Q: How long can the rally in equity prices last?

A: The 1990s rally lasted from 1995 through 1999 beginning with the Federal Reserve lowering interest rates and ending in a final speculative buying frenzy. Investors should remember each Bull & Bear market could unfold differently.

Q: Why did oil prices recently hit the highest levels since October 2023?

A: Oilprice.com cites Iran’s vow to take revenge on Israel over their strike on Iran’s Syrian consulate.

Headline Round Up

*U.S. Manufacturing Activity Expands for First Time Since 2022.

*10 Year U.S. Treasury Yield Spikes to 4.36% Corresponding to the Dow Falling to Near 39,000 Early in the Week.

*Gold Jumps to Near Record $2,300 Per Troy Ounce. What should investors know about prior gold cycles?

*Enterprise Product Partners Expands Permian Basin Natural Gas Operations.

*Diamondback Energy, Inc. in Talks with Oklo, Inc. for Small Modular Nuclear Reactor.

*Tellurian’s Former CEO, Charif Souki, Defaults on $100 Million in Loans & Now Claims Lenders including UBS O’Connor LLC Destroyed the Value of His Ranch/Sold Shares of Tellurian, Inc. at Shockingly Low Prices.

*Oilprice.com Interviews OPEC Secretary General HE Haitham Al Ghais.

*Time to Abandon Idea of Phasing Out Oil and Gas? “Big Oil still appears to oppose green global transitions and could well stand in its way.” says Oilprice.com.

*Odds of June Interest Rate Cut Briefly Dip Below 50%.

*Weakening Refining Margins & Carbon Taxes Endanger 20% of Global Refining Capacity. Europe & China face highest risk due to declining demand and environmental regulations.

*Biden May Lift Ban on New Liquefied Natural Gas Export Projects to Win Republican Approval for Extensive Ukraine Aid Package.

*Bank of America Energy Analysts See Summer Oil Peak at $95 Per Barrel.

*The Stock Market’s Magnificent Seven Now the Fab Four?

*U.S. Office Vacancy Rates at Record High, Near 20%.

*AT&T Data Leak Puts Info from 73 Million Accounts on Dark Web.

*Hybrid Car Sales Grew 5 Times Faster Than Electric Vehicle (EV) Sales in February.

*Trump Media Falls Over 21% Monday on Loss of $58 Million for 2023.

Mergers and Acquisitions!

*SLB to Buy Oilfield Services Rival ChampionX Corp. for $7.8 Billion in All Stock Deal.

Skid Row

*Fisker Slashes Prices of Ocean SUV 39% in March, but Only on Top Tier Trim “Extreme” in Effort to Stave Off Bankruptcy.

*Tesla Reports First Year Over Year Sales Drop Since 2020 as Q1 Sales Dip 8.5%.

*Brooklyn’s Tallest Skyscraper Defaults on $240 Million Loan.

Energy Select Sector SPDR Fund, Invesco QQQ Trust Series 1 & SPDR Standard & Poor’s 500 Exchange Traded Fund Trust (12/29/2023 – 04/04/2024)

– Courtesy of Bloomberg LP

Generic Crude Oil Futures Contract Spot Price (12/29/2023 – 04/04/2024)

– Courtesy of Bloomberg LP

Dow Jones Industrial Average Index (12/29/2023 – 04/04/2024)

