McGowanGroup Wealth Management

Q3 2023 Client Update

Disinflation and Possible Financial Outcomes Through 2026?

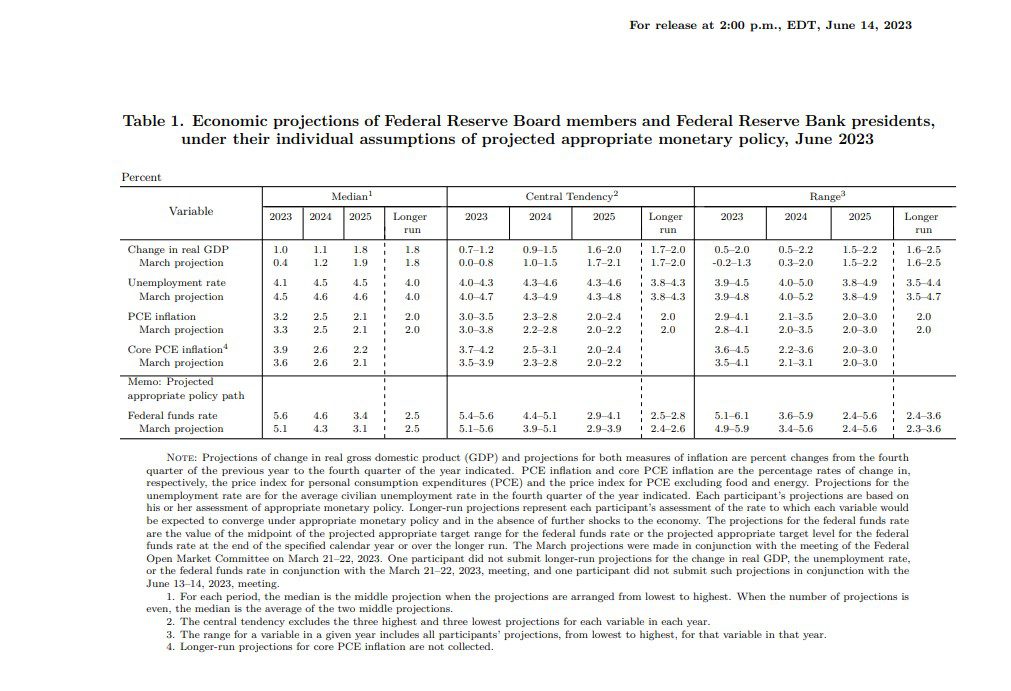

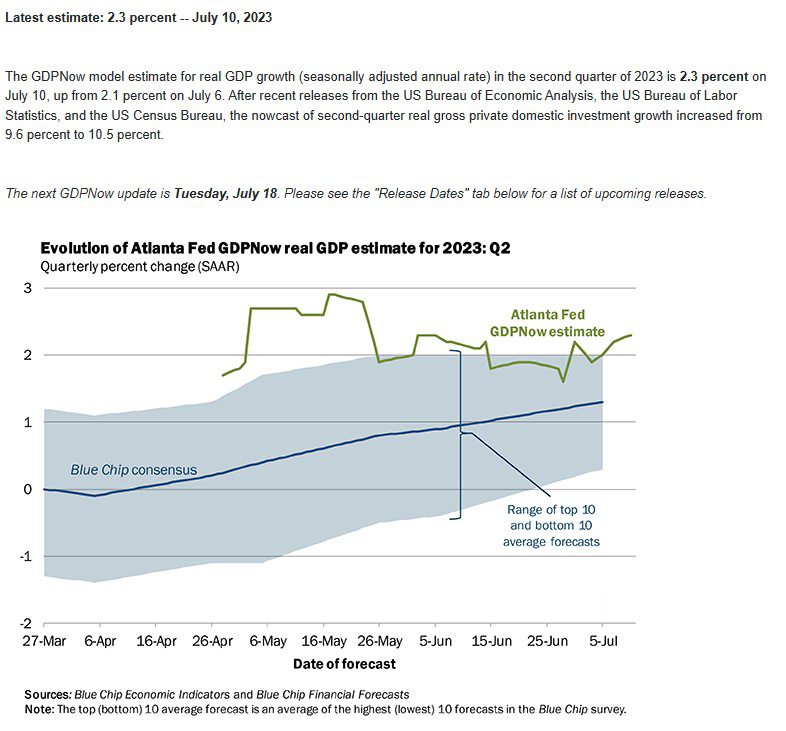

At this writing, Inflation has plummeted from 9.1% annually to 3% according to the Consumer Prince Index (CPI) annual measure. According to the Federal Reserve most recent projections, by 2026 the Federal Funds Rate is likely to be near 2%. So far, Gross Domestic Product (GDP) economic growth has remained healthy, near 2%, despite prevalent headlines of a “Looming Recession.”

