“Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.” – Sir John Templeton

Just how high is Inflation in the U.S.?

How did investors profit during 1978 -1982?

Who potentially benefits from inflation?

What types of investment allocations succeeded in the rangebound stock market of the 1970’s?

What types of investment allocations appear to have reached “bargain” status?

How can your investment portfolio possibly benefit in 2023 capitalizing on the current state of rampant pessimism?

What did this week’s earnings reports tell us?

What areas of the financial markets are making money so far during the Bear Market of 2022?

What events could signal the end of this bear market?

Why would smart, affluent investors and their families choose McGowanGroup Wealth Management (MGWM)?

Headline Round Up

*Big Inflation in June! Core Inflation Down?

*Federal Reserve Bank of Atlanta Says Recession! What happens next according to projections?

*Earnings Announcements So Far? How did companies really do in for Q2 2022?

*Dividend Payouts Hit Record Levels.

*King Dollar: Euro Near Parity!

*Delta Airlines Near Record Profits and Revenue.

*Heathrow Declares Passenger Limit of 100K Per Day with Travel Approaching a New Record.

*Pepsi Pricing Power: Profits up 8%.

*Bill Ackman Pulls Weed SPAC.

*Microchip Shortage Appears to Be Coming to an End.

*Canoo, Inc. Saved by Huge Walmart Order! Stock Doubled.

*Snoop Dogg Announces, “Sleepy Joe OG” Premium Cannabis!

*Could Twitter Go to $15?

*U.S. Bank Profits Tumble On Bad Loan Reserves.

*Overregulation: Ships Get Older and Slower.

*Home Buyers Disappear!

*Higher Oil Prices for Years?

*Worst of Global Energy Crisis is AHEAD?

*ERCOT Tells Texas Consumers to Conserve Electricity. Where is the Natural Gas?

*U.K. Racing to Go Nuclear.

