Has Inflation already disappeared?

What is happening now in the housing market?

What potentially caused the equity markets to make new lows for 2022 this week?

How has the McGowanGroup prevailed after prior Bear Market cycles?

When are the scheduled announcements for October?

• Jobs?

• Inflation?

• Earnings?

• Economy?

How does this Bear Market compare with prior Bear Market cycles?

What are some of the sources of current selling activity in the financial markets?

What areas of the equity markets could provide the strongest investment bargains now?

Headline Round Up

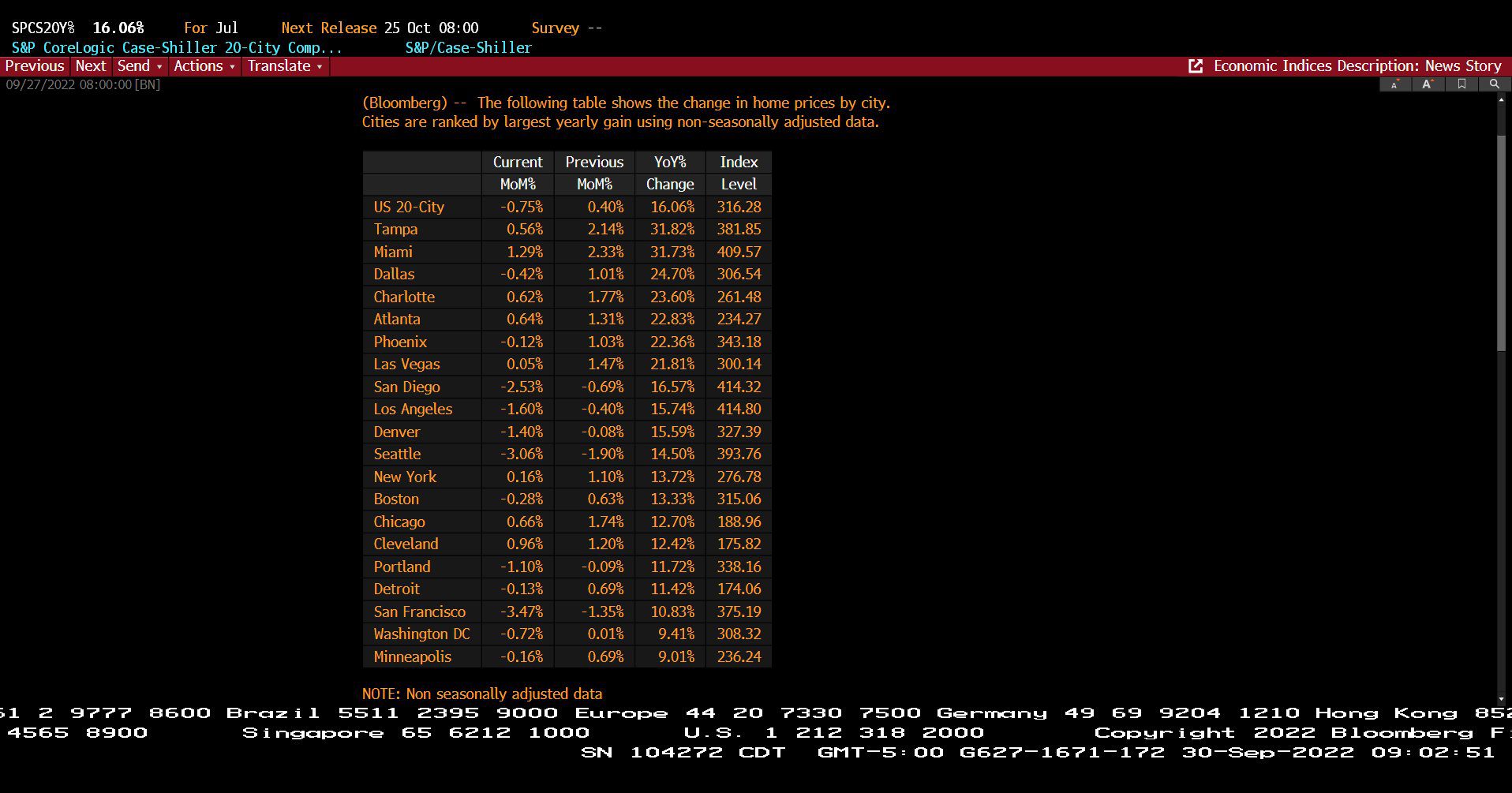

*Deflation! Home Prices Fall For First Time Since 2012.