A Potential Magic Carpet Ride for High Cash Flow Assets?

In previous Disinflation cycles, after reaching the peak Federal Funds Rate to control inflation, the Federal Reserve begins to return interest rates to normal. Net present value of future cash flows is higher when the competing discount rate is lowered. After 18 months of pressure on investment asset prices, the path to normal cash rates of 2-3% instead of over 5%, is likely to bring higher values for high cash flow assets including:

• Discounted Global High Yield Bond Funds

• Energy Infrastructure Assets

• Dividend Companies

Perspective Reversal of Prior Investor Pessimism?

Cautious optimism appears to have contributed to the legendary successes of Warren Buffet and Sir John Templeton. The negative equity market forecasts in late 2022, including economic contraction, so far have been proven wrong. Investors who enjoyed positive outcomes in the first half of 2023 appear to have shifted into a more optimistic perspective for now.

Q: What are some of the things McGowanGroup Wealth Management (MGWM) got right about the current equity market cycle and what are some of the things we got wrong?

A: Last August, we began reporting dramatic decreases in the monthly inflation numbers being released. Alex Tollen recently pointed out in an earlier program the positive impact on the financial markets as inflation dropped. Lastly, we underestimated the peak of inflation and resulting magnitude.

Q: Who gets McGowanGroup Bozo awards for the first half of 2023 and who gets McGowanGroup Sir John Templeton awards?

A: Forecasters that were overly bearish at the beginning of the year will be presented initial Bozo awards. Jim Paulsen, Chief Investment Strategist at the Leuthold Group, earns a Sir John Templeton award for his 2023 optimism. Finally, Spencer receives a Bozo award for underestimating the magnitude of the Federal Reserve’s Interest Rate increase cycle.

Q: What are Total Return Units?

A: Total Return Units are McGowanGroup managed model portfolios tactically allocated to four investment categories:

• Growth and Innovation

• Growth with Income

• High Cash Flow

• Tactical Safety and Income

U.S. Consumer Price Index Year over Year, Non-Seasonally Adjusted (07/13/2021 – 06/30/2023)

– Courtesy of Bloomberg LP

Evolution of Atlanta Fed GDPNow Real GDP Estimate for 2023 – Q2 (07/10/2023)

– Courtesy of The Atlanta Federal Reserve

Summary of Economic Projections – Economic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents, Under Their Individual Assumptions of projected Appropriate Monetary Policy, pg. 2 (06/14/2023)

– Courtesy of The Federal Reserve Board

Generic Crude Oil Futures Contract Spot Price (12/30/2022 – 07/13/2023)

– Courtesy of Bloomberg LP

Headline Round Up

*Inflation Finally Plummets!

*Oil Shortages Predicted Causing Oil Spikes Over $75 per barrel.

*Heat Wave Spikes Natural Gas Pricing.

*U.S. Crude Production Up 9% on Pace for Record Breaking Year? How does Oil get to the refineries?

*Canada Plans World’s Largest Nuclear Plant.

*Canadian Solar Expands to Mesquite, Texas!

*Warren Buffett Takes Control of Dominion Liquid Natural Gas Export Facility in Maryland. Brookfield Infrastructure Partners Controls Remaining 25%.

*Chinese Intelligence Hacks U.S. Government Agencies Again!

*Meta’s New App Threads to Rival Twitter. Cage Match Game On!

*FTC Loses Preliminary Injunction to Block Microsoft’s Purchase of Activision Blizzard.

*Luxury Manhattan Real Estate Heating Up?

*U.S. Banks Braced for Losses on Bad Real Estate Loans.

*Houston Oilman, Jeffery Hildebrand, Makes Billions from Climate Activist’s Divestments in Oil Wells.

*Online Prices For Goods Falling at Fastest Pace Since 2020 Shutdown.

*Advanced Micro Devices and Others to Challenge Nvidia’s Chip Dominance.

Profit Report

What can the fresh research from AllianceBernstein and PIMCO tell us?

If inflation returns, what are some of the factors likely to cause it? Could they benefit from potential gains?