Q: At this week’s lows the Dow Jones Industrial Average (Dow Jones) had dropped about 2,000 points or 5% below its recent peak of over 40,000 two weeks ago. What are some of the key factors contributing to this decline?

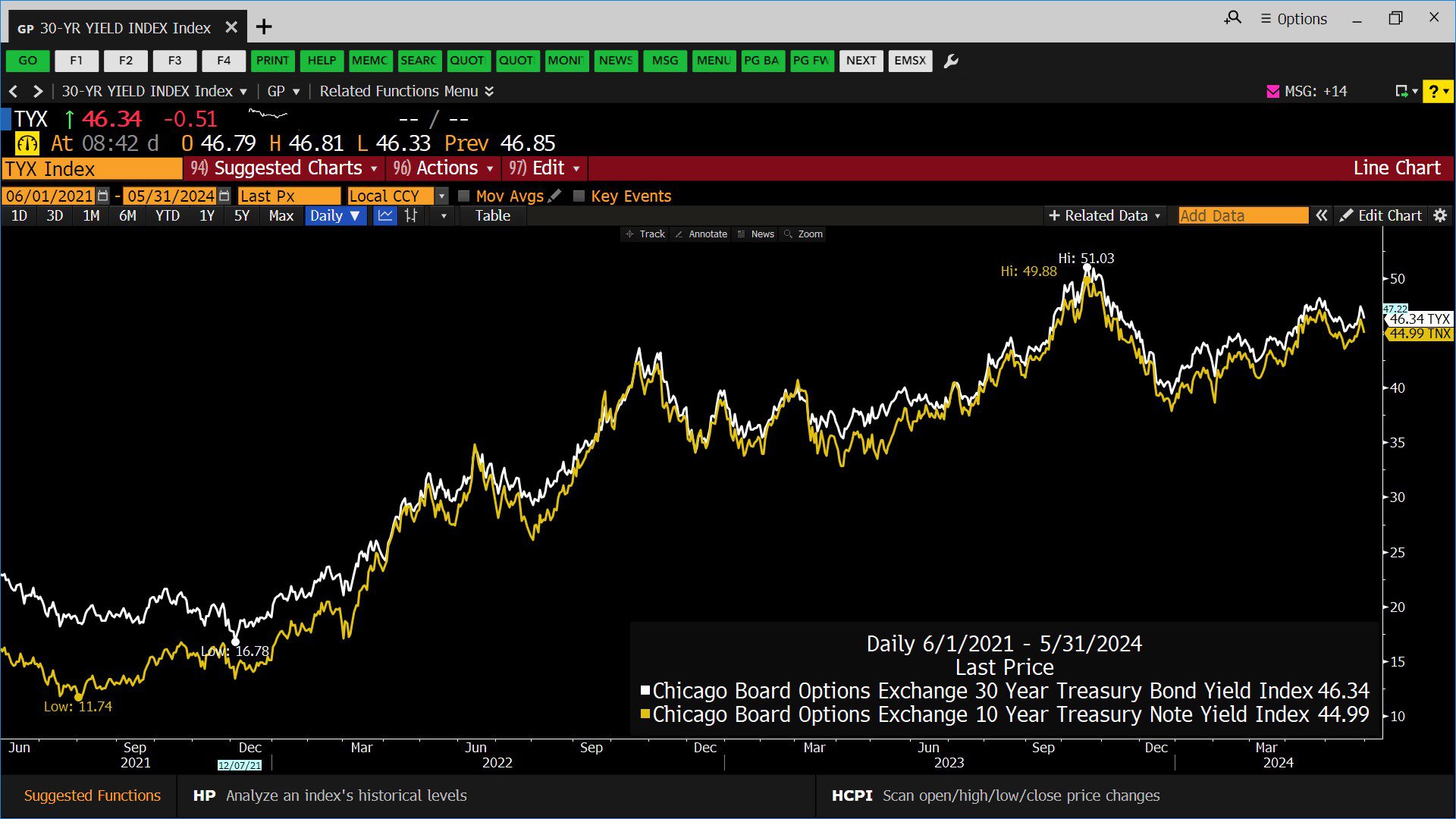

A: Salesforce, Inc. reported as much as 8% revenue gain for the period ending this July, but lowered forward guidance resulting in a near 20% single day drop. Also, CNBC reported that preparation for the core Personal Consumption Expenditures Price Index (PCE) inflation announcement corresponded to additional selling motivation before Friday’s report. Lastly, recent spikes in long U.S. Treasury bonds have created additional pressures that have had a negative effect on the Dow Jones.

Headline Round Up

*Kevin O’Leary, “Mr. Wonderful,” Wants to Buy TikTok with Your Help. Using StartEngine to crowdfund purchase?

*Record Home Prices: North Texas Home Prices Up 3.62% Over the Past Year. Nationwide prices are up 7.38%.

