What company stated that they planned to double profit and cash flow by 2027 even with forecasts of slowing economic growth?

What does slowing growth indicate for the financial markets in 2023?

Does a contraction in overall profits automatically lead to another correction in the equity markets?

Why did Kevin O’Leary, “Mr. Wonderful” apologize this week?

Why is news of a slowdown in the labor market potentially good news for the equity markets?

What are some of the key reports coming up next week for investors?

Headline Round Up

*Exxon Mobil Boldly States They Could Double Cash Flow and Profit by 2027.

*Jamie Dimon Calls Crypto Tokens “Pet Rocks.”

*Kevin O’Leary Lost $15 Million in FTX. What other high profile investors were involved?

*Goldman Sachs CEO, David Solomon, “Blockchain is More Than Crypto.”

*Slowdown! U.S. Manufacturing Orders From China Down 40%.

*Housing Costs Easing. Inflation Could Drop to 2% by 2024.

*Trapped: Investors Flee Commercial Property Funds While Withdrawals Are Being Capped!

*Carvana Collapse Imminent?

*New Mexico’s Oil Production Surpassing Mexico’s Output!

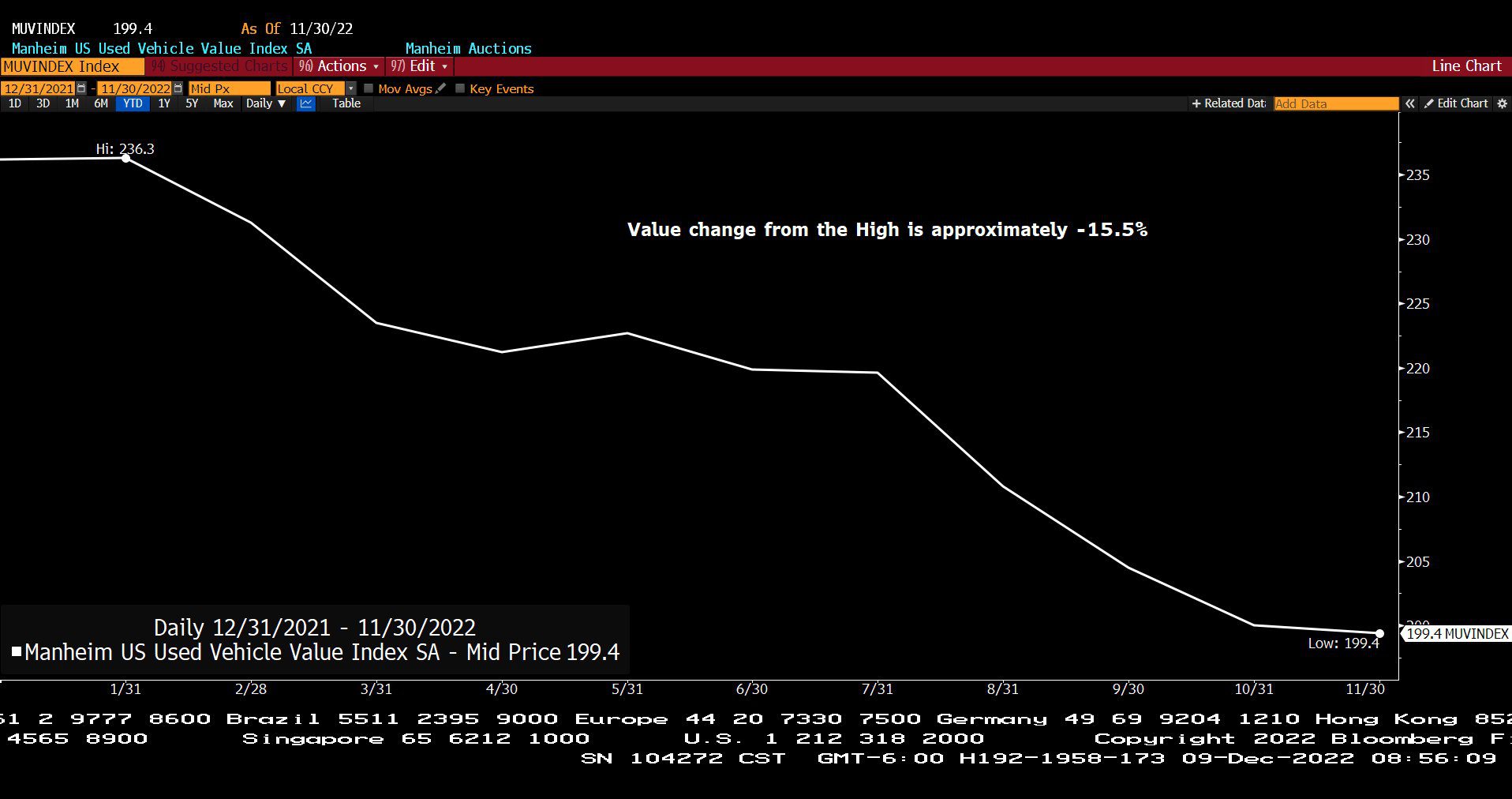

*Deflation! Used Car Prices Extend Free Fall.

*Deflation in Online Pricing.