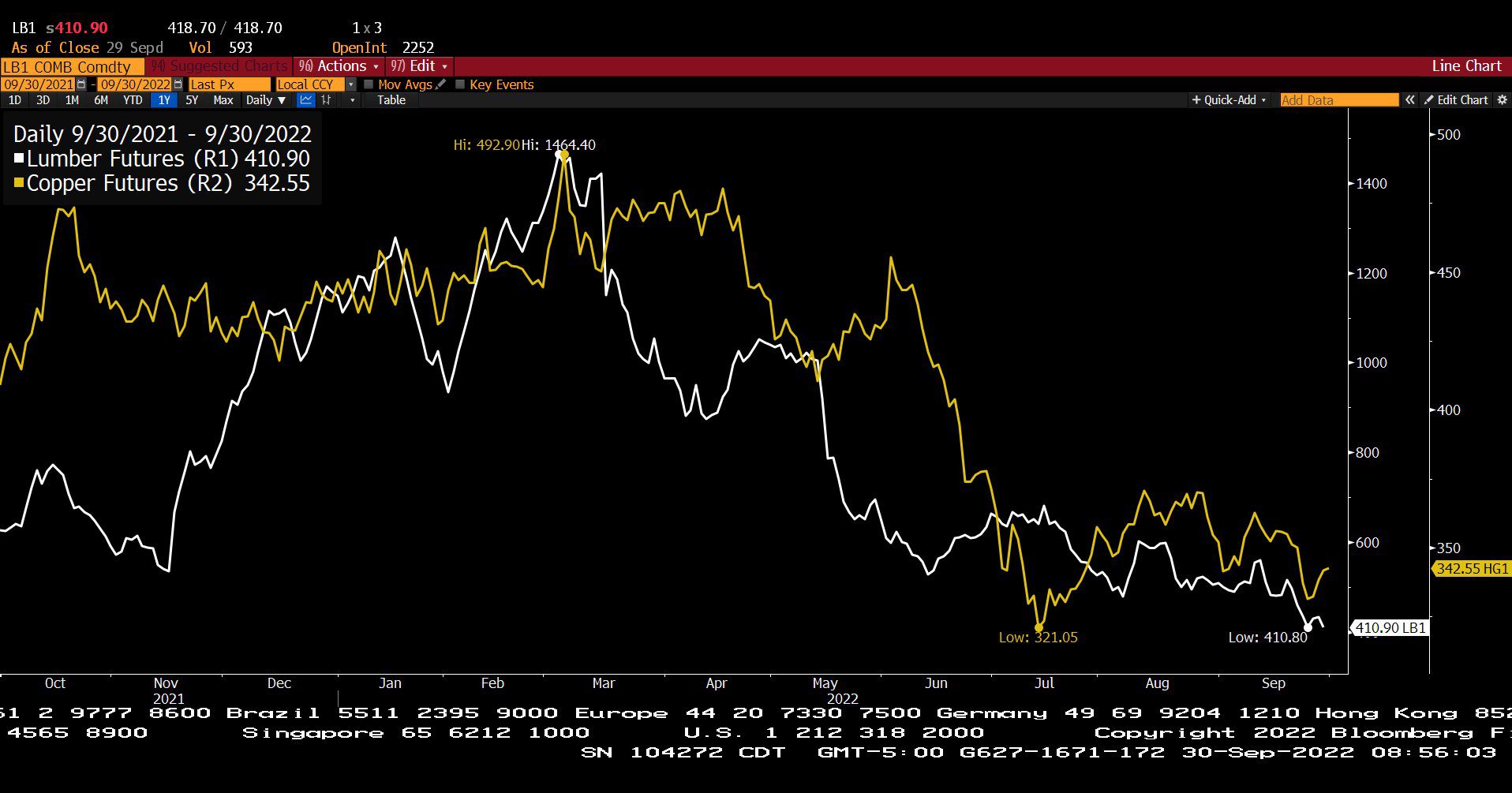

*Deflation! Commodities Tumble.

*Deflation! Lumber Prices Back to Below Pre Covid Levels.

*Bank of England Reverses Course to Restore Liquidity Driving Rates Down.

*Ten Year U.S. Treasury Hits 4%. 30 Year Mortgages Top 6.5%, Highest Since 2008?

* Jeffrey Gundlach, Chief Investment Officer at DoubleLine Capital, Starts Buying!

*Wharton Professor Jeremy Siegel Says Federal Reserve Chairman Jerome Powell Making a Huge Mistake!

*Pensions Brace for Private Equity Losses! The real story on alternative investments?

*Gasoline Prices Returning to $5 Per Gallon?

*The Coming Oil Supply Shock?

*Biogen Spikes 54% on Pre Market on Alzheimer Success.

*Is Ferrari Recession Proof?

*Hometown Deli $100 Million Fraud!

*Amazon and Berkshire Hathaway Hit With 15% Corporate Minimum Tax! Tax meant to target companies earning more than $1 billion per year.

*Belgium Shuts Nuclear Power Supply in Time for Winter? “It’s not easy being green”?

*Chevron Predicts Higher Natural Gas Prices This Winter.

