Why did oil prices spike this week?

What is the actual current inflation rate for the U.S.?

Why did the DealBook Summit still allow FTX CEO Sam Bankman-Fried to speak after $8 Billion in crypto deposits disappeared?

What areas of the equity markets have the potential to double next year?

Where did investor’s resiliency come from this year regarding the financial markets?

How is the U.S. economy doing right now?

What could happen to overall corporate profits in 2023?

What are 3 key updates investors should consider for a Financial Plan in 2023?

Headline Round Up

*Federal Reserve to Moderate Interest Rate Increases.

*Extreme Yield Curve Inversion 4.7% 1 Year, 3.6% 10 Year.

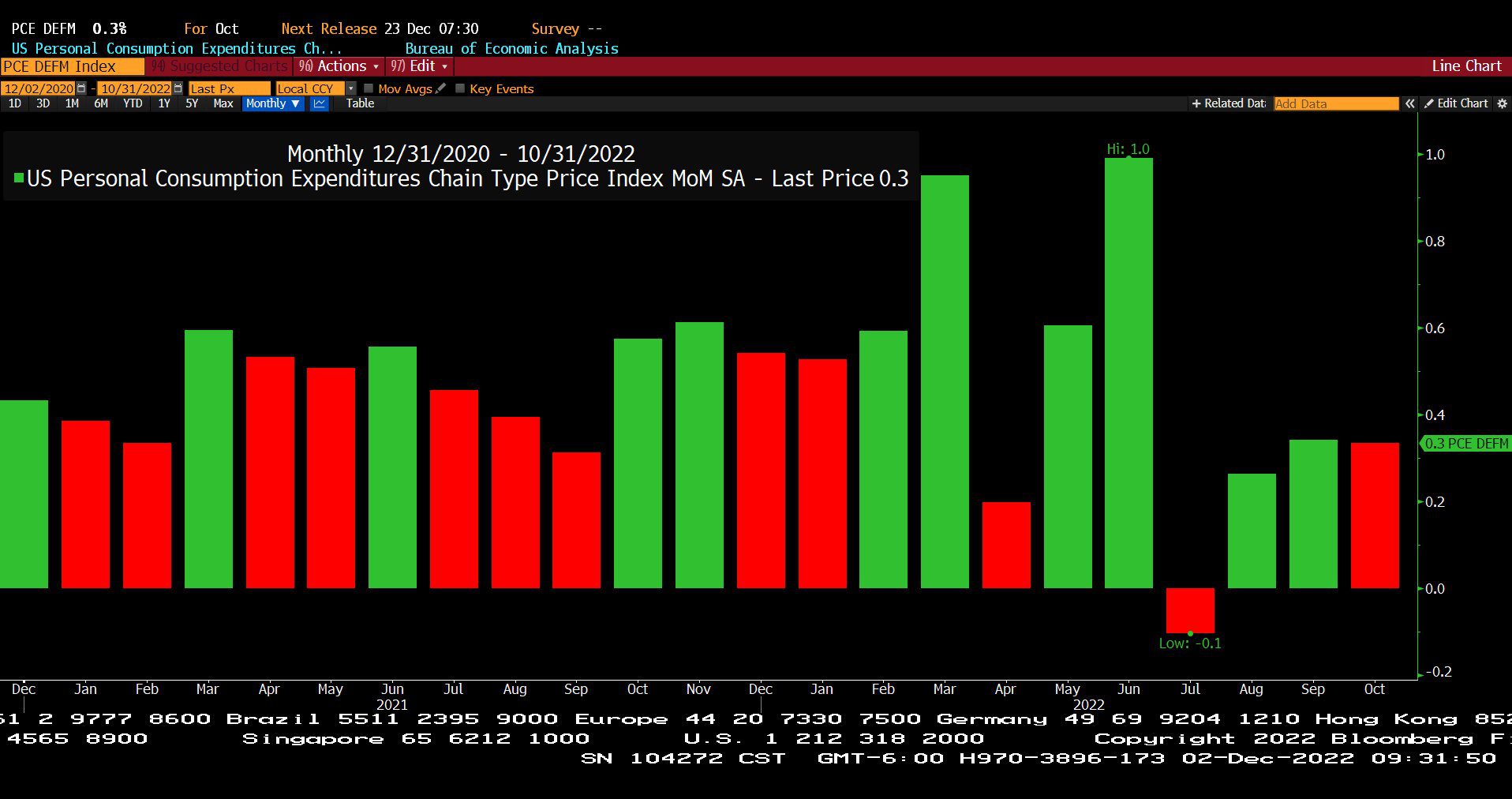

*October Personal Consumption Expenditures (PCE) Inflation Under 4%, Core 2.5%.

*Manufacturing Contracts First Time Since 2020 Says Latest Survey From The Institute for Supply Management.

*ADP National Employment Report: Job Growth Slows! Job Openings Also Down?

*Crypto-Exchange BlockFi Bankrupt. Cites FTX exposure!

*North Texas Home Values Drop Over 2% in September, Down 3 Months in a Row With More Price Drops Likely.

*Investor Home Buying Down 30% in the 3rd Quarter.

*Biden Administration Cautiously Embracing Nuclear.

*India Moves Forward On Small Modular Nuclear Reactors With 300 Megawatt Capacity.

*Why is Norway Nationalizing Farmland?

*Enterprise Products Partners’ Sea Port Oil Terminal Gets Green Light on Gulf!

*American Energy Alliance President Tom Pyle Cites 125 Specific Actions by Biden Administration and Democratic Congress that Impedes Energy Production.

