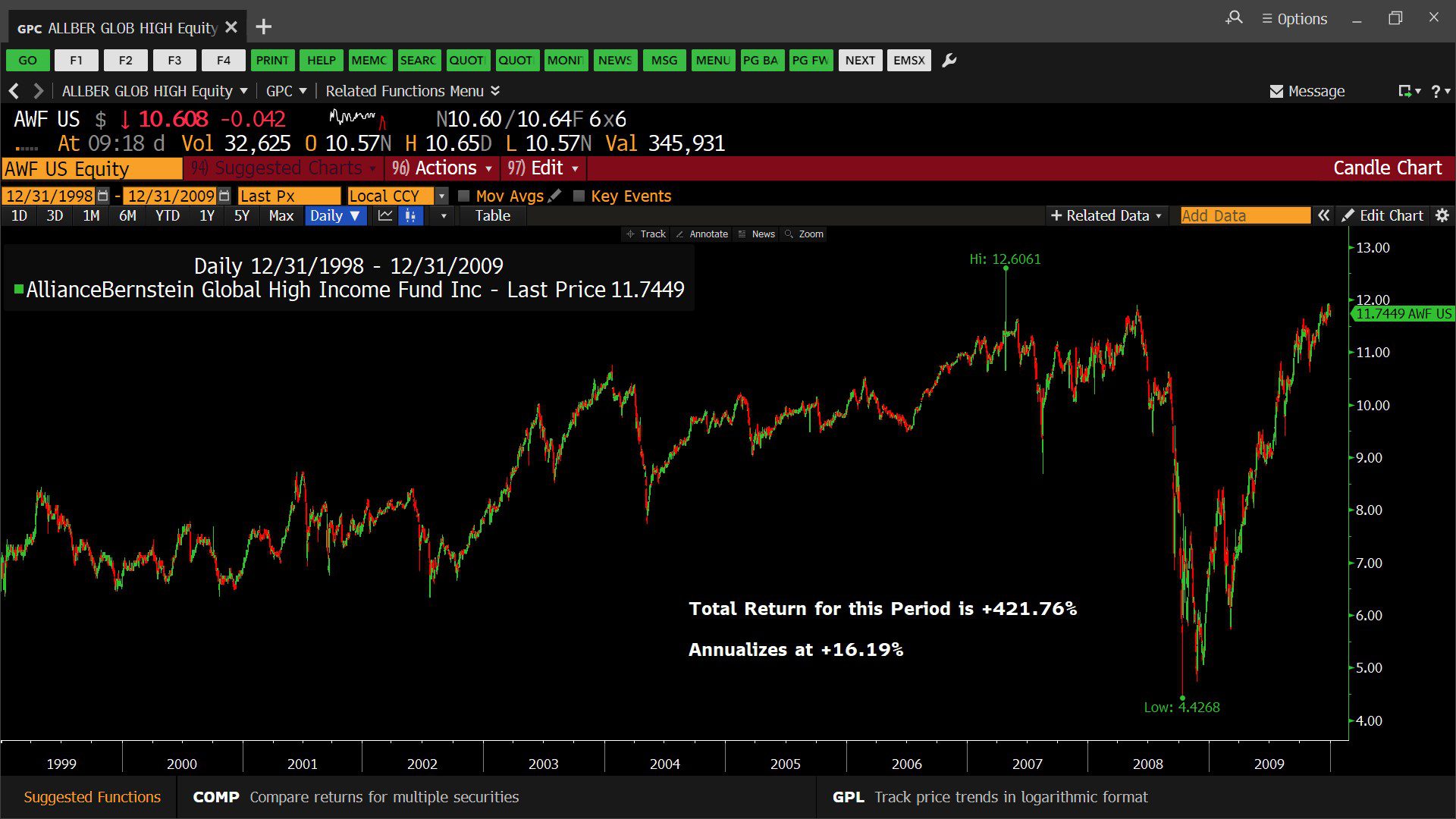

Q: What are some bond strategies that led to success from 1999 – 2009?

Q: What do Moody’s Ratings and Federal Reserve Chairman Jerome Powell have in common?