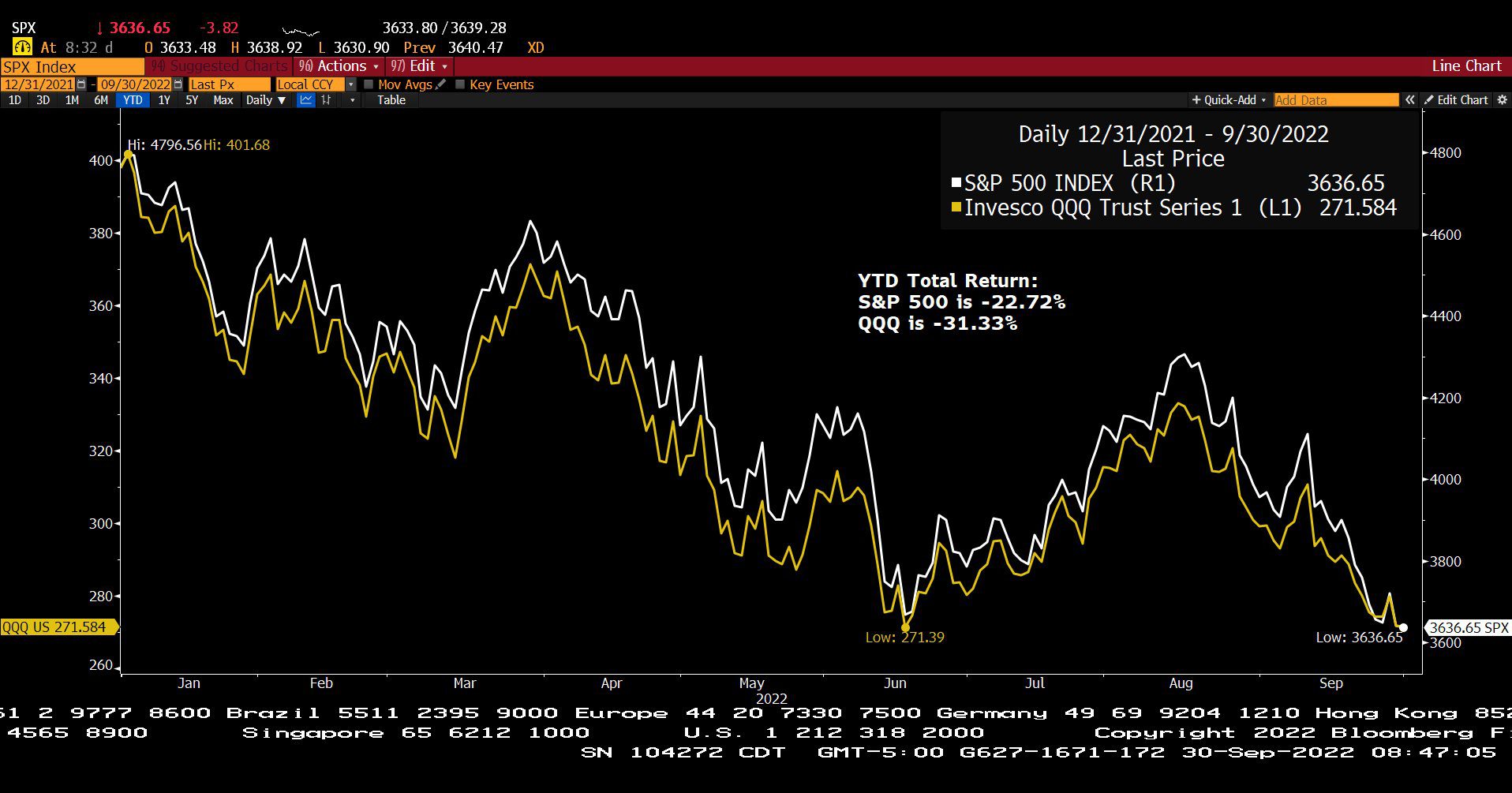

Standard & Poor’s 500 Index & Invesco QQQ (12/31/2021 – 09/30/2022)

– Courtesy of Bloomberg LP

Unum Group, AbbVie, Inc, Merck & Co., Inc & Bristol-Myers Squibb Co. (12/31/2021 – 09/30/2022)

– Courtesy of Bloomberg LP

Energy Select Sector SPDR Fund (12/31/2022 – 09/30/2022)

– Courtesy of Bloomberg LP

C.B.O.E. 10 Year Treasury Note Yield Index (12/31/2021 – 09/30/2022)

