MGAM Model Portfolios

The team has contributed to our ability to define disciplines that address financial planning objectives with separately managed accounts:

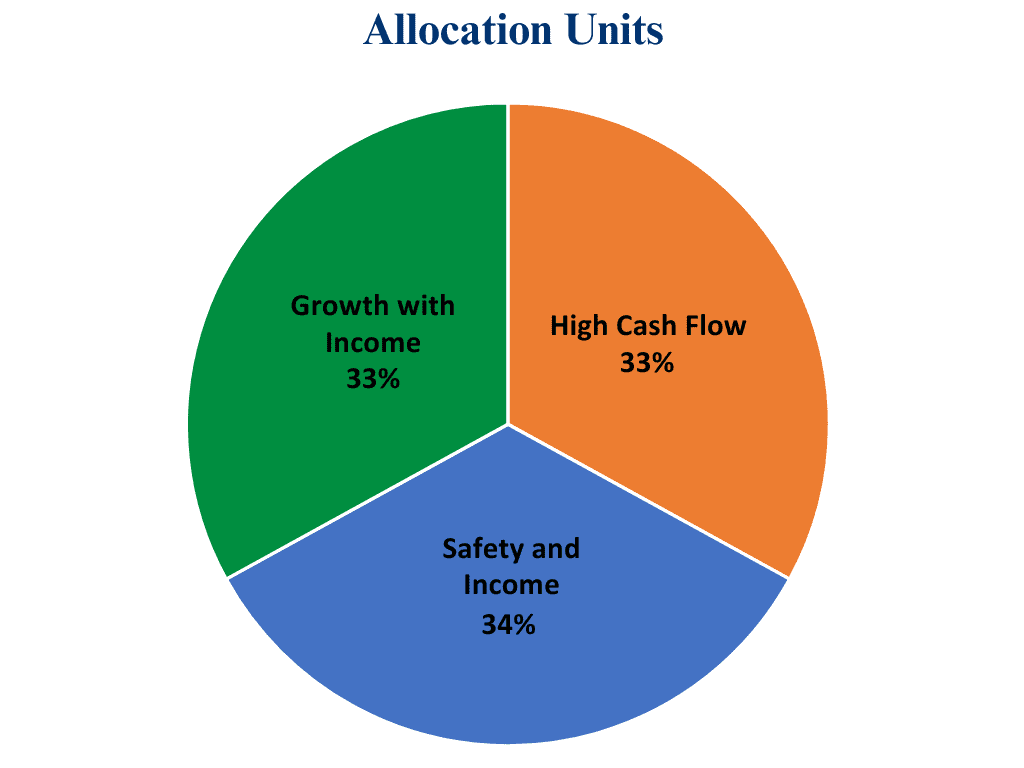

Allocation Units®

Disclosure information is available under the discipline information

The MGAM Allocation Units discipline employs multiple asset class tactical allocation strategies based upon estimated forward returns including net portfolio income and potential capital appreciation. The discipline utilizes both fixed income and exchange-traded investments.

CashFlow Units®

The MGAM CashFlow Units discipline seeks to deliver high current income and capital appreciation above inflation.

Long-Term Income Units®

The MGAM Long-Term Income Units discipline seeks to deliver a high level of taxable or tax-free coupon income through fixed maturity investments with a secondary objective of capital appreciation.

Growth Units®

The MGAM Growth Units discipline seeks to provide long-term capital appreciation for more aggressive investors.

Energy Units®

The MGAM Energy Units discipline seeks to provide a high total return from a combination of capital appreciation and current income.