Join Us for The Latest Financial Headlines and Valuable Research from The McGowanGroup. Built for Investors by Experienced Portfolio Managers!

Click here to get the monthly newsletter

Headline Round Up

*Moody’s Downgrades the U.S. to Aa1 from Aaa, But With a Stable Outlook!?

*Federal Reserve Officials Give Speeches Touching on Economic Activity, the Labor Market, Inflation, Along with Economic Outlook and Monetary Policy.

*Institutional Selling of Long U.S. Treasuries Spikes 30 Year Yield Over 5.1%.

*Dow Jones Industrial Average Falls 900 Points on Wednesday?

*Cryptomania? Bitcoin Tops $106,000 Per Coin on Tuesday.

*Big Fat Beautiful Bill Increases Deficit by 3 Trillion Passes House & Now Goes to Senate?

*Buyer Beware as New Private Credit Pitch Uses Modern Portfolio Theory.

*Tariffs on Asian Solar Gear 3,521% After Panel Vote?

*Portland’s Largest Office Tower Value Falls 80% Below What Owner’s Paid For it a Decade Ago.

*Cathie Wood’s Ark Invest Goes Nuclear.

*Leon Cooperman, Heavily Invested in Energy, Latest MLP (Master Limited Partnership) Addition is Sunoco, LP!

Texas!

*North Texas Winner! Landsea Homes to Go Private in $1.2 Billion Cash Deal!

*Abilene Texas is Home of Open AI’s Biggest Data Center & Secures $11.6 Billion in Funding.

*Blackstone Infrastructure, a unit of Private Equity Giant Blackstone, Buying Publicly Traded Albuquerque company TXNM Energy, Inc., Owner of Utilities in New Mexico & Texas, for about $5.7 Billion.

*Galveston Texas Gets First Bunkering Permit on U.S. Gulf Coast to Fuel Ships with LNG (Liquified Natural Gas).

NetWorth Radio’s Texas Business Leadership Series: Spencer McGowan Interviews Michael D. Rubin, CEO & Founder of MDR & Associates, on Maximizing The Value of Your North Texas Business!

Mr. Rubin is responsible for the overall vision of MDR & Associates and has expanded the firm’s reach significantly over the last decade by opening offices in Dallas, Houston and the main corporate headquarters in Frisco. He is an accomplished sales coach who possesses a high level of negotiating skills, closing skills and overall deal making abilities. Mr. Rubin possesses a long-term, high integrity approach to each and every client we serve. He has two grown boys and has been married to his beautiful wife of over 27 years. Mr. Rubin is active in his local church and enjoys giving his time, treasure and talents to his foundation, his church body and his community in Frisco.

Mr. Rubin is responsible for the overall vision of MDR & Associates and has expanded the firm’s reach significantly over the last decade by opening offices in Dallas, Houston and the main corporate headquarters in Frisco. He is an accomplished sales coach who possesses a high level of negotiating skills, closing skills and overall deal making abilities. Mr. Rubin possesses a long-term, high integrity approach to each and every client we serve. He has two grown boys and has been married to his beautiful wife of over 27 years. Mr. Rubin is active in his local church and enjoys giving his time, treasure and talents to his foundation, his church body and his community in Frisco.

MDR & Associates is a boutique M&A Advisory firm with offices in Dallas, Fort Worth, Frisco, Austin, Houston and San Antonio. We specialize in selling companies with revenues between $1,000,000 and $100,000,000 in the manufacturing, distribution, service and construction industries. We offer a complimentary discovery meeting and free opinion of value to our clients. Our firm was founded on 3 core principals: High Integrity, Transparency and Confidentiality in all business transactions. Our principals have completed over 200 transactions since inception and we are growing rapidly each and every year. Simply put, that means if we do not successfully complete a transaction, you owe us nothing. We strive to be your ultimate resource when contemplating a recapitalization or sale of your Texas-based company. Contact us today to receive a complimentary opinion of value!

