“I think Jeffrey Hirsch, author of “The Stock Trader’s Almanac” (which I highly recommend), does the best work on the topic. Hirsch states, “S&P gains in January’s first five days preceded full year gains 83.3% of the time, 14 of last 18 post-presidential election years followed the first five day’s direction.” – Andrew Rocco, Zack’s Research

Q: How did the first 5 days of the new year go for the S&P 500 Index and what could it indicate to investors about 2025?

Q: What are some companies and industries that started the new year strong on the first 5 days of 2025?

Join Us for The Latest Financial Headlines and Valuable Research from The McGowanGroup. Built for Investors by Experienced Portfolio Managers!

Click here to get the monthly newsletter

Headline Round Up

*Bloomberg Analyst Consensus Currently Forecasts the S&P 500 Index 2025 Profit Growth Estimates at Over 12% While 2026 Estimates Also Indicate Another 12%!

*Early Lead: The S&P Energy Sector is Up Nearly 5X Times More than S&P 500 Index So Far in 2025!

*U.S. Energy Information Administration (EIA): North America Projected to Double Liquified Natural Gas (LNG) Export Capacity by 2028.

*Energy Transfer Signs 20 Year Agreement to Supply Two Million Tons of LNG to Chevron Annually.

*Where Would Federal Spending Cuts Begin to Reduce the Congressional Budget Office’s (CBO) Estimated 2025 $1.938 Trillion Deficit? What are some the potential financial market impacts?

*The Federal Reserve’s Updated Projections for Interest Rate Cuts.

*Quantum Computing Companies Take a Pounding on Nvidia’s CEO, Jensen Huang, Comments on Commercial “Viability”?

*U.S. Household Net Assets Hit $168.8 Trillion in Q3 2024!

*UBER and LYFT are Gearing Up for the Robotaxi Revolution.

*Zuckerberg Gone to Texas! Meta Content Moderation Teams Moving from California to Texas to Combat Concerns About Bias and Censorship.

*Pershing Square Capital’s CEO, Bill Ackman, Pushing Trump to Privatize Mortgage Giants Fannie Mae & Freddie Mac!

*Artificial Intelligence (AI) is Increasing American Worker Productivity! Activities that took hours now take minutes.

*U.S. Commercial Crude Oil Stockpiles Decline for 7th Straight Week, But Gasoline & Distillate Products Grow by More Than Six Million Barrels Each.

*Actuary Gail Tverberg Predicts Energy Shortages and Potential Recession in 2025? What are some potential inflation hedges for investors?

*Job Openings at 4.8% in November While ADP Reported 122,000 Net New Jobs in December!

*U.S. Nuclear Regulatory Commission to Pursue More Efficient & Streamlined Reactor Approvals.

2025 Mergers, Acquisitions, & IPOs

*Makin’ Bacon! Largest Pork Producer, Hong Kong Based WH Group, Spins Off Virgina Based Smithfield for Initial Public Offering (IPO) with $5.4 Billion Valuation!

*Paychex Strikes $4.1 Billion Cash & Debt Deal for Rival Paycor.

*Getty Images Merging with Shutterstock in $3.7 Billion Cash & Stock Deal.

*Cintas Rebuffed a Second Time by UniFirst on $5.3 Billion Offer!

*Constellation Energy in Talks to Buy Houston Based Calpine for Near $30 Billion in Stock & Debt Deal.

Standard & Poor’s 500 Index – Daily (12/31/2024 – 01/08/2025)

– Courtesy of Bloomberg LP

Invesco QQQ Trust Series 1 – Daily (12/31/2024 – 01/08/2025)

– Courtesy of Bloomberg LP

iShares 20+ Year Treasury Bond Exchange Traded Fund (01/10/2020 – 01/08/2025)