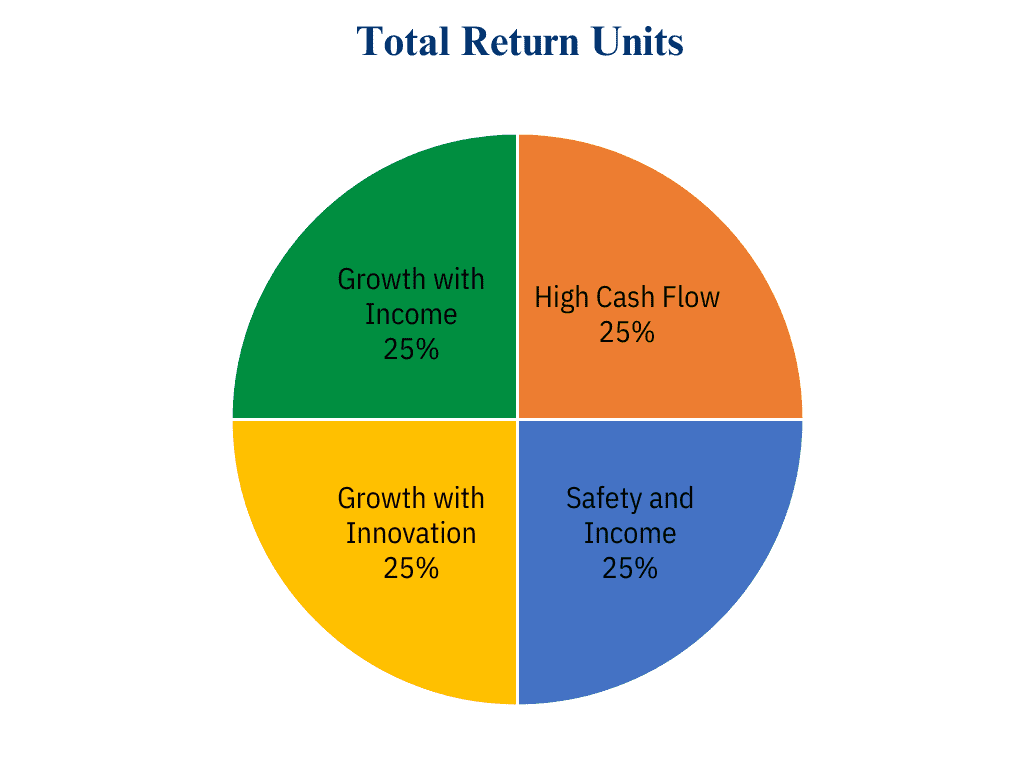

Total Return Units®

Disclosure information is available under the discipline information

The MGAM Total Return Units, the broadest McGowanGroup model discipline, seeks to provide both high cash flow and appreciation with a secondary objective of capital preservation with the advantages of tactical allocation.

McGowanGroup Asset Management has developed a unique account structure working toward client success. After an Investment Plan Outline is established to determine the client’s current financial status and future goals, two distinct account structures are developed. The first is a traditional account platform (The Vault) which represents the fixed income and fixed maturity portion of the portfolio. The second is a fee-based account platform which represents our managed account platform designed for equity-based dividend paying investments and high cash flow instruments (CashFlow Units®).

CashFlow Units® comprises two investment strategies:

- High Cash Flow in the closed end mutual fund space.

- Growth and Income through individual securities.

To receive a copy of our Dividend Report, Candidate List, and sample CashFlow Allocation Strategies, click here to Request a NetWorth Radio Package.

You can also click the following links to view the most recent McGowan Group Asset Management (MGAM) Account Performance, and MGAM Performance Year over Year.

To receive a copy of our Total Return Philosophy, call Alex Tollen at 214-720-4400 .

Disclaimer: McGowanGroup Asset Management, Inc. is a Federally Registered Investment Advisory Firm utilizing Pershing LLC, a BNY Mellon Company for asset custody. Past performance is not indicative of future results. Investments are subject to market risks including the potential loss of principal invested. Individual portfolios are reviewed for asset size and investment start dates. This information is required in order to reflect adequate investment history and size along with a mix of equities and fixed income closely associated with the MGAM investment strategies/disciplines. All information presented herein is considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted.