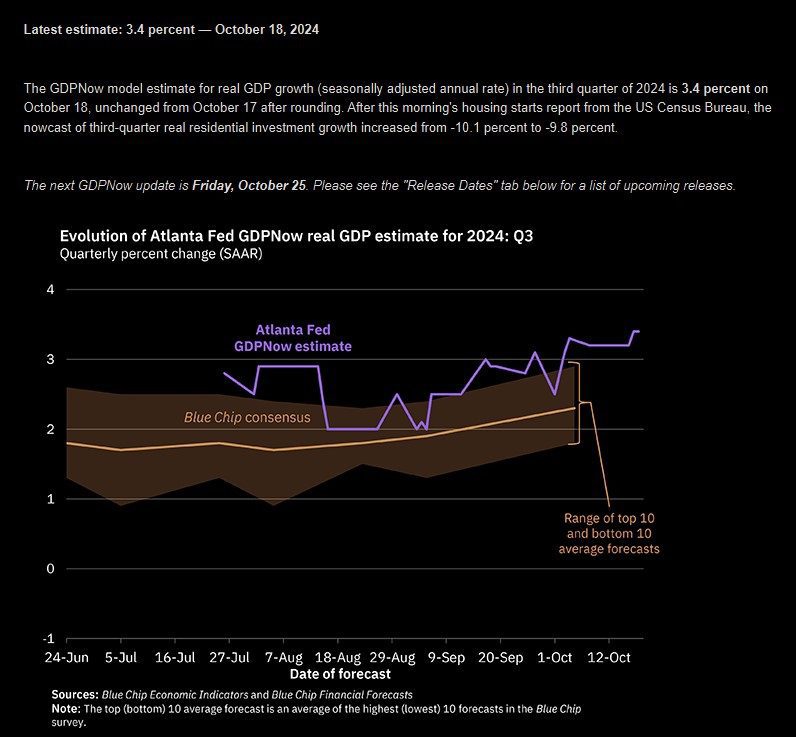

Q: What is the current projected economic growth for the U.S. in the 3rd quarter?

A: The Atlanta Federal Reserve’s GDPNow estimate on Oct. 18th was at 3.4%. This is significantly stronger than the 2.1% 20-year average.

Q: What is the McGowanGroup’s take on the U.S. Dollar, Gold, Printed Money & the Federal Reserve’s balance sheet?

A: Stay tuned to this week’s broadcast as Spencer McGowan covers those topics for investors!

Headline Round Up

*Residential Real Estate Updates: Total Home Inventories Are Up 23% While Existing Home Sales Hit a 14 Year Low in September and New Home Sales Spike in September as well!

*The Big Short All Over Again: Asset Backed Securities Are Back?

*JPMorgan Sees Solid Growth Ahead for Stocks While Goldman Sachs Says Big Decade of Gains Coming to An End.

*Chinese Capital Exodus: Chinese Residents Using Cryptocurrency and Fine Art to Move Money Overseas.

*Tax Free Munis? State and Local Infrastructure Sales Near $250 Billion and the Vanguard Municipal Money Market Fund Recently Pulls Ahead of Treasury Bills in Net After Tax Yield for Higher Brackets?

*Could North Dakota End Property Taxes?

*Unexpected Surge in U.S. Power Demand?

*Corpus Christi Now The World’s Third Largest Oil Export Port Due to Record Volumes This Year.

*The Dallas Express: Texas Models How Clean Energy Should Work.

*Natural Gas Crunch Likely? International Energy Agency (IEA) Warning of Potential Supply Shortages Due to Insufficient Investment in Production.

*Cheniere Energy Predicts Chinese Demand for Natural Gas to Jump by More Than 50% by 2040 While Shell Predicts Global Demand to Surge by 50% by 2040.

*Goldman Sachs See Limited Upside for Oil Prices & Predicts $76 Per Barrell Oil for 2025.

*Heavy Betting Against Clean Energy? $5 Trillion Hedge Fund Industry is Net Long Oil, Gas and Coal, But Net Short Batteries, Solar, Electric Vehicles (EVs) & Hydrogen!

*Google and Microsoft Advance Artificial Intelligence (AI) Features, Respectively.

*Hidden Inflation? Consumer Price Index (CPI) Excludes Property Taxes, Tips, and Interest Payments. Bureau of Labor Statistics Economist, Steve Reed, says some items “can’t be realistically priced”.

*UPS Spikes on Profit Growth and Volume Increase for the First Time in Two Years!

*Tesla’s 3rd Quarter Profit Growth 17% & Elon Musk is Forecasting as Much as 30% Vehicle Growth for Year Ahead.

*Steaming Streaming: Netflix Profits Up 45% & Sales Up 15% for the 3rd Quarter.

*General Motors Profits Up 30% and Revenue Up 10% in the Most Recent Quarter.

*3M Raising Low End of 2024 Profit Target as Q3 Profits Up 18%

*Dallas Based AT&T Spikes on Mobile Subscriber Gains in Q3. The real story for investors.

*Boeing Reports $6 Billion Loss Ahead of Strike Vote.

Atlanta Federal Reserve Real GDP Estimate for 2024 Q3 (10/18/2024)

– Courtesy of Atlanta Federal Reserve

Dow Jones Industrial Average Year-To-Date Total Return (12/29/2023- 10/25/2024)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index – Quarterly Earnings Analysis by Sector (08/16/2024 – 11/15/2024)

– Courtesy of Bloomberg LP

Federal Reserve Balance Sheet (10/27/2004 – 10/23/2024)

– Courtesy of Bloomberg LP

United States Dollar Index Spot (12/31/1974 – 10/25/2024)

– Courtesy of Bloomberg LP

Gold Per Troy Ounce Vs. United States Dollars Spot (12/31/1974 – 10/25/2024)

– Courtesy of Bloomberg LP

Gold Per Troy Ounce Vs. United States Dollars Spot (11/30/2004 – 10/25/2024)

– Courtesy of Bloomberg LP

iShares China Large-Cap ETF (12/31/2004 – 10/25/2024)

– Courtesy of Bloomberg LP

Profit Report

The 2025 Tax Brackets Are Here.

Year End Tax Planning Ideas with McGowanGroup Wealth Management.