– Courtesy of Bloomberg LP

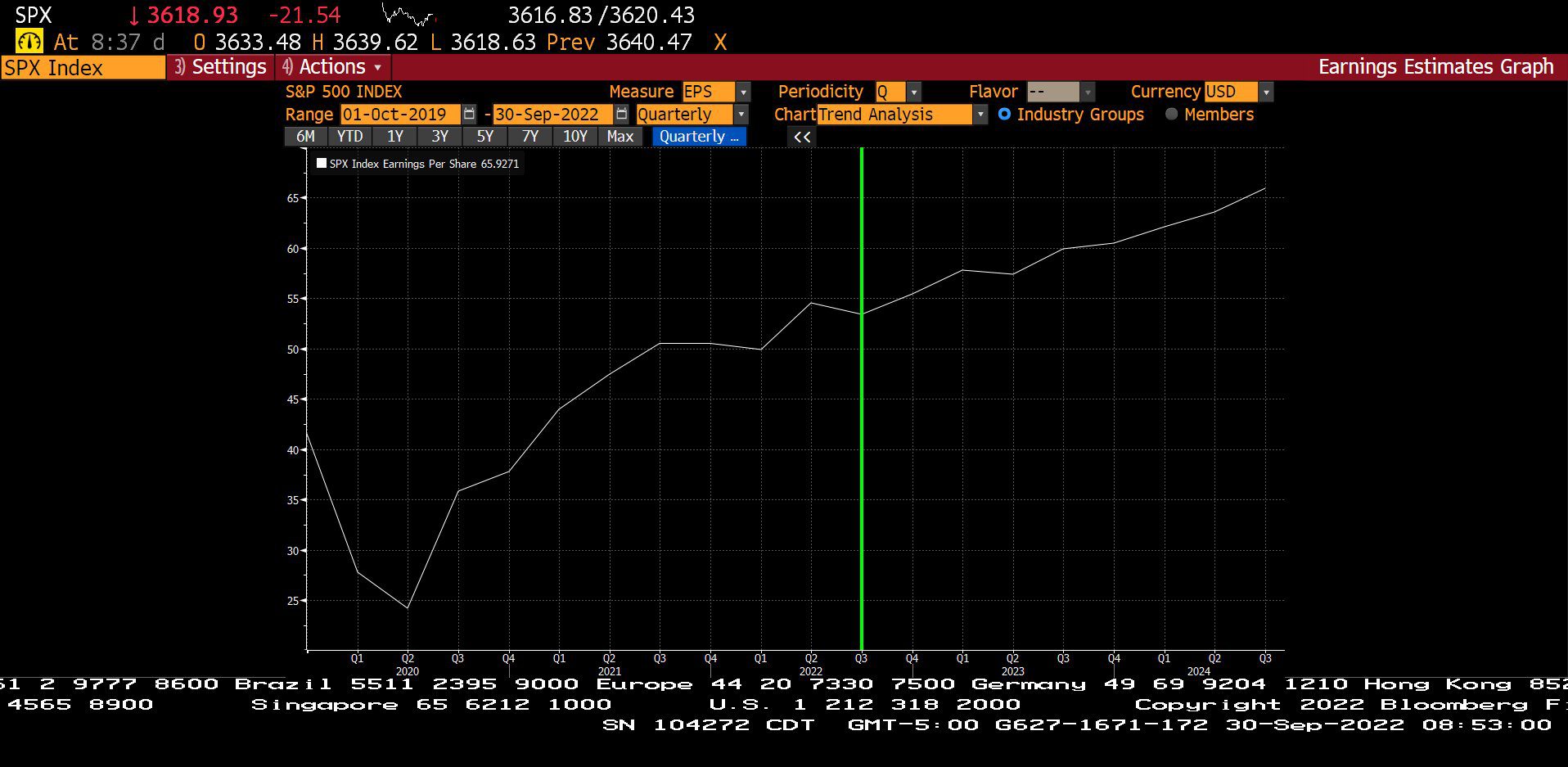

Standard & Poor’s 500 Index – Quarterly Earnings Estimates (10/01/2019 – 09/30/2022)

– Courtesy of Bloomberg LP

Standard & Poor’s CoreLogic Case-Shiller 20 City Composite – Change in Home Prices By City, Non-Seasonally Adjusted (09/27/2022)

– Courtesy of Bloomberg LP

Generic Lumber & Copper Futures Contract Spot Prices (09/30/2021 – 09/30/2022)

– Courtesy of Bloomberg LP

Generic Wheat, Cotton and Corn Futures Contracts Spot Prices (09/30/2021 – 09/30/2022)

