What are some the financial market impacts of the tragic siege in Ukraine?

What do we know so far about sanctions and future implications for the Global Economy?

What has happened to the equity markets in Russia so far?

What is the impact on the energy crisis?

How have the commodity markets reacted so far?

What is really going on inside Ukraine?

How can we help the Ukrainian people?

How should Investment Portfolios be updated?

Headline Round Up

*Russia Decimates Ukraine But Fails to Seize Control of Ukraine. Putin’s latest speech admits initial casualties but claims it is according to his plan?

*The Free World Unites with Ukraine Against Russia! Sanctions from the European Union, U.S., and even Switzerland?

*Finland Drifts Toward NATO Membership?

*Russian Capital Markets Collapse.

*Multiple Rumors of Martial Law Declaration Inside Russia.

*Commodities Skyrocket! Oil, Natural Gas, Wheat, Aluminum and Lithium.

Profit Report

Portfolio Strategy Updates!

NetWorth Radio’s Powerful Texas Global Leadership Series: Spencer McGowan Interviews Oksana and Adam Bartkoski!

Amazing North Texas mobilization to provide direct humanitarian aid for Ukraine kicked into high gear! Oksana and Adam Bartkoski, a Ukrainian and Polish couple, detail their amazing devotion and provide resources below to contribute to the effort!

UKRAINIAN CULTURAL CLUB OF DALLAS

Other areas for donations the Bartoskis have found to be very helpful include:

Humanitarian efforts in Ukraine:

Razom for Ukraine

Ukrainian American Coordinating Council (Option to use donation for helmets/armory vests)

Direct support to Ukrainian military:

National Bank of Ukraine – (switch to English translation; also includes direct wire instructions)

Dow Jones Industrial Average Index (12/31/2021 – 03/04/2022)

– Courtesy of Bloomberg LP

VanEck Russia ETF (03/04/2021 – 03/04/2022)

– Courtesy of Bloomberg LP

Generic Crude Oil Futures Contract Spot Price (03/04/2021 – 03/04/2022)

– Courtesy of Bloomberg LP

Global X MLP ETF (03/04/2021 – 03/04/2022)

– Courtesy of Bloomberg LP

Generic Wheat Futures Contract Spot Price (03/04/2021 – 03/04/2022)

– Courtesy of Bloomberg LP

C.B.O.E. Short Term Interest Rate Index (03/04/2021 – 03/04/2022)

– Courtesy of Bloomberg LP

C.B.O.E. 10 Year Treasury Note Yield Index (03/04/2021 – 03/04/2022)

– Courtesy of Bloomberg LP

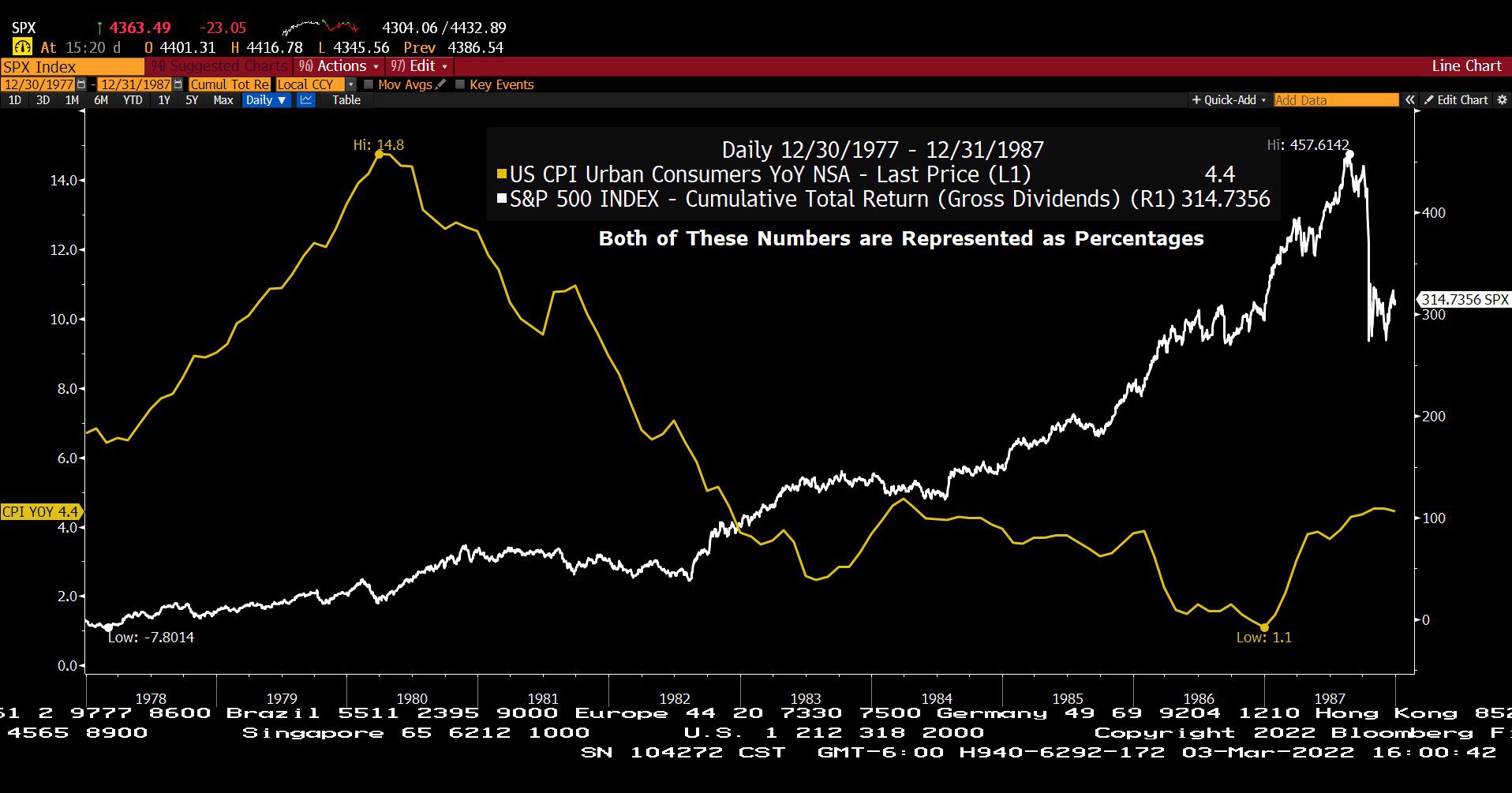

Standard & Poor’s 500 Index (Cumulative Total Return Gross of Dividends) and U.S. Consumer Price Index – Urban Consumers Year over Year, Non Seasonally Adjusted (12/30/1977 – 12/31/1987)

– Courtesy of Bloomberg LP

Real GDP – Purchasing Power Parity

gdp for world 3.2.22