*Chevron Given Green Light On Limited Energy Production in Venezuela?

*$70 Floor Under Oil? Biden Administration to Replenish Strategic Petroleum Reserve between $67 and $72?

*$375,000 Ferrari Purosangue SUV Sells Out for 2 Years!

*”It Ain’t Easy Being Green” Solar Panel Shortage in U.S. As New Laws Target Labor Abuses in China.

*Tesla’s Lithium Supply in Danger As Musk Rejects Multiple Proposals & Increased Competition?

*U.S. Liquified Natural Gas (LNG) Exports Rebound to Highest Levels Since June.

Profit Report

Alex, what surprised investors the most in 2022?

• Tech?

• Crypto?

• Federal Reserve?

U.S. Personal Consumption Expenditures Chain Type Price Index, Month over Month, Seasonally Adjusted (12/31/2020 – 10/31/2022)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index, West Texas Intermediate Crude Futures Contract Spot Price and Bitcoin Currency Spot Price (12/31/2021 – 12/02/2022)

– Courtesy of Bloomberg LP

Bristol-Myers Squibb Co., AbbVie, Inc., Unum Group and Merck & Co., Inc. (12/31/2021 – 12/02/2022)

– Courtesy of Bloomberg LP

Global X MLP ETF (12/31/2021 – 12/02/2022)

– Courtesy of Bloomberg LP

Natural Gas Futures Contract Spot Price (12/08/1997 – 12/02/2022)

– Courtesy of Bloomberg LP

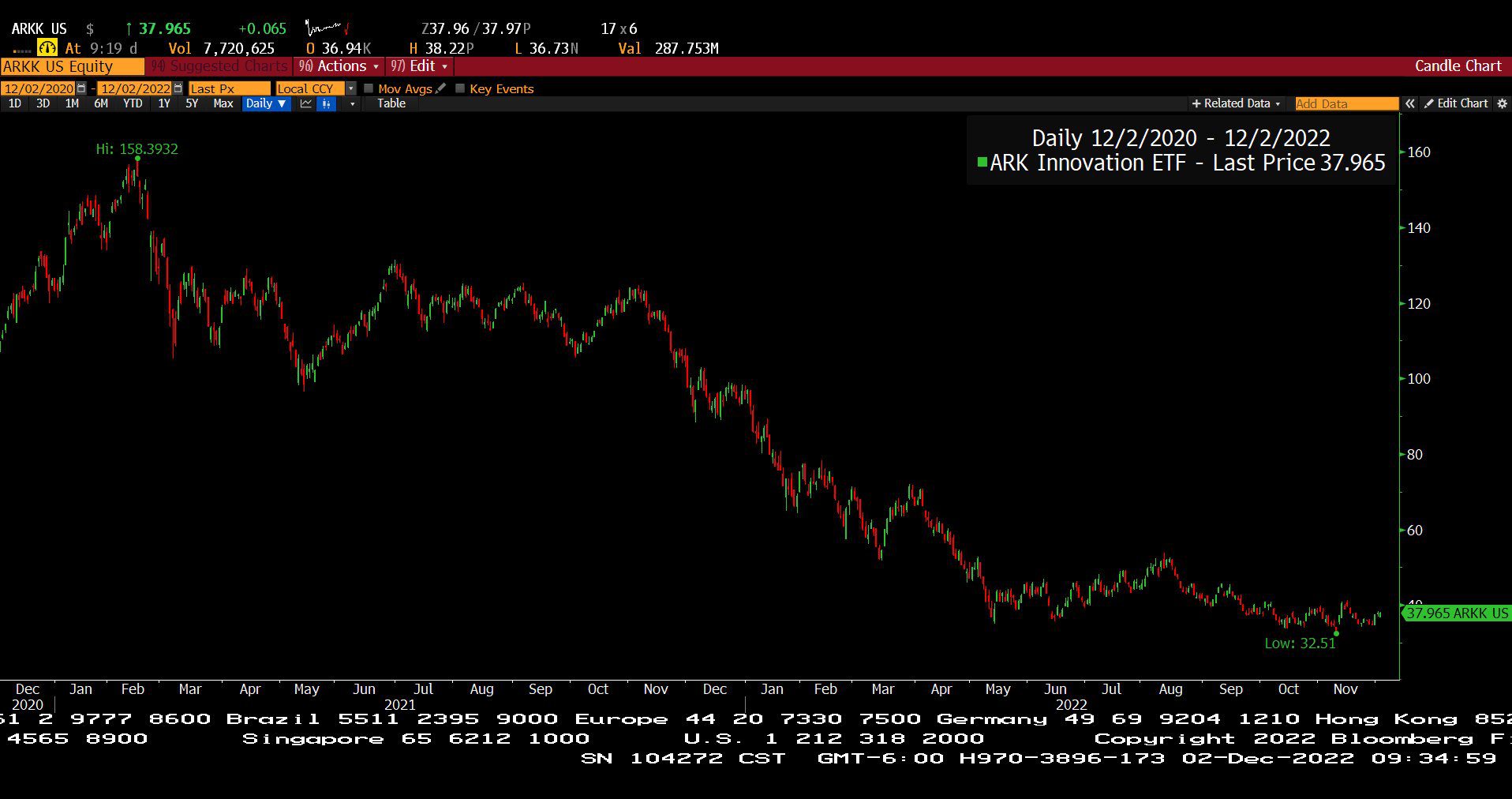

ARK Innovation ETF (12/02/2020 – 12/02/2022)

– Courtesy of Bloomberg LP