*SPAC Weeds Pulled. Does Cathie Wood lose again?

*Oil Prices and Energy Stock Prices Diverge. Why? What do current valuations look like?

*Southwest Airlines Reinstates Dividend!

*iBuyer’s Report Massive Housing Losses!

*Consumers Stretched? Campbell Soup Sales Spike 15%.

*Ken Griffin’s Citadel Up 32% This Year. How did he do that in this market?

*Vanguard Quits Major Investment-Industry Initiative on Climate Change Citing Need for Independence.

Profit Report

Logistics of consolidation with The McGowanGroup!

Standard & Poor’s 500 Index (12/31/2021 – 12/09/2022)

– Courtesy of Bloomberg LP

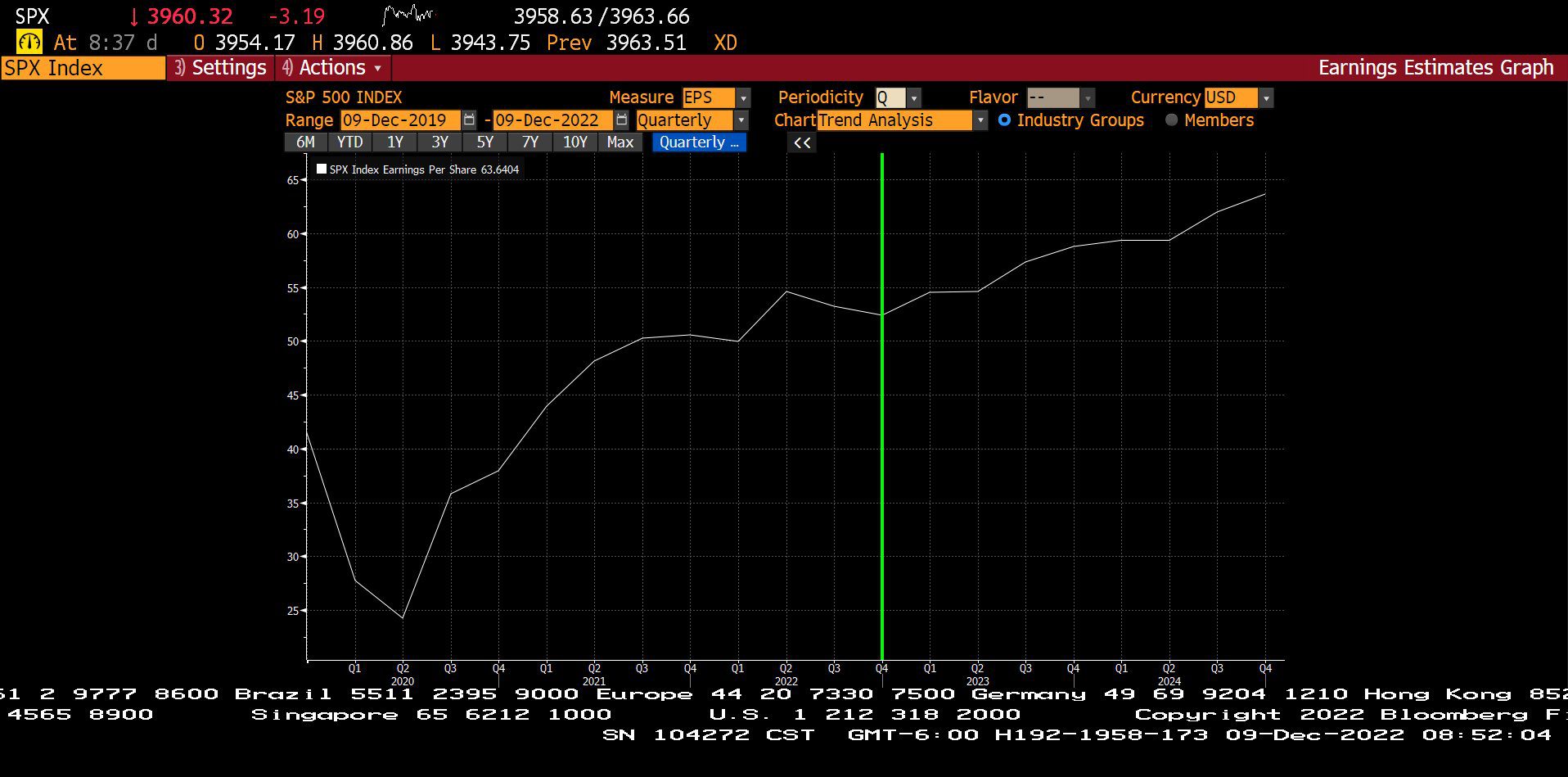

Standard & Poor’s 500 Index – Quarterly Earning Estimates (12/09/2019 – 12/09/2022)

– Courtesy of Bloomberg LP

Global X MLP ETF (12/31/2021 – 12/09/2022)

– Courtesy of Bloomberg LP

Manheim U.S. Used Vehicle Value Index, Seasonally Adjusted (12/31/2021 – 11/30/2022)

– Courtesy of Bloomberg LP

Carvana Co. (12/31/2021 – 12/09/2022)

– Courtesy of Bloomberg LP