*Kohl’s Smacked By 20% on Surprise Q1 Losses. Also lowered sales forecast for the year.

*Travel Peak? American Airlines Smacked 15% This Week on Lower Revenue Estimates.

*Abercrombie & Fitch, Co. Spikes to All Time High on Better Than Expected Q1 Sales & Updated Growth Estimates.

*$65 Billion Activist Hedge Fund, Elliott, Takes $2.5 Billion Stake in Texas Instruments.

*After 2 Years of Selling, Investors Have Added $172 Billion, So Far This Year, to Stock & Bond Funds.

*HP, Inc. Spikes as Q2 Revenue Beats Analysts Expectation Due to Robust PC Demand.

*Foot Locker Spikes 30% as Retailer’s Turnaround Plan is On Track.

*Birkenstock Stock Soars 15% After Updated Earnings Forecast.

*Former Board member Explains Why OpenAI CEO Sam Altman was Fired?

*Ether Exchange Traded Funds (ETFs) Heading Towards Approval After SEC Rule Change.

*S&P 500 Index Companies Profit Margin’s Heading to 16 Year High!

*Republican’s Debate Extending Tax Cuts Beyond 2025? What are the fiscal impacts of extending these tax cuts?

*The Highest Paid CEO’s of 2023?

Mergers & Acquisitions

*Energy Transfer, LP to Buy Permian Operator WTG Midstream for $3.25 Billion in Cash & Stock.

*ConocoPhillips to Buy Marathon Oil in a $17 Billion All Stock Deal!

Skid Row

*”I’m Broke”? Antonio Brown Filed for Bankruptcy, After Earning Over $80 Million during his NFL Career, From an 18,000 Square Foot, 12 Bedroom Mansion in Fort Lauderdale?

Dow Jones Industrial Average Index (12/29/2023 – 05/31/2024)

– Courtesy of Bloomberg LP

Salesforce, Inc. (06/03/2019 – 05/31/2024)

– Courtesy of Bloomberg LP

C.B.O.E. 30 Year Treasury Bond Yield Index & 10 Year Treasury Note Yield Index (06/01/2021 – 05/31/2024)

– Courtesy of Bloomberg LP

Marathon Oil Corp. (06/03/2019 – 05/31/2024)

– Courtesy of Bloomberg LP

American Airlines Group, Inc. (06/03/2019 – 05/31/2024)

– Courtesy of Bloomberg LP

HP, Inc. (05/30/2024)

– Courtesy of Bloomberg LP

Generic Copper Futures Contract Spot Price (06/03/2014 – 05/31/2024)

– Courtesy of Bloomberg LP

NetWorth Radio’s Texas Global Business Leadership Series: Spencer McGowan Interviews Brad Olsen and Oliver Doolin from Recurrent Advisors in Houston!

Prior to co-founding Recurrent, Brad was most recently the lead MLP portfolio manager for BP Capital Fund Advisors (BPCFA). Under Brad’s leadership, MLP AUM more than doubled (excluding the impact of appreciation).

From 2011 to 2015, Brad led Midstream Research for Tudor, Pickering, Holt & Co. (TPH & Co.), where he was recognized as the top all-around stock picker in the US by the Financial Times in 2013, and the top energy stock picker in the US by Starmine in 2014. Under Olsen’s leadership, the TPH & Co. midstream team was recognized in the WSJ’s “Best on the Street” poll as well as by Institutional Investor Magazine.

Brad also has experience as an investment analyst at Eagle Global Advisors in Houston, where he was part of a 3-person team that grew midstream/MLP AUM from $300mm to over $1bn from 2008 through 2011. He has also worked in investment roles at Millennium International, a large global hedge fund, and Strome Investment Management, an energy-focused hedge fund based in Santa Monica, CA. He began his career in the UBS Investment Banking Global Energy Group in Houston.

Brad earned a BA in Philosophy, Political Science, and Slavic Studies from Rice University in Houston.

Brad resides in Houston with his wife and four children. Brad was nearly fluent in Russian, but is very rusty.

Client Portfolio Manager / Energy Specialist

Oliver has spent over a decade specializing in natural resources, oil & gas, and MLP institutional equity research, most recently at Heikkinen Energy Advisors in Houston.Prior to joining Heikkinen, Oliver served in both research and business development roles at energy-focused investment banks, including 6 years as a Vice President at Tudor, Pickering, Holt & Co (TPH) in Houston, where he specialized in exploration and production (E&P), oilfield services (OFS) and midstream MLP companies.

Oliver began his career as a research analyst covering E&P and Oilfield Service companies for both TPH and Howard Weil, respectively.

Oliver holds a BS with dual concentrations in Finance and Legal Studies (Tulane University) as well as an MS in Accounting from the A.B. Freeman School of Business at Tulane University.

Oliver, originally from south Louisiana, is an avid outdoorsmen and runner. He resides with his wife and two children in Houston.

Profit Report

Earnings Details for Some of The Top CEOs.