What is the future for Investment Advisory services?

How do investors benefit?

What is the case for a September pullback?

What is Tactical Safety?

How do I use tactical safety in a pullback?

What are the 4 main asset categories?

What are the key lessons and resulting strategies from the last 35 years regarding the Financial Markets?

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index (Year to Date)

– Courtesy of Bloomberg LP

Global X MLP ETF (Year to Date)

– Courtesy of Bloomberg LP

Natural Gas Futures Spot Price (Year to Date)

– Courtesy of Bloomberg LP

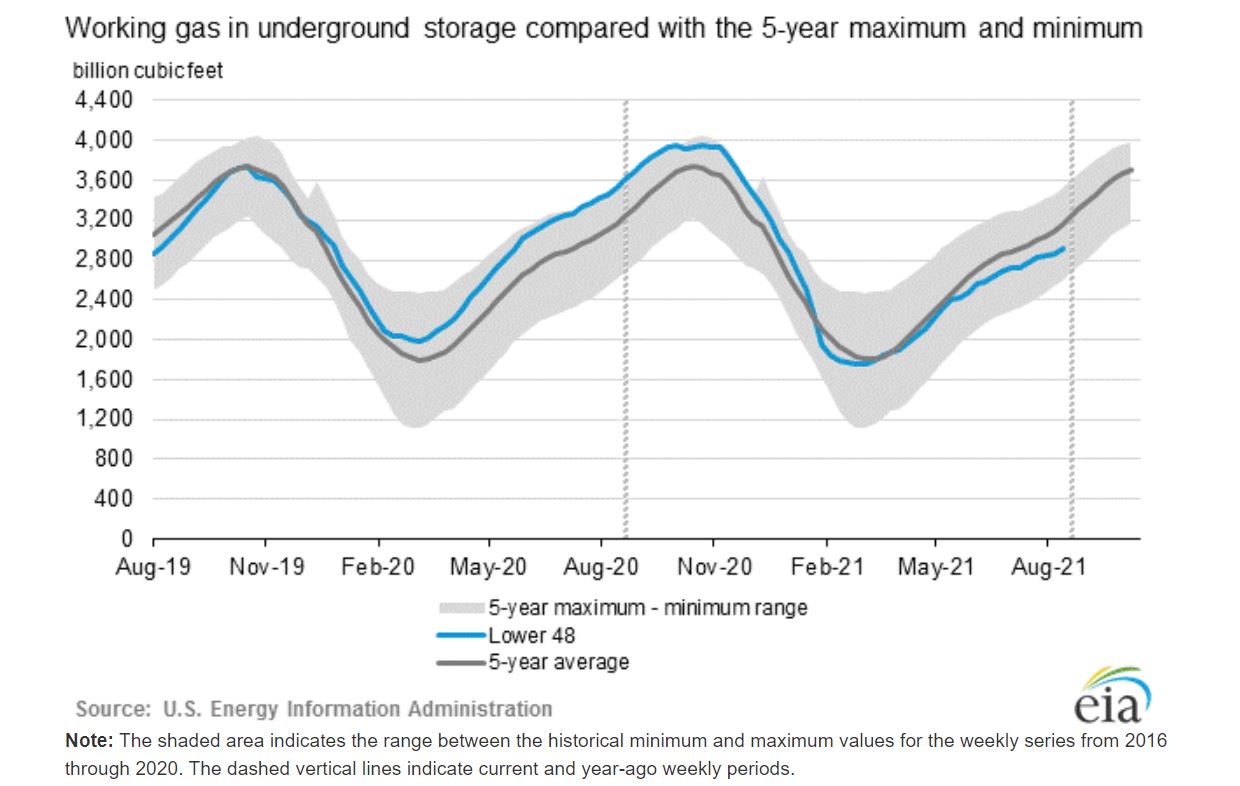

Natural Gas Underground Storage Compared with 5 year Minimums & Maximums (08/2019 – 08/2021)

– Courtesy of U.S. Energy Information Administration

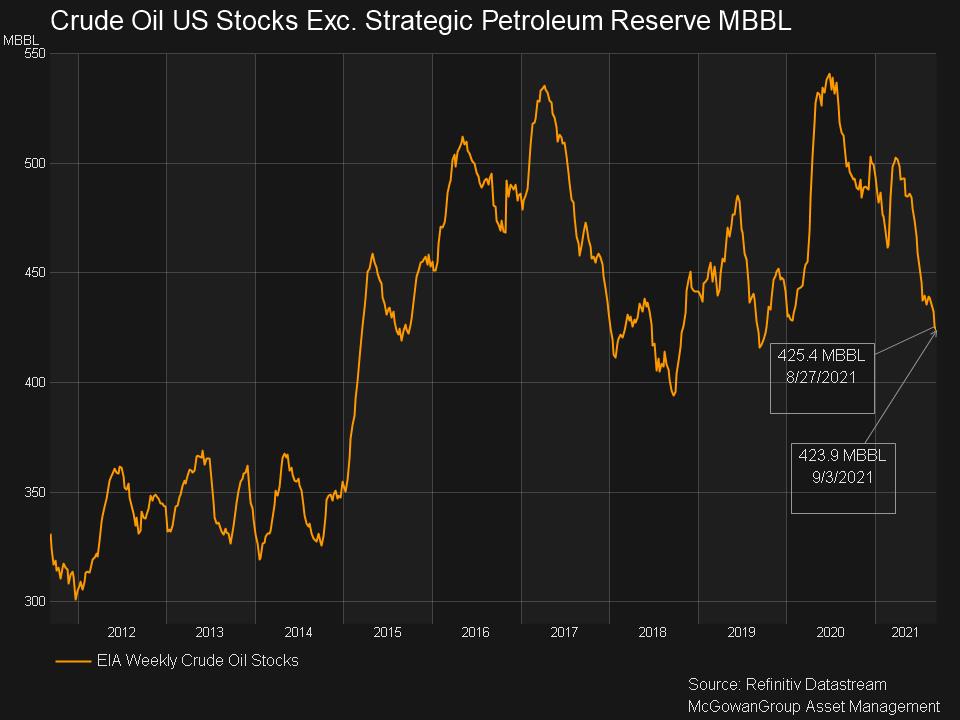

U.S. Crude Oil Stocks, Strategic Petroleum Reserve in MBBL (09/10/2021)

– Courtesy of Refinitiv

Headline Round Up

*Nearly 11 Million Jobs Available!

*Wage Push Inflation! Pay Raises for Everyone?

*Jobless Claims Declining! Still elevated.

*Fed Trigger for Tightening? Record Employment?

*CNBC’s Cramer’s List of Reasons for a Pullback?

*Congress’ Attack on Mega IRA’s.

*Update on Estate Tax Exemption Reductions.

*Cannabis Industry Research in “Healing” Efficacy?

*El Salvador Becomes First Country to Make Bitcoin a National Currency?

*SEC Attacks Crypto Lending Says Coinbase CEO Armstrong.

*Jim Simons and Renaissance Partners Pay an Extra $7 Billion in Taxes.

*October Government Shutdown?

*The Federal Reserve, Morgan Stanley, and Citigroup: Slowing Growth?

*Cheniere General Partner Declares First Dividend!

*Aluminum 13 Year High!

*Uranium 6 Year High!

*Natural Gas $5 in U.S.!

*The Problem with Electric Vehicles.

*Hurricane Ida Impact?

Profit Report

PappaDean’s Story on Adversity!

The Future of Investment Planning and Advisory Services?

Wharton Models for Federal Budgets and Taxes?

Best Client Questions?

MGAM Disciplines and Evolution.

The 4 Main Asset Categories.