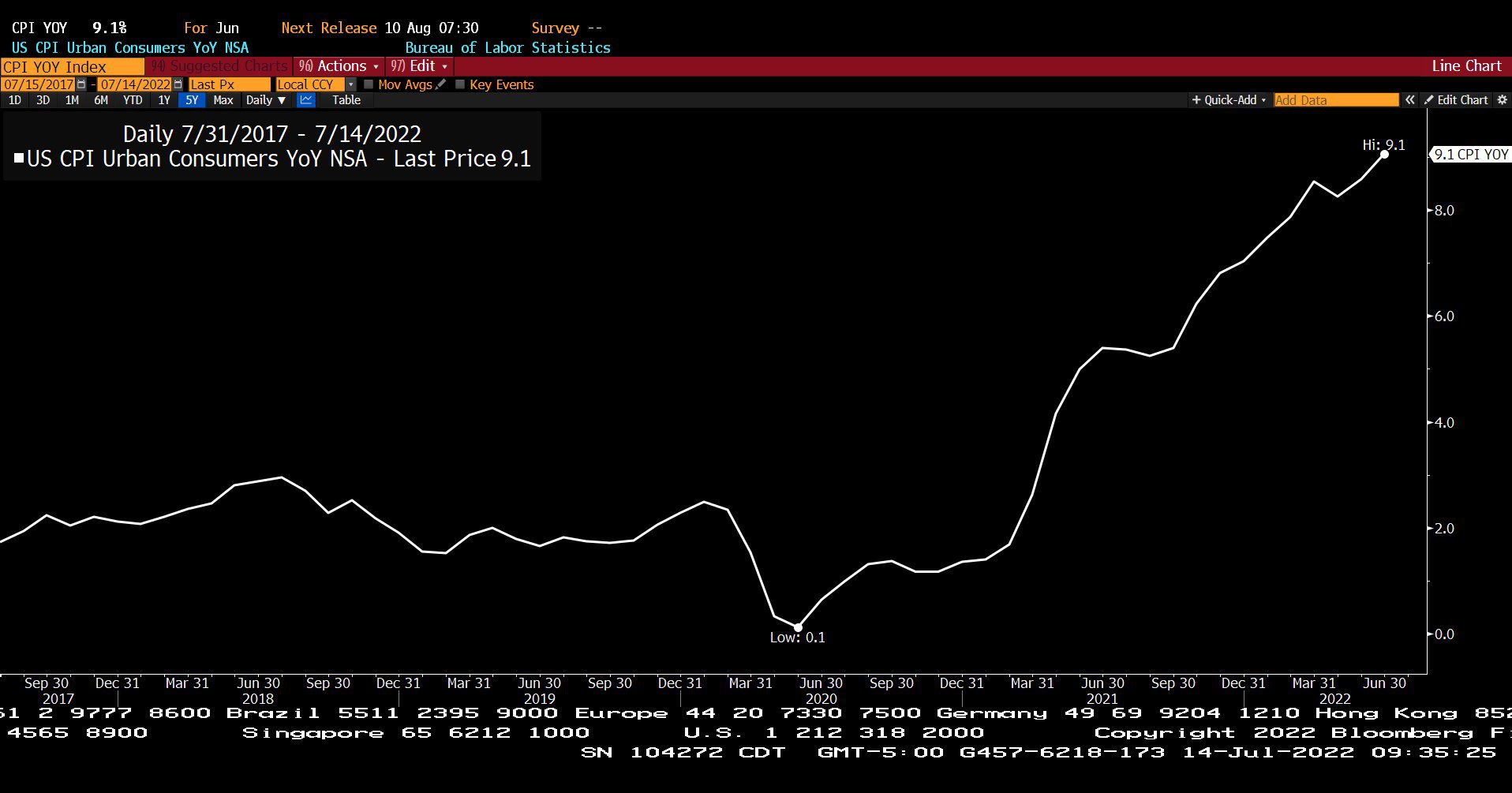

U.S. Consumer Price Index – Urban Consumers Year over Year, Non-Seasonally Adjusted (07/31/2017 – 07/14/2022)

– Courtesy of Bloomberg LP

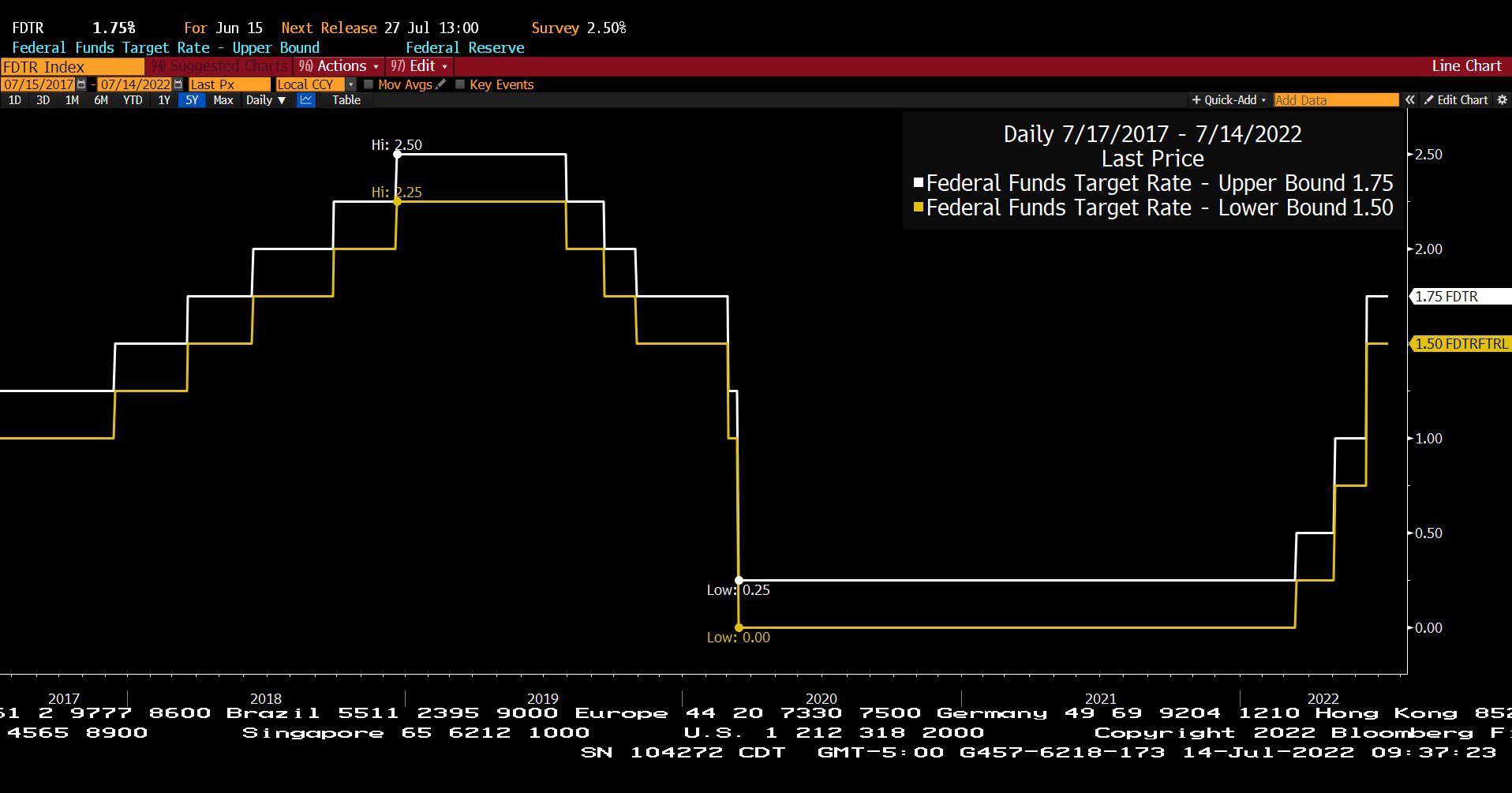

Federal Funds Target Rate Index (07/17/2017 – 07/14/2022)