Chicago Board Options Exchange 30 Year Treasury Bond Yield Index – Weekly (05/26/2015 – 05/23/2025)

– Courtesy of Bloomberg LP

iShares 20+ Year Treasury Bond ETF (Exchange Traded Fund) – Weekly (05/26/2015 – 05/23/2025)

– Courtesy of Bloomberg LP

SPDR Dow Jones Industrial Average ETF (Exchange Traded Fund) Trust – Daily (12/31/2024 – 05/23/2025)

– Courtesy of Bloomberg LP

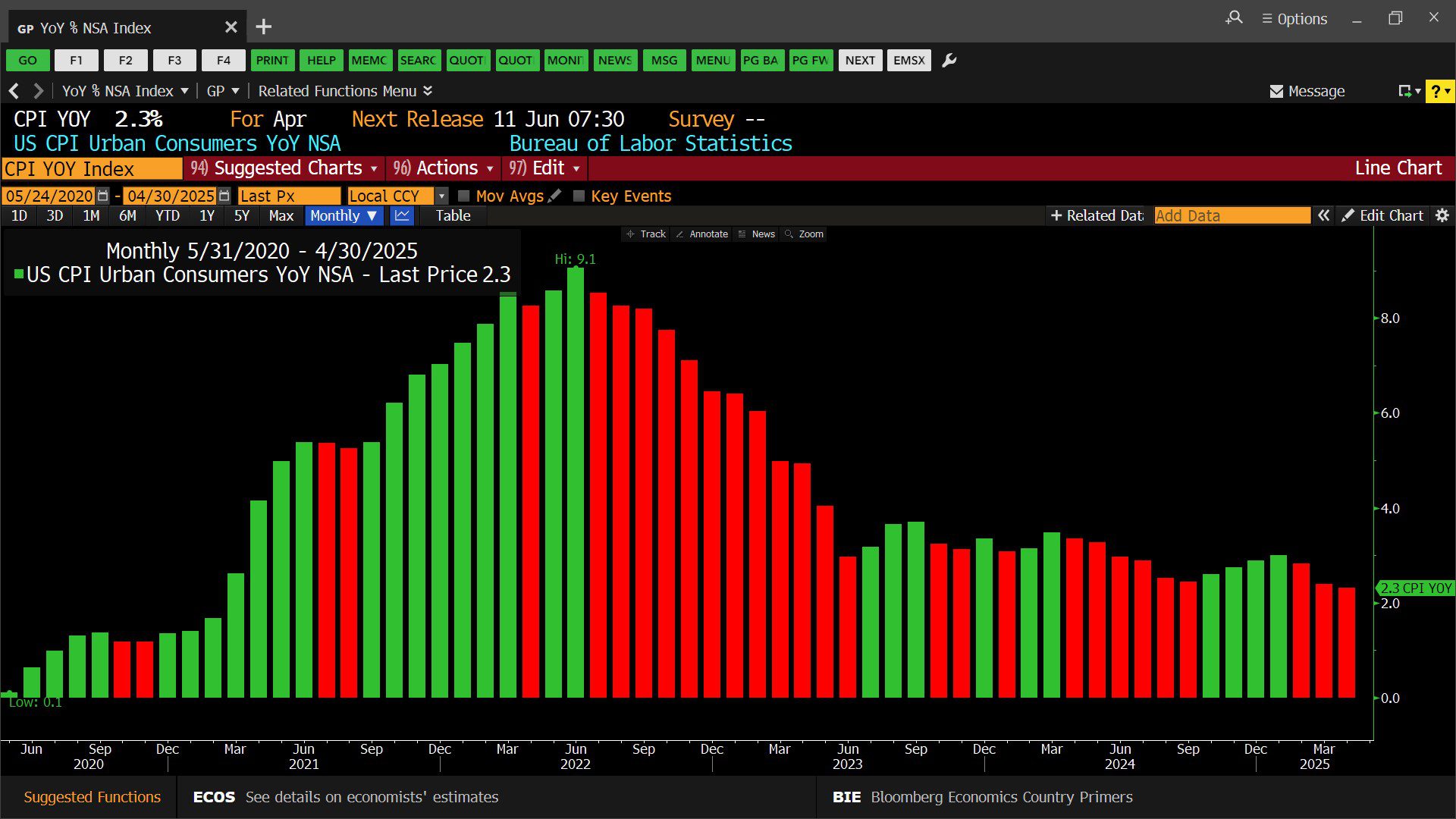

U.S. Consumer Price Index – Urban Consumers Year over Year, Non-Seasonally Adjusted (05/24/2020 – 04/30/2025)