– Courtesy of Bloomberg LP

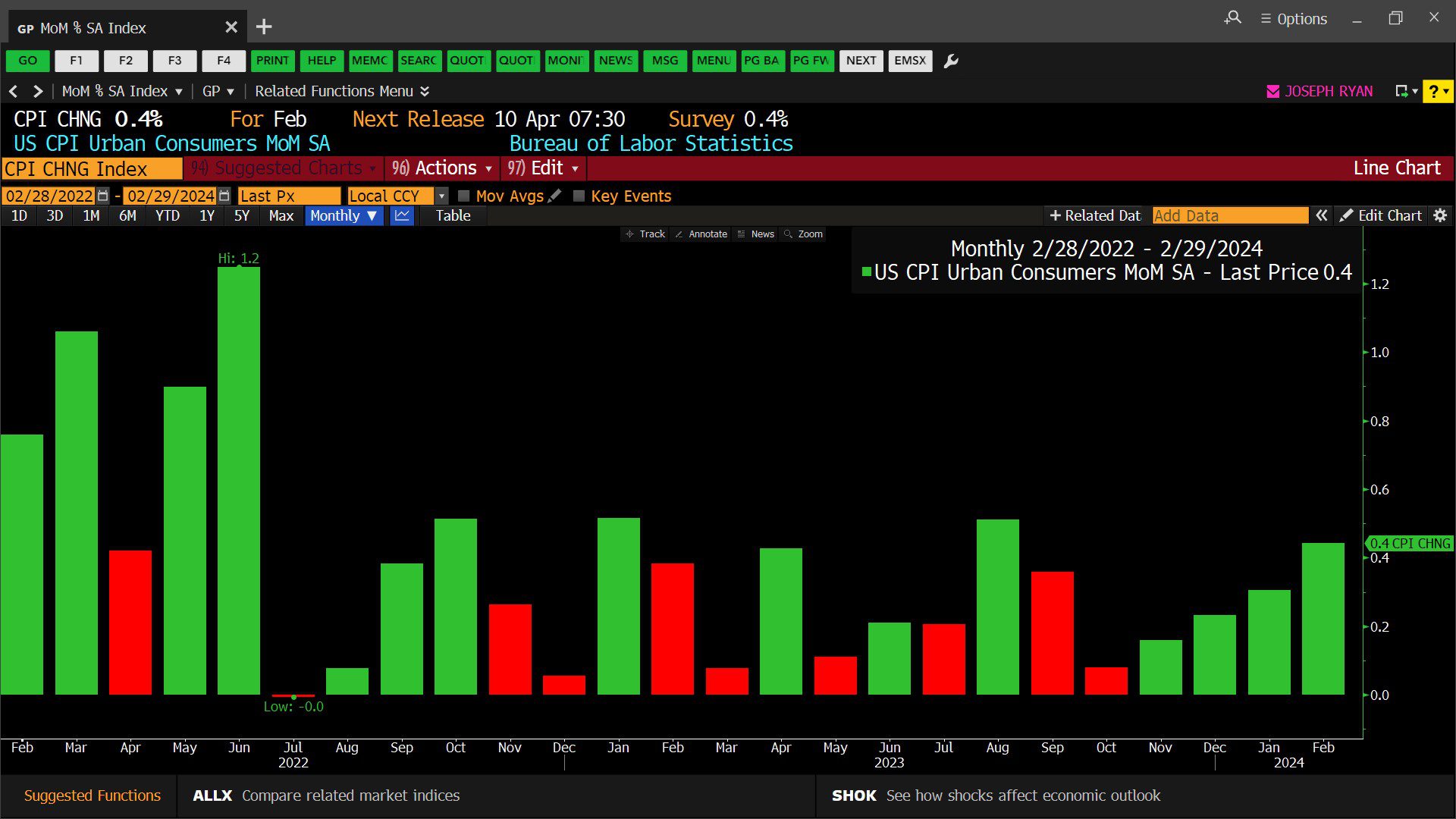

U.S. Consumer Price Index – Urban Consumers Month over Month, Seasonally Adjusted (02/28/2022 – 02/29/2024)

– Courtesy of Bloomberg LP

Trump Media & Technology Group Corp. (12/29/2023 – 04/04/2024)

– Courtesy of Bloomberg LP

Gold Spot Price Per Troy Ounce (04/17/1974 – 04/04/2024)

– Courtesy of Bloomberg LP

Profit Report

1. 2024 Best and Worst Performances in the Financial Markets so far!

2. The McGowanGroup Wealth Management’s (MGWM) solutions toolbox for astute client questions.

McGowanGroup Wealth Management

Q2 2024 Client Update

The 2024 Magic Carpet Ride So Far

The rewards for dedication to great high cash flow assets at bargain prices are coming to fruition in the portfolios. The Q1 equity rally to new highs corresponded to the Federal Reserve updated projections of potentially 3 interest rate cuts during 2024 along with an increase in economic growth projections.

The projected Fed Funds target rate for 2027 has been estimated at 2.6%, but these numbers can change. This figure represents the intention to consistently lower rates for the next 3 years. As the competing discount rate decreases, the net present value of future earnings increases corresponding to increased equity values so far in 2024.

Artificial Intelligence (AI) Supercycle?

Non-farm business sector labor productivity increased 3.2% in the fourth quarter of 2023, according to the U.S. Bureau of Labor Statistics, representing a significant improvement.

Recent productivity gains corresponded to profit gains during the 1990s driven by the Personal Computer (PC) revolution and internet adoption. For evidence that AI advances correspond to efficiency gains, productivity and profit reports should be closely watched.

Know What You Own

Energy Infrastructure

At this writing, the S&P Energy Select Sector Index has pulled ahead of the S&P 500 Index. The rally appears to have broadened from a focus on technology companies to other bargains.

At the end of 2023, Recurrent Advisors estimated that Energy Infrastructure companies are trading at about 6 times cash flow. Of that estimated 16%, 8% roughly represents current dividends and direct share buybacks of about 8%. The resulting increase in assets under control per share would equate to about 40% over a 5-year period in addition to the cash dividends.

Global High Yield

Our four primary high yield managers continue with gains after delivering an impressive 2023. The current yield, equally weighted is above 9%. While that is an impressive cash dividend, the estimated discount to par value under control per share, is over 10%. The resulting appreciation potential during declining interest rates could be quite impressive assuming bonds drift back towards par values.

Blue Chip Additions

The McGowanGroup Asset Management Investment Committee successfully added Nuclear assets, Utility assets, Pharmaceuticals, and AI related technology assets during 2023 dips. Our Next Steps? Financial market rallies provide the opportunity to raise tactical safety for future resilience especially as valuation targets are harvested.

Team Update Highlights

Financial Planning Models: Harrison Smith has evolved our planning process to include financial projection models to test portfolios with cash flows under multiple scenarios. The benefits include advanced decision making and allocation planning.

Tax Season Mastery: Vanessa Avila has already provided your CPA with the tax forms needed to file returns through our secure portal. If you have changed CPAs or have not yet provided us with their contact information, please let us know.