– Courtesy of Bloomberg LP

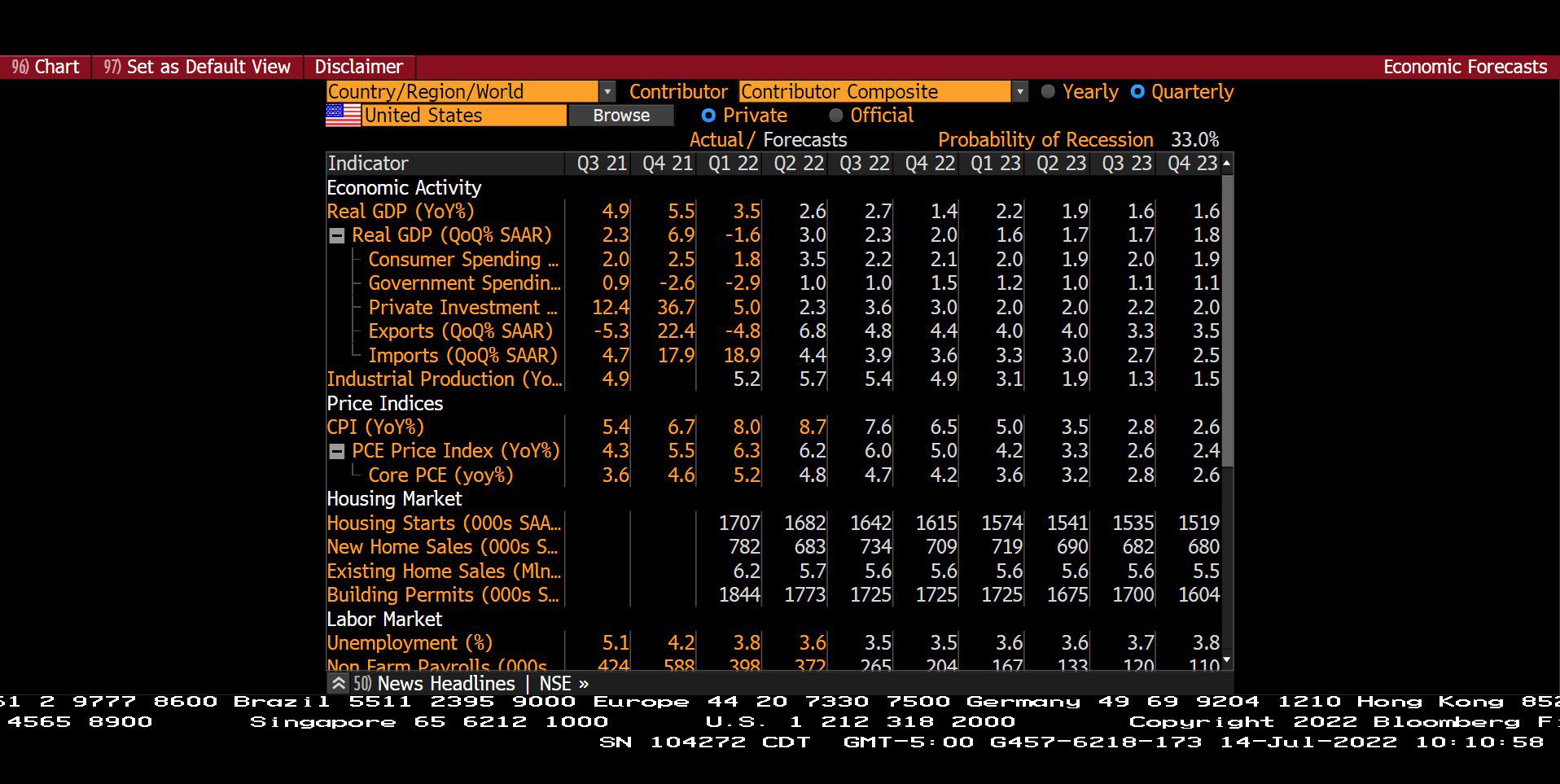

Quarterly U.S. Economic Forecast with Probability of Recession (Q3 2021 – Q4 2023)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index and U.S. Consumer Price Index – Urban Consumers Year over Year, Non-Seasonally Adjusted (12/30/1977 – 12/31/1982)

