Top Financial Surprises of the Year, So Far

*Equity markets rally ahead of Federal Reserve (Fed) interest rate cuts.

*Artificial Intelligence (AI) dominates investor focus.

*Utilities rally on datacenter demand projections.

*North Texas power generator, Vistra Corp., up more percentage wise than Nvidia?

*Big Tech embraces “carbon free” nuclear power.

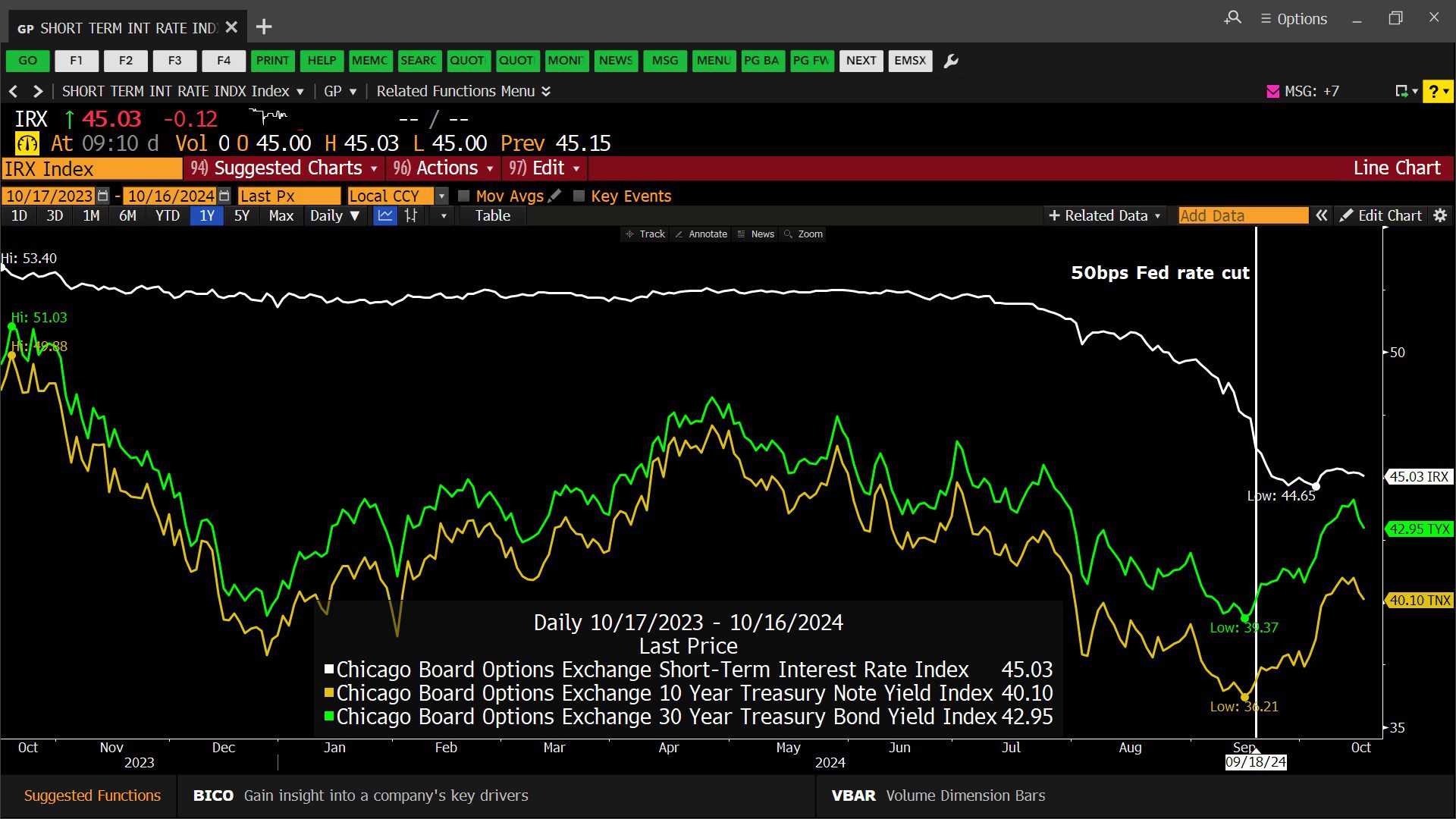

*Long interest rates moved up after the Fed cut interest rates?