– Courtesy of Bloomberg LP

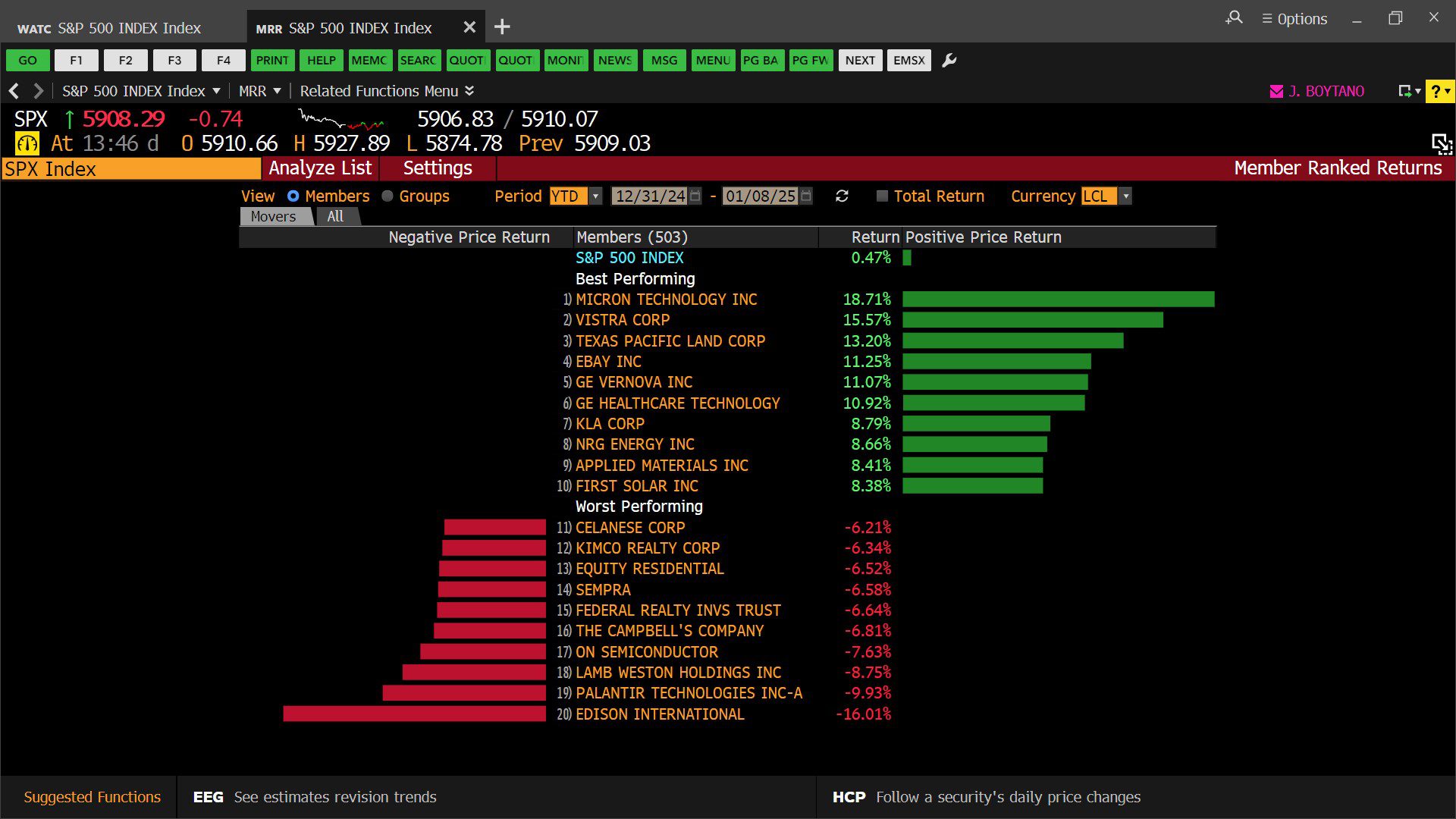

Standard & Poor’s 500 Index – Top 10 & Bottom 10 Member Ranked Returns (12/31/2024 – 01/08/2025)

– Courtesy of Bloomberg LP

Plains GP Holdings, LP – Daily (12/31/2024 – 01/08/2025)

– Courtesy of Bloomberg LP

eBay, Inc. – Daily (12/31/2024 – 01/08/2025)

– Courtesy of Bloomberg LP

Dell Technologies, Inc. – Daily (12/31/2024 – 01/08/2025)

– Courtesy of Bloomberg LP

Cheniere Energy Partners, LP – Daily (12/31/2024 – 01/08/2025)

– Courtesy of Bloomberg LP

J.P.Morgan Asset Management – Guide to the Markets 1Q 2025, pg 18 (12/31/2024)

– Courtesy of J.P.Morgan Asset Management

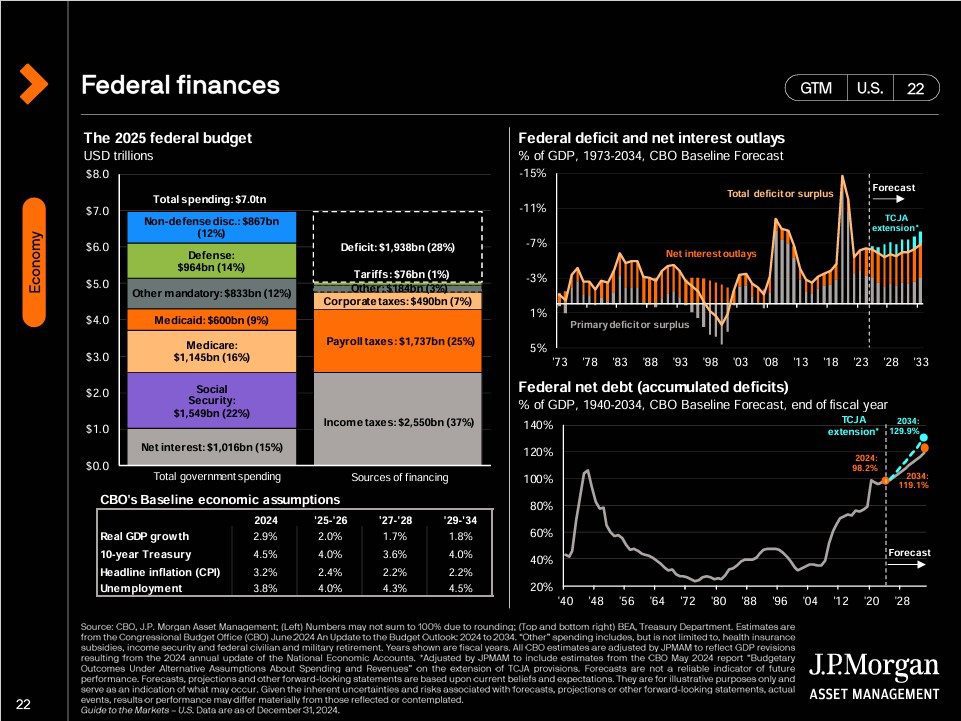

J.P.Morgan Asset Management – Guide to the Markets 1Q 2025, pg 22 (12/31/2024)

– Courtesy of J.P.Morgan Asset Management

Profit Report

Secrets of the man who made Nvidia the world’s most valuable company.