– Courtesy of Bloomberg LP

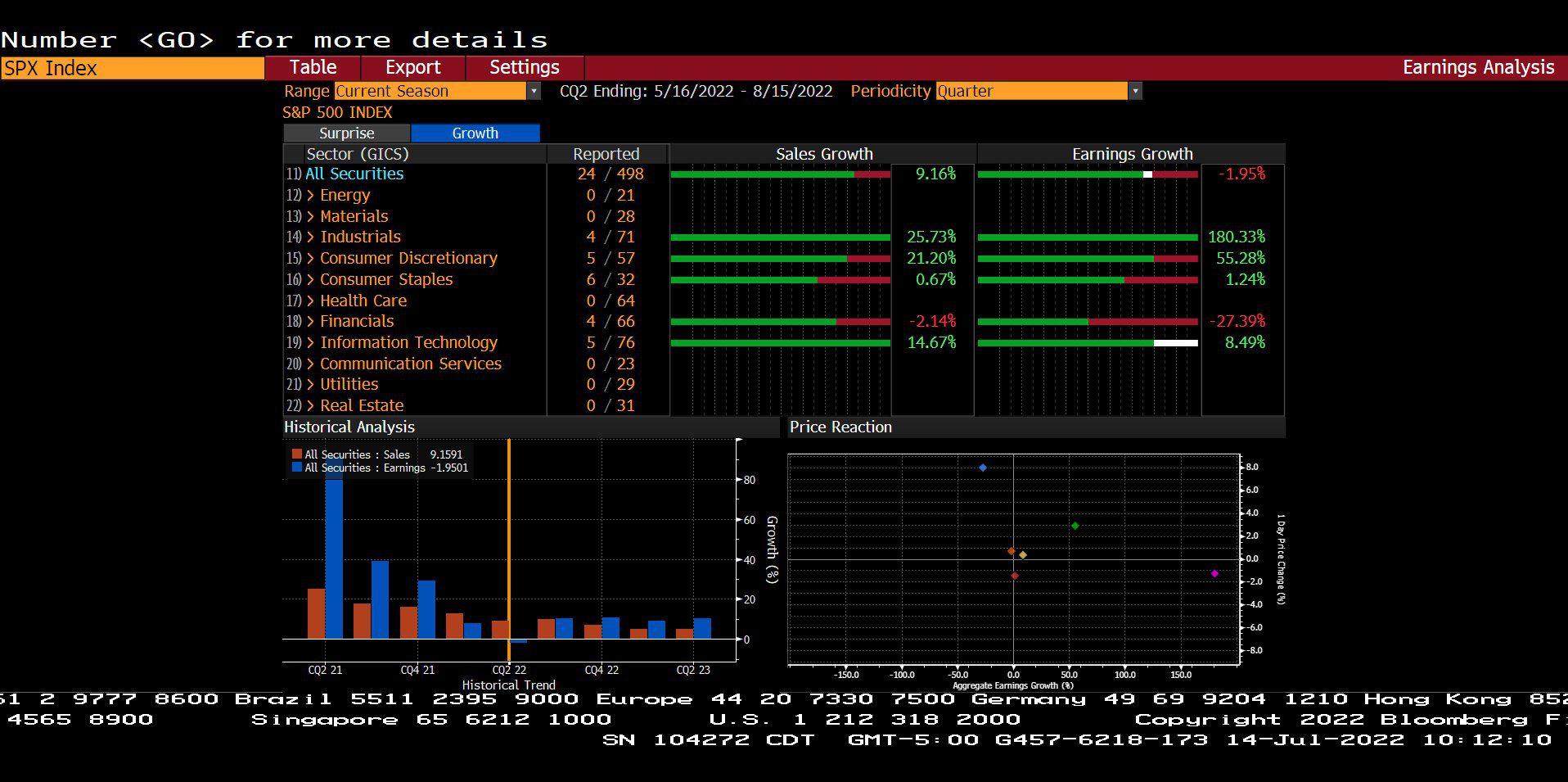

Standard & Poor’s 500 Index – Quarterly Earnings Analysis By Sector (05/16/2022 – 08/15/2022)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index (12/31/2021 – 07/14/2022)

– Courtesy of Bloomberg LP

Generic West Texas Intermediate Crude Futures Contract Spot Price (12/31/2021 – 07/14/2022)

– Courtesy of Bloomberg LP

Profit Report

Client anecdotes of the week: How could your investment portfolio give you a pay raise?