– Courtesy of Bloomberg LP

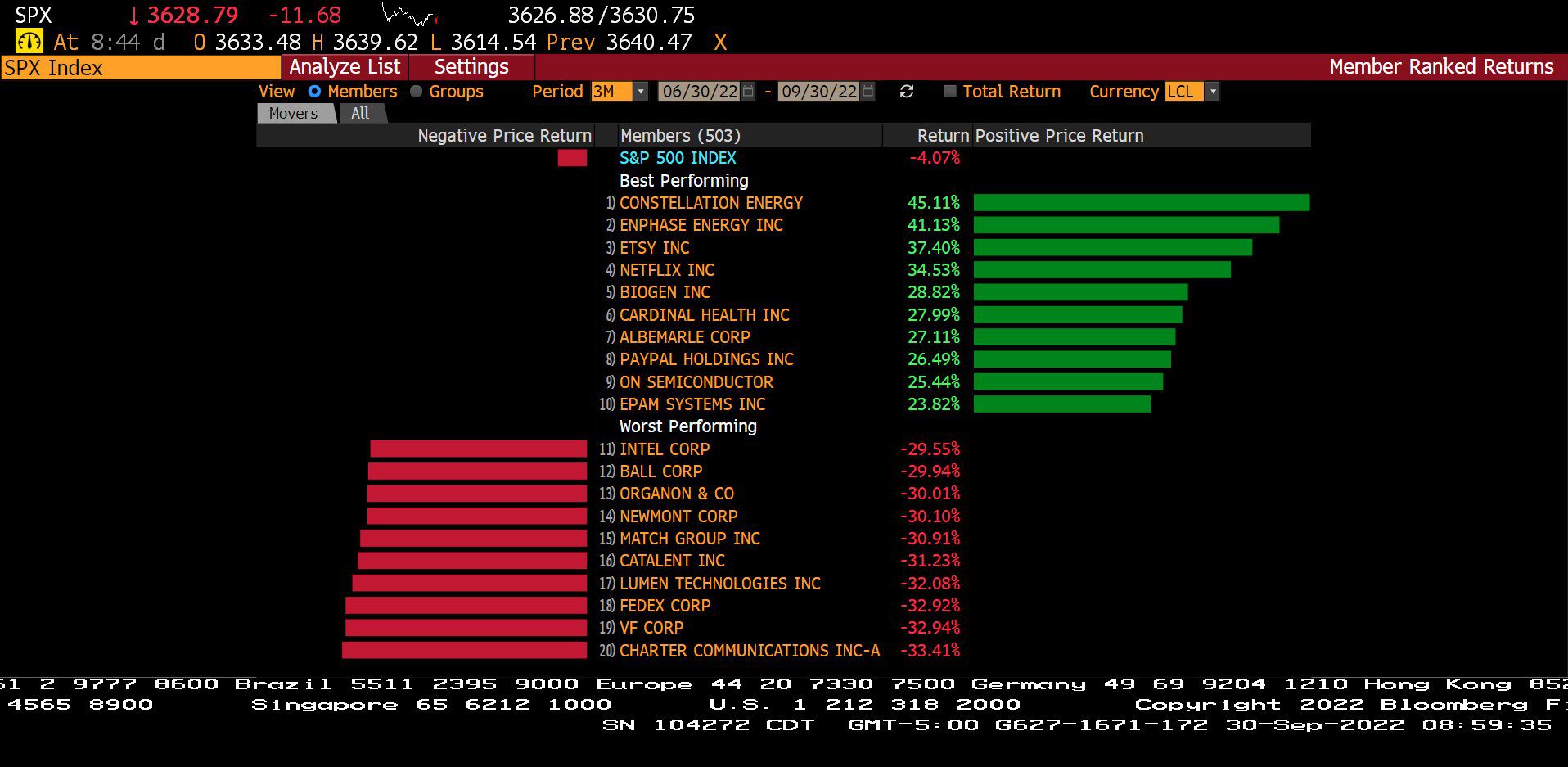

Standard & Poor’s 500 Index – Member Ranked Returns (06/30/2022 – 09/30/2022)

– Courtesy of Bloomberg LP

Profit Report

What Are Some of the Best Client Questions We Received This Week?

What is a “Dynasty 529”?

PappaDean’s Notes

2022 Bear Market

1. The Average Bear Market Length since 1928 has been 289 Days.

2. The current length of the 2022 Bear Market as of Saturday Oct. 1, 2022?

• 280 DAYS – PER S&P 500

• 322 Days – PER NASDAQ

3. Historically, 34% of the Stock Market’s best days occur in the next 60 days after declines.

4. Investors should be in the equity markets during the first 60 days AFTER major market declines.

5. Most Investor’s portfolios are currently down 25% – 30% depending on the Stock Index.

6. Are you going to potentially miss out on a third of the best UP days in the financial markets on the rebound?