*Oil prices fell as inventories declined to near historic lows.

*Natural gas prices stay flat.

Q: Should investors buy more tech stocks now?

A: If you were not a buyer during late 2022, the shift in strategy could be ill timed after the recent large tech rally. For many investors, the solution could be a carefully timed, gradual addition of a reasonable growth and innovation position built into a long-term plan.

Headline Round Up

*Big Tech Goes Nuclear with Small Reactors to Power AI!

*How AI Will Impact Energy Industry Margins Over Next 5 Years.

*SpaceX Catches Giant Starship Booster with “Chopsticks”!

*Elon Musk Tapped to Be “Secretary of Cost Cutting”?

*Wall Street Journal Editorial Board – Updates on the $42.5 Billion Broadband Rollout to Underserved Rural Communities.

*Updates on the $5 Billion for Electric School Buses. Critics say green boondoggle while advocates cite boost to U.S. manufacturing and cleaner air.

*High Home Prices Force Builders to Offer Customer Concessions Like Mortgage Buydowns.

*International Energy Agency (IEA) Trims 2024 Oil Demand Forecast Again with Reduced Chinese Consumption Weighing on Global Outlook.

*Citi Research Sees Possibility of $120 Oil if Supplies Disrupted by Mideast Conflict Despite Weak Market Fundamentals.

*Fierce Blackwell Microchip Demand Powers Nvidia Toward Stock Record Again!

*Adobe Announces AI Video Generator in Race with OpenAI & Meta.

*Bargain Prices on New & Used Electric Vehicles (EVs) Put Owners and Dealers in a Bind.

*Helene and Milton Seen Costing Insurers Between $35 Billion to $55 Billion Says Moody’s RMS Risk Modeling Unit.

*Goldman Sachs 3rd Quarter Profits Soar as Stock Trading Unit Posts Best Quarter in More Than Three Years!

*Dell Technologies, Inc. Ready to Ship Servers with New Nvidia Chips to Select Customers in November.

Dow Jones Industrial Average Index – Total Return Analysis, Daily (12/29/2023 – 10/16/2024)

– Courtesy of Bloomberg LP

Chicago Board Options Exchange – Short Term Interest Rate Index, 10 Year Treasury Note Yield Index, & 30 Year Treasury Bond Yield Index (10/17/2023 – 10/16/2024)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index – Quarterly Earnings Analysis by Sector (08/16/2024 – 11/15/2024)

– Courtesy of Bloomberg LP

Department of Energy’s Cushing Oklahoma Crude Oil Total Stocks (10/04/2014 – 10/04/2024)

– Courtesy of Bloomberg LP

Department of Energy’s Crude Oil Total Inventory Data, Excluding Strategic Petroleum Reserve (10/04/2014 – 10/04/2024)

– Courtesy of Bloomberg LP

Generic Lithium Futures Contract Spot Price (10/17/2017 – 10/15/2024)

– Courtesy of Bloomberg LP

Vistra Corp., Texas Pacific Land Corp., Brinker International, Inc., Cinemark Holdings, Inc., & Tenet Healthcare Corp. – Comparative Returns (12/29/2023 – 10/16/2024)

– Courtesy of Bloomberg LP

Profit Report

Investment Book Review: Timeless Principles from The Richest Man in Babylon.

The Richest Man in Babylon by George S. Clason is a book of parables that teaches readers how to become wealthy through seven principles:

• Start thy purse to fattening: Save money and put more money in your purse than you spend.

• Control thy expenditures: Learn to live within your means and don’t spend more than you need.

• Make thy gold multiply: Invest wisely and make your money work for you.

• Guard thy treasures from loss: Avoid risky investments and protect your money from conmen.

• Make of thy dwelling a profitable investment: Owning your home can help you achieve your goals.

• Ensure a future income: Plan for unexpected accidents or deaths that could limit your ability to work.

• Increase thy ability to earn: Strive to learn and become wiser so you can earn more.

The book’s main lesson is that the secrets to wealth building have remained the same throughout history.