– Courtesy of Bloomberg LP

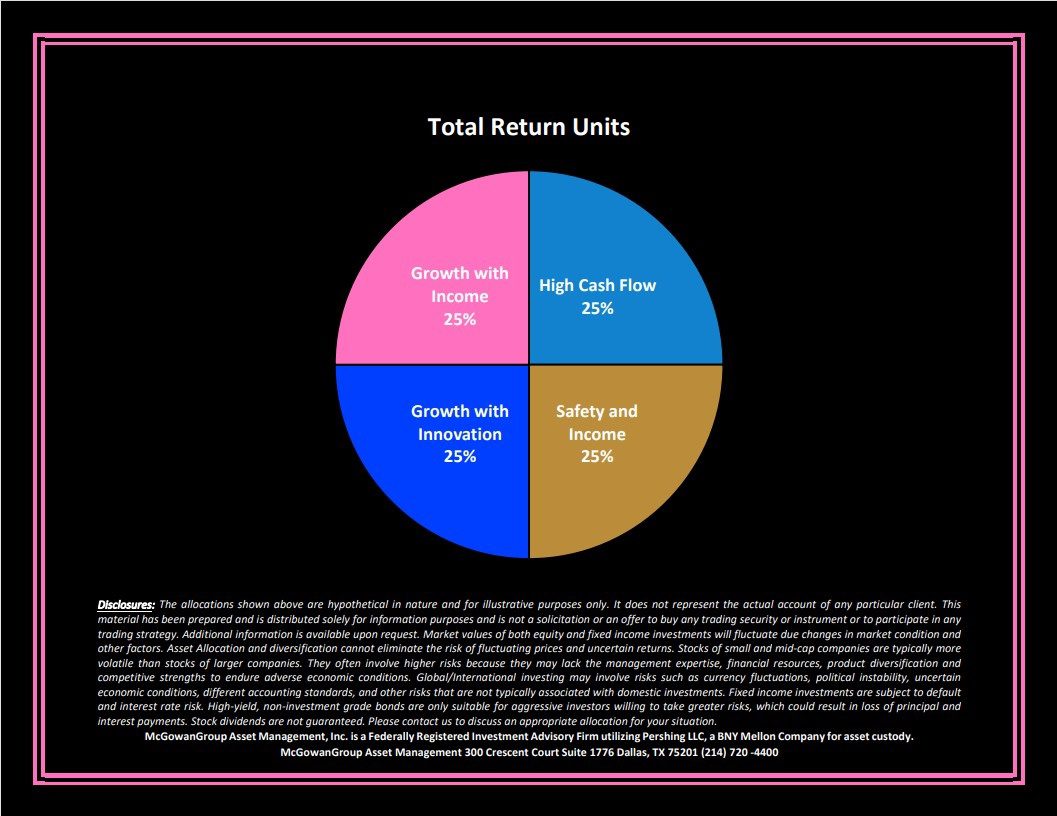

The McGowanGroup’s Total Return Units Allocation Pie Chart (05/16/2025)

– Courtesy of The McGowanGroup

PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF (Exchange Traded Fund) – Monthly (10/30/2009 – 05/23/2025)

– Courtesy of Bloomberg LP

AllianceBernstein Global High Income Fund, Inc. – Daily (12/31/1998 – 12/31/2009)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index – Monthly (01/01/2018 – 12/31/2019)

– Courtesy of Bloomberg LP

U.S. Consumer Price Index – Urban Consumers Year over Year, Non-Seasonally Adjusted (01/01/2018 – 12/31/2019)

– Courtesy of Bloomberg LP

Profit Report

Warren Buffett retires as CEO of Berkshire Hathaway!

Preston’s Lane

The controversial & alleged luxury fashion scandal of 2025 along with the Chinese takedown of European brands!